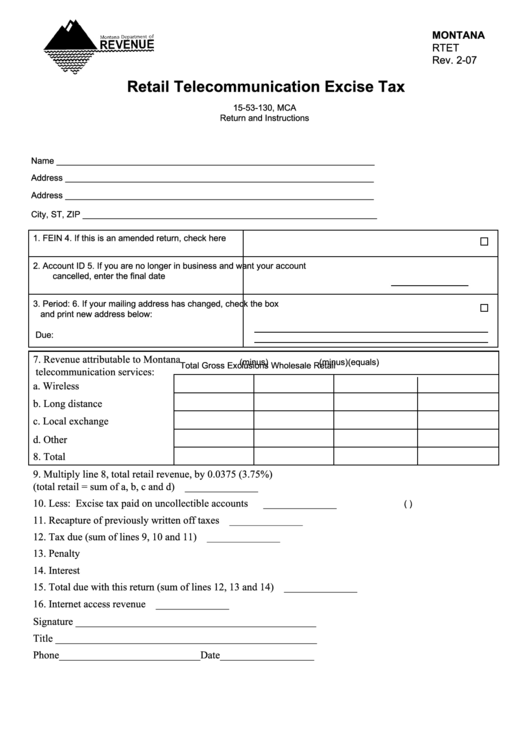

MONTANA

RTET

Rev. 2-07

Retail Telecommunication Excise Tax

15-53-130, MCA

Return and Instructions

Name ___________________________________________________________________

Address _________________________________________________________________

Address _________________________________________________________________

City, ST, ZIP ______________________________________________________________

1. FEIN

4. If this is an amended return, check here

2. Account ID

5. If you are no longer in business and want your account

cancelled, enter the final date

3. Period:

6. If your mailing address has changed, check the box

and print new address below:

Due:

7. Revenue attributable to Montana

(minus)

(minus)

(equals)

Total Gross

Exclusions

Wholesale

Retail

telecommunication services:

a. Wireless ..............................

b. Long distance .....................

c. Local exchange . ..................

d. Other . ..................................

8. Total . .......................................

9. Multiply line 8, total retail revenue, by 0.0375 (3.75%)

(total retail = sum of a, b, c and d) ............................................................................ ______________

10. Less: Excise tax paid on uncollectible accounts .................................................... ______________

(

)

11. Recapture of previously written off taxes ................................................................. ______________

12. Tax due (sum of lines 9, 10 and 11) .......................................................................... ______________

13. Penalty . ............................ ........................................................................................ ______________

14. Interest . ............................ ........................................................................................ ______________

15. Total due with this return (sum of lines 12, 13 and 14) ............................................ ______________

16. Internet access revenue . ............................................................................................. ______________

Signature ______________________________________________

Title __________________________________________________

Phone___________________________ Date__________________

1

1 2

2 3

3