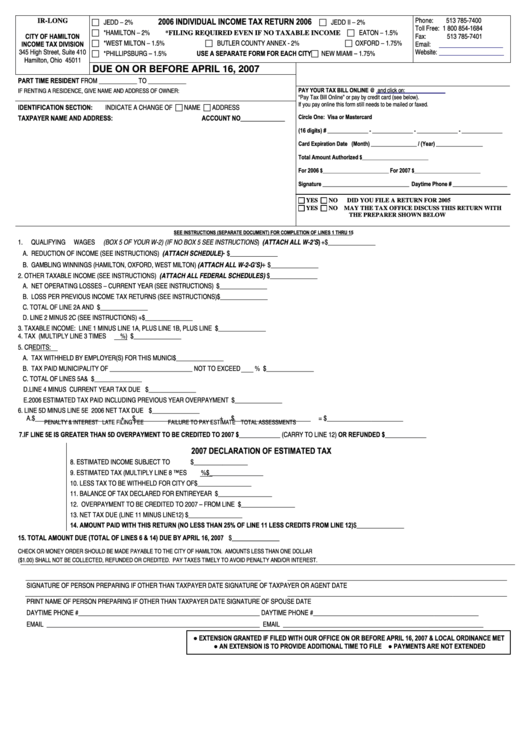

2006 Individual Income Tax Return - Hamilton Income Tax Division

ADVERTISEMENT

Phone:

513 785-7400

2006 INDIVIDUAL INCOME TAX RETURN 2006

IR-LONG

JEDD – 2%

JEDD II – 2%

Toll Free: 1 800 854-1684

*HAMILTON – 2%

EATON – 1.5%

*FILING REQUIRED EVEN IF NO TAXABLE INCOME

CITY OF HAMILTON

Fax:

513 785-7401

*WEST MILTON – 1.5%

BUTLER COUNTY ANNEX - 2%

OXFORD – 1.75%

INCOME TAX DIVISION

Email:

citytax@ci.hamilton.oh.us

345 High Street, Suite 410

Website:

*PHILLIPSBURG – 1.5%

USE A SEPARATE FORM FOR EACH CITY

NEW MIAMI – 1.75%

Hamilton, Ohio 45011

DUE ON OR BEFORE APRIL 16, 2007

PART TIME RESIDENT FROM ____________ TO ____________

PAY YOUR TAX BILL ONLINE @

and click on:

IF RENTING A RESIDENCE, GIVE NAME AND ADDRESS OF OWNER:

“Pay Tax Bill Online” or pay by credit card (see below).

If you pay online this form still needs to be mailed or faxed.

IDENTIFICATION SECTION:

INDICATE A CHANGE OF

NAME

ADDRESS

Circle One: Visa or Mastercard

TAXPAYER NAME AND ADDRESS:

ACCOUNT NO______________

(16 digits) #

________________ - ________________ - ________________ - ________________

Card Expiration Date (Month)

/ (Year)

__________________

__________________

Total Amount Authorized

$__________________________

For 2006

For 2007

$__________________________

$__________________________

Signature

Daytime Phone #

__________________________________

_____________________

YES

NO

DID YOU FILE A RETURN FOR 2005

YES

NO

MAY THE TAX OFFICE DISCUSS THIS RETURN WITH

THE PREPARER SHOWN BELOW

SEE INSTRUCTIONS (SEPARATE DOCUMENT) FOR COMPLETION OF LINES 1 THRU 15

1.

QUALIFYING WAGES (BOX 5 OF YOUR W-2) (IF NO BOX 5 SEE INSTRUCTIONS) (ATTACH ALL W-2’S) ............................................ + $_______________

-

A. REDUCTION OF INCOME (SEE INSTRUCTIONS) (ATTACH SCHEDULE)..................................................................................................

$_______________

+

B. GAMBLING WINNINGS (HAMILTON, OXFORD, WEST MILTON) (ATTACH ALL W-2-G’S).........................................................................

$_______________

2.

OTHER TAXABLE INCOME (SEE INSTRUCTIONS) (ATTACH ALL FEDERAL SCHEDULES) ............................... $_______________

A. NET OPERATING LOSSES – CURRENT YEAR (SEE INSTRUCTIONS) ................................. $_______________

B. LOSS PER PREVIOUS INCOME TAX RETURNS (SEE INSTRUCTIONS) ............................... $_______________

C. TOTAL OF LINE 2A AND 2B........................................................................................................................................... $_______________

D. LINE 2 MINUS 2C (SEE INSTRUCTIONS)........................................................................................................................................................ + $_______________

3.

TAXABLE INCOME: LINE 1 MINUS LINE 1A, PLUS LINE 1B, PLUS LINE 2D.................................................................................................... $_______________

4.

TAX (MULTIPLY LINE 3 TIMES

%) ....................................................................................................................... $_______________

5.

CREDITS:

A. TAX WITHHELD BY EMPLOYER(S) FOR THIS MUNICIPALITY............................................... $_______________

B. TAX PAID MUNICIPALITY OF __________________________ NOT TO EXCEED

% .... $_______________

C. TOTAL OF LINES 5A & B................................................................................................................................................ $_______________

D. LINE 4 MINUS 5C ....................................................................................................................................................CURRENT YEAR TAX DUE $_______________

E. 2006 ESTIMATED TAX PAID INCLUDING PREVIOUS YEAR OVERPAYMENT ................................................................................................. $_______________

6.

LINE 5D MINUS LINE 5E ..........................................................................................................................................................................................2006 NET TAX DUE $_______________

A.$________________________

+

$________________________

+

$________________________

=

$________________________

PENALTY & INTEREST

LATE FILING FEE

FAILURE TO PAY ESTIMATE

TOTAL ASSESSMENTS

7.

IF LINE 5E IS GREATER THAN 5D OVERPAYMENT TO BE CREDITED TO 2007 $_____________ (CARRY TO LINE 12) OR REFUNDED $_____________

2007 DECLARATION OF ESTIMATED TAX

8.

ESTIMATED INCOME SUBJECT TO

TAX.............................................$_________________

9.

ESTIMATED TAX (MULTIPLY LINE 8 TMES

%..................................................................$_________________

10.

LESS TAX TO BE WITHHELD FOR CITY OF .............................................................................$_________________

11.

BALANCE OF TAX DECLARED FOR ENTIRE YEAR ................................................................$_________________

12.

OVERPAYMENT TO BE CREDITED TO 2007 – FROM LINE 7.................................................$_________________

13.

NET TAX DUE (LINE 11 MINUS LINE 12)...................................................................................$_________________

14.

AMOUNT PAID WITH THIS RETURN (NO LESS THAN 25% OF LINE 11 LESS CREDITS FROM LINE 12) ...................................................... $_______________

15. TOTAL AMOUNT DUE (TOTAL OF LINES 6 & 14) ........................................................................................................................................ DUE BY APRIL 16, 2007 $_______________

CHECK OR MONEY ORDER SHOULD BE MADE PAYABLE TO THE CITY OF HAMILTON. AMOUNTS LESS THAN ONE DOLLAR

($1.00) SHALL NOT BE COLLECTED, REFUNDED OR CREDITED. PAY TAXES TIMELY TO AVOID PENALTY AND/OR INTEREST.

__________________________________________________________________________

_____________________________________________________________________

SIGNATURE OF PERSON PREPARING IF OTHER THAN TAXPAYER

DATE

SIGNATURE OF TAXPAYER OR AGENT

DATE

__________________________________________________________________________

_____________________________________________________________________

PRINT NAME OF PERSON PREPARING IF OTHER THAN TAXPAYER

DATE

SIGNATURE OF SPOUSE

DATE

DAYTIME PHONE # _________________________________________________________

DAYTIME PHONE # ____________________________________________________

EMAIL ___________________________________________________________________

EMAIL _______________________________________________________________

● EXTENSION GRANTED IF FILED WITH OUR OFFICE ON OR BEFORE APRIL 16, 2007 & LOCAL ORDINANCE MET

● AN EXTENSION IS TO PROVIDE ADDITIONAL TIME TO FILE ● PAYMENTS ARE NOT EXTENDED

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1