Form Wte-3 - Employer Summary Of Withholding - 2005

ADVERTISEMENT

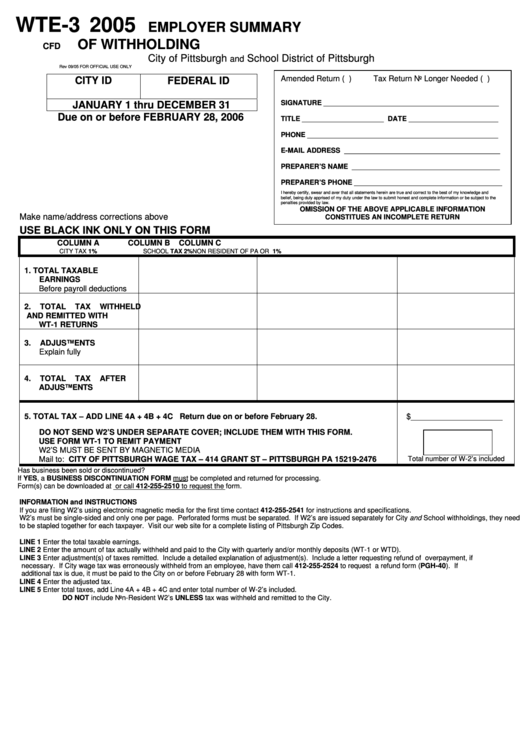

WTE-3 2005

EMPLOYER SUMMARY

OF WITHHOLDING

CFD

City of Pittsburgh

School District of Pittsburgh

and

Rev 09/05

FOR OFFICIAL USE ONLY

Amended Return ( )

Tax Return No Longer Needed ( )

CITY ID

FEDERAL ID

SIGNATURE _____________________________________________

JANUARY 1 thru DECEMBER 31

Due on or before FEBRUARY 28, 2006

TITLE _____________________ DATE _______________________

PHONE _________________________________________________

E-MAIL ADDRESS ________________________________________

PREPARER’S NAME ______________________________________

PREPARER’S PHONE ______________________________________

I hereby certify, swear and aver that all statements herein are true and correct to the best of my knowledge and

belief, being duly apprised of my duty under the law to submit honest and complete information or be subject to the

penalties provided by law.

OMISSION OF THE ABOVE APPLICABLE INFORMATION

Make name/address corrections above

CONSTITUES AN INCOMPLETE RETURN

USE BLACK INK ONLY ON THIS FORM

COLUMN A

COLUMN B

COLUMN C

CITY TAX 1%

SCHOOL TAX 2%

NON RESIDENT OF PA OR U.S. 1%

1.

TOTAL TAXABLE

EARNINGS

Before payroll deductions

2.

TOTAL TAX WITHHELD

AND REMITTED WITH

WT-1 RETURNS

3.

ADJUSTMENTS

Explain fully

4.

TOTAL TAX AFTER

ADJUSTMENTS

5.

TOTAL TAX – ADD LINE 4A + 4B + 4C

Return due on or before February 28.

$_____________________

DO NOT SEND W2’S UNDER SEPARATE COVER; INCLUDE THEM WITH THIS FORM.

USE FORM WT-1 TO REMIT PAYMENT

W2’S MUST BE SENT BY MAGNETIC MEDIA

Mail to: CITY OF PITTSBURGH WAGE TAX – 414 GRANT ST – PITTSBURGH PA 15219-2476

Total number of W-2’s included

Has business been sold or discontinued?

If YES, a BUSINESS DISCONTINUATION FORM must be completed and returned for processing.

Form(s) can be downloaded at or call 412-255-2510 to request the form.

INFORMATION and INSTRUCTIONS

If you are filing W2’s using electronic magnetic media for the first time contact 412-255-2541 for instructions and specifications.

W2’s must be single-sided and only one per page. Perforated forms must be separated. If W2’s are issued separately for City and School withholdings, they need

to be stapled together for each taxpayer. Visit our web site for a complete listing of Pittsburgh Zip Codes.

LINE 1

Enter the total taxable earnings.

LINE 2

Enter the amount of tax actually withheld and paid to the City with quarterly and/or monthly deposits (WT-1 or WTD).

LINE 3

Enter adjustment(s) of taxes remitted. Include a detailed explanation of adjustment(s). Include a letter requesting refund of

overpayment, if

necessary. If City wage tax was erroneously withheld from an employee, have them call 412-255-2524 to request

a refund form (PGH-40). If

additional tax is due, it must be paid to the City on or before February 28 with form WT-1.

LINE 4

Enter the adjusted tax.

LINE 5

Enter total taxes, add Line 4A + 4B + 4C and enter total number of W-2’s included.

DO NOT include Non-Resident W2’s UNLESS tax was withheld and remitted to the City.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1