Cnic Naf 401(K) Savings Plan Termination Of Employment Form

ADVERTISEMENT

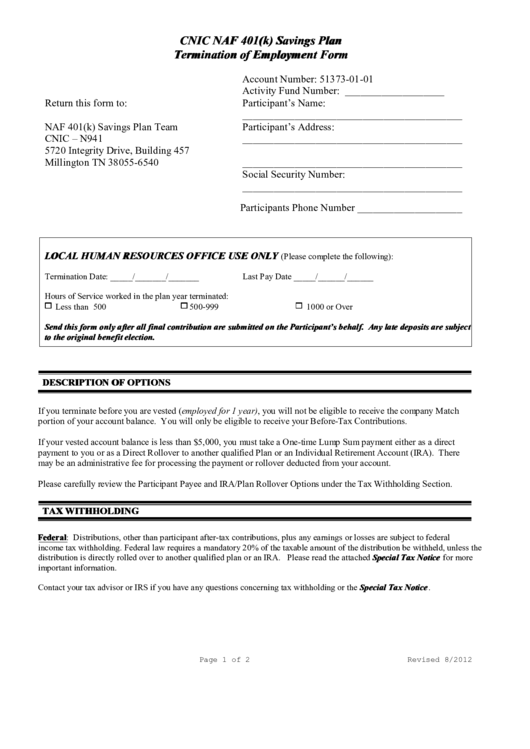

CNIC NAF 401(k) Savings Plan

Termination of Employment Form

Account Number: 51373-01-01

Activity Fund Number: ___________________

Return this form to:

Participant’s Name:

__________________________________________

NAF 401(k) Savings Plan Team

Participant’s Address:

CNIC – N941

__________________________________________

5720 Integrity Drive, Building 457

Millington TN 38055-6540

__________________________________________

Social Security Number:

__________________________________________

Participants Phone Number ____________________

LOCAL HUMAN RESOURCES OFFICE USE ONLY

(Please complete the following):

Termination Date: _____/_______/_______

Last Pay Date _____/______/______

Hours of Service worked in the plan year terminated:

Less than 500

500-999

1000 or Over

Send this form only after all final contribution are submitted on the Participant’s behalf. Any late deposits are subject

to the original benefit election.

DESCRIPTION OF OPTIONS

If you terminate before you are vested (employed for 1 year), you will not be eligible to receive the company Match

portion of your account balance. You will only be eligible to receive your Before-Tax Contributions.

If your vested account balance is less than $5,000, you must take a One-time Lump Sum payment either as a direct

payment to you or as a Direct Rollover to another qualified Plan or an Individual Retirement Account (IRA). There

may be an administrative fee for processing the payment or rollover deducted from your account.

Please carefully review the Participant Payee and IRA/Plan Rollover Options under the Tax Withholding Section.

TAX WITHHOLDING

Federal: Distributions, other than participant after-tax contributions, plus any earnings or losses are subject to federal

income tax withholding. Federal law requires a mandatory 20% of the taxable amount of the distribution be withheld, unless the

distribution is directly rolled over to another qualified plan or an IRA. Please read the attached Special Tax Notice for more

important information.

Contact your tax advisor or IRS if you have any questions concerning tax withholding or the Special Tax Notice.

Page 1 of 2

Revised 8/2012

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8