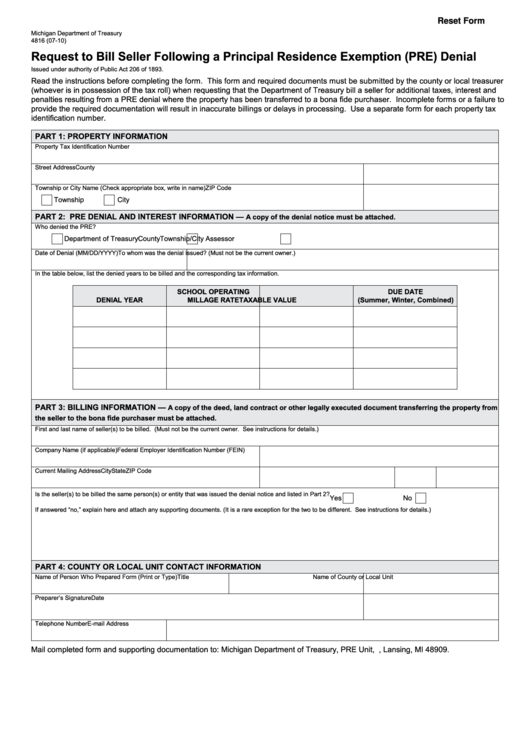

Reset Form

Michigan Department of Treasury

4816 (07-10)

Request to Bill Seller Following a Principal Residence Exemption (PRE) Denial

Issued under authority of Public Act 206 of 1893.

Read the instructions before completing the form. This form and required documents must be submitted by the county or local treasurer

(whoever is in possession of the tax roll) when requesting that the Department of Treasury bill a seller for additional taxes, interest and

penalties resulting from a PRE denial where the property has been transferred to a bona fide purchaser. Incomplete forms or a failure to

provide the required documentation will result in inaccurate billings or delays in processing. Use a separate form for each property tax

identification number.

PART 1: PROPERTY INFORMATION

Property Tax Identification Number

Street Address

County

Township or City Name (Check appropriate box, write in name)

ZIP Code

Township

City

PART 2: PRE DENIAL AND INTEREST INFORMATION —

A copy of the denial notice must be attached.

Who denied the PRE?

Department of Treasury

County

Township/City Assessor

Date of Denial (MM/DD/YYYY)

To whom was the denial issued? (Must not be the current owner.)

In the table below, list the denied years to be billed and the corresponding tax information.

SchOOL OPERATINg

DuE DATE

DENIAL YEAR

MILLAgE RATE

TAxABLE vALuE

(Summer, Winter, combined)

PART 3: BILLINg INFORMATION —

A copy of the deed, land contract or other legally executed document transferring the property from

the seller to the bona fide purchaser must be attached.

First and last name of seller(s) to be billed. (Must not be the current owner. See instructions for details.)

Company Name (if applicable)

Federal Employer Identification Number (FEIN)

Current Mailing Address

City

State

ZIP Code

Is the seller(s) to be billed the same person(s) or entity that was issued the denial notice and listed in Part 2?

Yes

No

If answered “no,” explain here and attach any supporting documents. (It is a rare exception for the two to be different. See instructions for details.)

PART 4: cOuNTY OR LOcAL uNIT cONTAcT INFORMATION

Name of Person Who Prepared Form (Print or Type)

Title

Name of County or Local Unit

Preparer’s Signature

Date

Telephone Number

E-mail Address

Mail completed form and supporting documentation to: Michigan Department of Treasury, PRE Unit, P.O. Box 30440, Lansing, MI 48909.

1

1 2

2