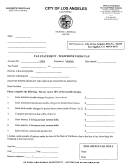

2015 Estimated Tax Statement Form

ADVERTISEMENT

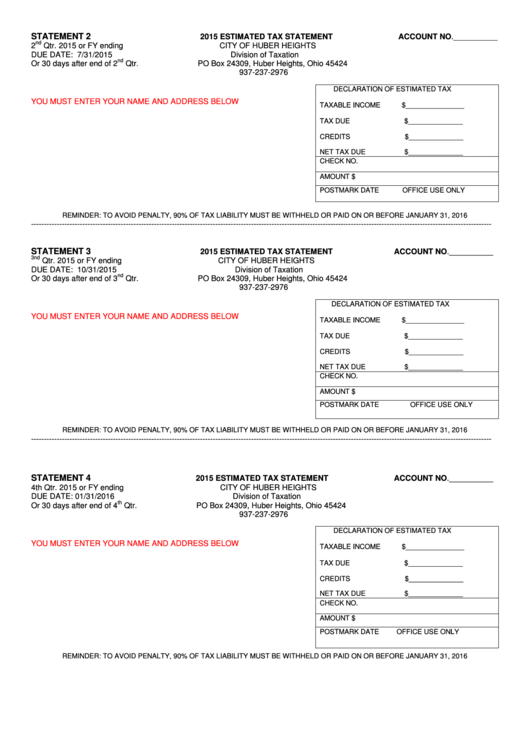

STATEMENT 2

2015 ESTIMATED TAX STATEMENT

ACCOUNT NO.__________

nd

2

Qtr. 2015 or FY ending

CITY OF HUBER HEIGHTS

DUE DATE: 7/31/2015

Division of Taxation

nd

Or 30 days after end of 2

Qtr.

PO Box 24309, Huber Heights, Ohio 45424

937-237-2976

DECLARATION OF ESTIMATED TAX

YOU MUST ENTER YOUR NAME AND ADDRESS BELOW

TAXABLE INCOME

$_______________

TAX DUE

$______________

CREDITS

$______________

NET TAX DUE

$______________

CHECK NO.

AMOUNT $

POSTMARK DATE

OFFICE USE ONLY

REMINDER: TO AVOID PENALTY, 90% OF TAX LIABILITY MUST BE WITHHELD OR PAID ON OR BEFORE JANUARY 31, 2016

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

STATEMENT 3

2015 ESTIMATED TAX STATEMENT

ACCOUNT NO.__________

3nd

Qtr. 2015 or FY ending

CITY OF HUBER HEIGHTS

DUE DATE: 10/31/2015

Division of Taxation

nd

Or 30 days after end of 3

Qtr.

PO Box 24309, Huber Heights, Ohio 45424

937-237-2976

DECLARATION OF ESTIMATED TAX

YOU MUST ENTER YOUR NAME AND ADDRESS BELOW

TAXABLE INCOME

$_______________

TAX DUE

$______________

CREDITS

$______________

NET TAX DUE

$______________

CHECK NO.

AMOUNT $

POSTMARK DATE

OFFICE USE ONLY

REMINDER: TO AVOID PENALTY, 90% OF TAX LIABILITY MUST BE WITHHELD OR PAID ON OR BEFORE JANUARY 31, 2016

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

STATEMENT 4

2015 ESTIMATED TAX STATEMENT

ACCOUNT NO.__________

4th Qtr. 2015 or FY ending

CITY OF HUBER HEIGHTS

DUE DATE: 01/31/2016

Division of Taxation

th

Or 30 days after end of 4

Qtr.

PO Box 24309, Huber Heights, Ohio 45424

937-237-2976

DECLARATION OF ESTIMATED TAX

YOU MUST ENTER YOUR NAME AND ADDRESS BELOW

TAXABLE INCOME

$_______________

TAX DUE

$______________

CREDITS

$______________

NET TAX DUE

$______________

CHECK NO.

AMOUNT $

POSTMARK DATE

OFFICE USE ONLY

REMINDER: TO AVOID PENALTY, 90% OF TAX LIABILITY MUST BE WITHHELD OR PAID ON OR BEFORE JANUARY 31, 2016

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1