Clear Form

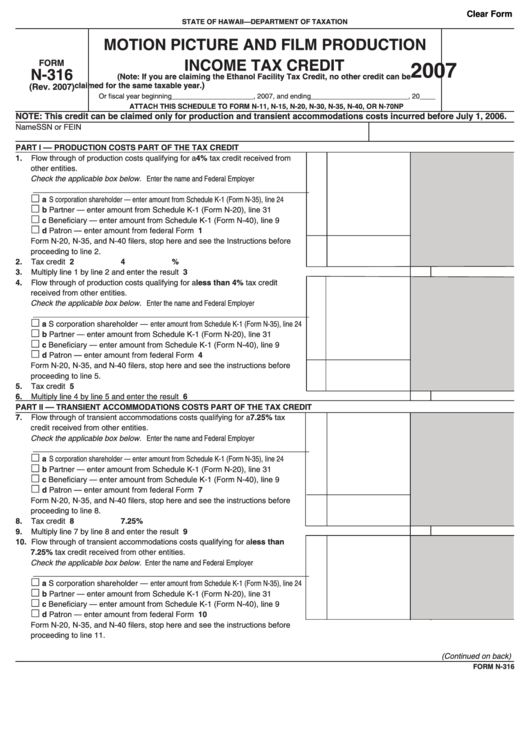

STATE OF HAWAII—DEPARTMENT OF TAXATION

MOTION PICTURE AND FILM PRODUCTION

FORM

INCOME TAX CREDIT

2007

N-316

(Note: If you are claiming the Ethanol Facility Tax Credit, no other credit can be

)

claimed for the same taxable year.

(Rev. 2007)

Or fiscal year beginning _____________________, 2007, and ending _________________________, 20____

ATTACH THIS SCHEDULE TO FORM N-11, N-15, N-20, N-30, N-35, N-40, OR N-70NP

NOTE: This credit can be claimed only for production and transient accommodations costs incurred before July 1, 2006.

Name

SSN or FEIN

PART I –– PRODUCTION COSTS PART OF THE TAX CREDIT

1.

Flow through of production costs qualifying for a 4% tax credit received from

other entities.

Check the applicable box below. Enter the name and Federal Employer I.D. No. of Entity

_______________________________________________________________

£

a S corporation shareholder — enter amount from Schedule K-1 (Form N-35), line 24

£

b Partner — enter amount from Schedule K-1 (Form N-20), line 31

£

c Beneficiary — enter amount from Schedule K-1 (Form N-40), line 9

£

d Patron — enter amount from federal Form 1099-PATR.............................

1

Form N-20, N-35, and N-40 filers, stop here and see the Instructions before

proceeding to line 2.

2.

Tax credit percentage.........................................................................................

2

4%

3.

Multiply line 1 by line 2 and enter the result here ...............................................................................................

3

4.

Flow through of production costs qualifying for a less than 4% tax credit

received from other entities.

Check the applicable box below. Enter the name and Federal Employer I.D. No. of Entity

_______________________________________________________________

£

a S corporation shareholder — enter amount from Schedule K-1 (Form N-35), line 24

£

b Partner — enter amount from Schedule K-1 (Form N-20), line 31

£

c Beneficiary — enter amount from Schedule K-1 (Form N-40), line 9

£

d Patron — enter amount from federal Form 1099-PATR.............................

4

Form N-20, N-35, and N-40 filers, stop here and see the instructions before

proceeding to line 5.

5.

Tax credit percentage.........................................................................................

5

6.

Multiply line 4 by line 5 and enter the result here ...............................................................................................

6

PART II –– TRANSIENT ACCOMMODATIONS COSTS PART OF THE TAX CREDIT

7.

Flow through of transient accommodations costs qualifying for a 7.25% tax

credit received from other entities.

Check the applicable box below. Enter the name and Federal Employer I.D. No. of Entity

_______________________________________________________________

£

a S corporation shareholder — enter amount from Schedule K-1 (Form N-35), line 24

£

b Partner — enter amount from Schedule K-1 (Form N-20), line 31

£

c Beneficiary — enter amount from Schedule K-1 (Form N-40), line 9

£

d Patron — enter amount from federal Form 1099-PATR.............................

7

Form N-20, N-35, and N-40 filers, stop here and see the instructions before

proceeding to line 8.

8.

Tax credit percentage.........................................................................................

8

7.25%

9.

Multiply line 7 by line 8 and enter the result here ..............................................................................................

9

10. Flow through of transient accommodations costs qualifying for a less than

7.25% tax credit received from other entities.

Check the applicable box below. Enter the name and Federal Employer I.D. No. of Entity

_______________________________________________________________

£

a S corporation shareholder — enter amount from Schedule K-1 (Form N-35), line 24

£

b Partner — enter amount from Schedule K-1 (Form N-20), line 31

£

c Beneficiary — enter amount from Schedule K-1 (Form N-40), line 9

£

d Patron — enter amount from federal Form 1099-PATR.............................

10

Form N-20, N-35, and N-40 filers, stop here and see the instructions before

proceeding to line 11.

(Continued on back)

FORM N-316

1

1 2

2