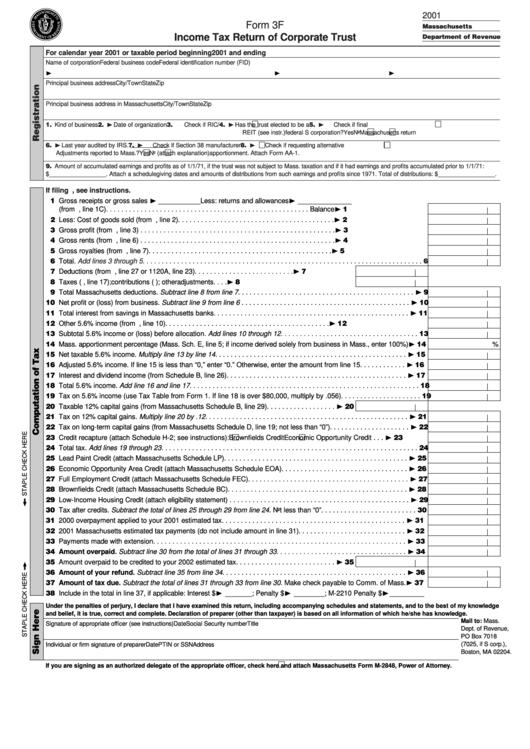

Form 3f - Income Tax Return Of Corporate Trust - 2001

ADVERTISEMENT

2001

Form 3F

Massachusetts

Income Tax Return of Corporate Trust

Department of Revenue

For calendar year 2001 or taxable period beginning

2001 and ending

Name of corporation

Federal business code

Federal identification number (FID)

❿

❿

❿

Principal business address

City/Town

State

Zip

Principal business address in Massachusetts

City/Town

State

Zip

2. ❿ Date of organization

4. ❿ Has the trust elected to be a

5. ❿

1. Kind of business

3.

Check if RIC/

Check if final

REIT (see instr.)

federal S corporation?

Yes

No

Massachusetts return

6. ❿ Last year audited by IRS

7. ❿

8. ❿

.

Check if Section 38 manufacturer

Check if requesting alternative

Adjustments reported to Mass.?

Yes

No (attach explanation)

apportionment. Attach Form AA-1.

9. Amount of accumulated earnings and profits as of 1/1/71, if the trust was not subject to Mass. taxation and if it had earnings and profits accumulated prior to 1/1/71:

$ _________________. Attach a schedule giving dates and amounts of distributions from such earnings and profits since 1971. Total of distributions: $ _________________.

If filing U.S. Form 1120S, see instructions.

11 Gross receipts or gross sales ❿ ___________ Less: returns and allowances ❿ ______________

(from U.S. Forms 1120 or 1120A, line 1C). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Balance ❿ 1

12 Less: Cost of goods sold (from U.S. Forms 1120 or 1120A, line 2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 2

13 Gross profit (from U.S. Forms 1120 or 1120A, line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 3

14 Gross rents (from U.S. Forms 1120 or 1120A, line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 4

15 Gross royalties (from U.S. Forms 1120 or 1120A, line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 5

16 Total.

Add lines 3 through 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

17 Deductions (from U.S. Form 1120, line 27 or 1120A, line 23) . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 7

18 Taxes (U.S. Forms 1120 or 1120A, line 17); contributions (U.S. line 19); other adjustments. . . . ❿ 8

19 Total Massachusetts deductions. Subtract line 8 from line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 9

10 Net profit or (loss) from business. Subtract line 9 from line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 10

11 Total interest from savings in Massachusetts banks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 11

12 Other 5.6% income (from U.S. Forms 1120 or 1120A, line 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 12

13 Subtotal 5.6% income or (loss) before allocation. Add lines 10 through 12. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Mass. apportionment percentage (Mass. Sch. E, line 5; if income derived solely from business in Mass., enter 100%) ❿ 14

%

15 Net taxable 5.6% income. Multiply line 13 by line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 15

16 Adjusted 5.6% income. If line 15 is less than “0,” enter “0.” Otherwise, enter the amount from line 15 . . . . . . . . . . . . ❿ 16

17 Interest and dividend income (from Schedule B, line 26) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 17

18 Total 5.6% income. Add line 16 and line 17. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Tax on 5.6% income (use Tax Table from Form 1. If line 18 is over $80,000, multiply by .056). . . . . . . . . . . . . . . . . . . . . 19

20 Taxable 12% capital gains (from Massachusetts Schedule B, line 29) . . . . . . . . . . . . . . . . . . ❿ 20

21 Tax on 12% capital gains. Multiply line 20 by .12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 21

22 Tax on long-term capital gains (from Massachusetts Schedule D, line 19; not less than “0”) . . . . . . . . . . . . . . . . . . . . . ❿ 22

Economic Opportunity Credit . . . ❿ 23

23 Credit recapture (attach Schedule H-2; see instructions):

Brownfields Credit

24 Total tax. Add lines 19 through 23 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

25 Lead Paint Credit (attach Massachusetts Schedule LP) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 25

26 Economic Opportunity Area Credit (attach Massachusetts Schedule EOA) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 26

27 Full Employment Credit (attach Massachusetts Schedule FEC). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 27

28 Brownfields Credit (attach Massachusetts Schedule BC) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 28

29 Low-Income Housing Credit (attach eligibility statement) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 29

30 Tax after credits. Subtract the total of lines 25 through 29 from line 24. Not less than “0”. . . . . . . . . . . . . . . . . . . . . . . . . 30

31 2000 overpayment applied to your 2001 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 31

32 2001 Massachusetts estimated tax payments (do not include amount in line 31) . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 32

33 Payments made with extension . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 33

34 Amount overpaid. Subtract line 30 from the total of lines 31 through 33 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 34

35 Amount overpaid to be credited to your 2002 estimated tax. . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 35

36 Amount of your refund. Subtract line 35 from line 34 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 36

37 Amount of tax due. Subtract the total of lines 31 through 33 from line 30. Make check payable to Comm. of Mass. ❿ 37

38 Include in the total in line 37, if applicable: Interest $❿ _______; Penalty $❿ ________; M-2210 Penalty $❿_________

Under the penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge

and belief, it is true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which he/she has knowledge.

Mail to: Mass.

Signature of appropriate officer (see instructions)

Date

Social Security number

Title

Dept. of Revenue,

PO Box 7018

(7025, if S corp.),

Individual or firm signature of preparer

Date

PTIN or SSN

Address

Boston, MA 02204.

If you are signing as an authorized delegate of the appropriate officer, check here

and attach Massachusetts Form M-2848, Power of Attorney.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4