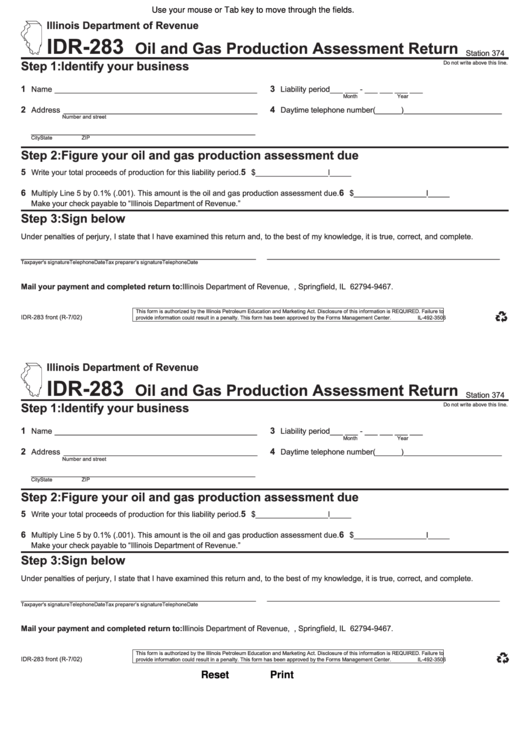

Use your mouse or Tab key to move through the fields.

Illinois Department of Revenue

IDR-283

Oil and Gas Production Assessment Return

Station 374

Do not write above this line.

Step 1: Identify your business

1

3

Name _______________________________________________

Liability period ___ ___ - ___ ___ ___ ___

Month

Year

2

4

Address _____________________________________________

Daytime telephone number (______)_______________________

Number and street

____________________________________________________

City

State

ZIP

Step 2: Figure your oil and gas production assessment due

5

5

Write your total proceeds of production for this liability period.

$_________________l_____

6

6

Multiply Line 5 by 0.1% (.001). This amount is the oil and gas production assessment due.

$_________________l_____

Make your check payable to “Illinois Department of Revenue.”

Step 3: Sign below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

_______________________________________________________

______________________________________________________

Taxpayer's signature

Telephone

Date

Tax preparer’s signature

Telephone

Date

Mail your payment and completed return to: Illinois Department of Revenue, P.O. Box 19467, Springfield, IL 62794-9467.

This form is authorized by the Illinois Petroleum Education and Marketing Act. Disclosure of this information is REQUIRED. Failure to

IDR-283 front (R-7/02)

provide information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-3506

Illinois Department of Revenue

IDR-283

Oil and Gas Production Assessment Return

Station 374

Do not write above this line.

Step 1: Identify your business

1

3

Name _______________________________________________

Liability period ___ ___ - ___ ___ ___ ___

Month

Year

2

4

Address _____________________________________________

Daytime telephone number (______)_______________________

Number and street

____________________________________________________

City

State

ZIP

Step 2: Figure your oil and gas production assessment due

5

5

Write your total proceeds of production for this liability period.

$_________________l_____

6

6

Multiply Line 5 by 0.1% (.001). This amount is the oil and gas production assessment due.

$_________________l_____

Make your check payable to “Illinois Department of Revenue.”

Step 3: Sign below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

_______________________________________________________

______________________________________________________

Taxpayer's signature

Telephone

Date

Tax preparer’s signature

Telephone

Date

Mail your payment and completed return to: Illinois Department of Revenue, P.O. Box 19467, Springfield, IL 62794-9467.

This form is authorized by the Illinois Petroleum Education and Marketing Act. Disclosure of this information is REQUIRED. Failure to

IDR-283 front (R-7/02)

provide information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-3506

Reset

Print

1

1 2

2