New Lexington Income Tax Return Form

ADVERTISEMENT

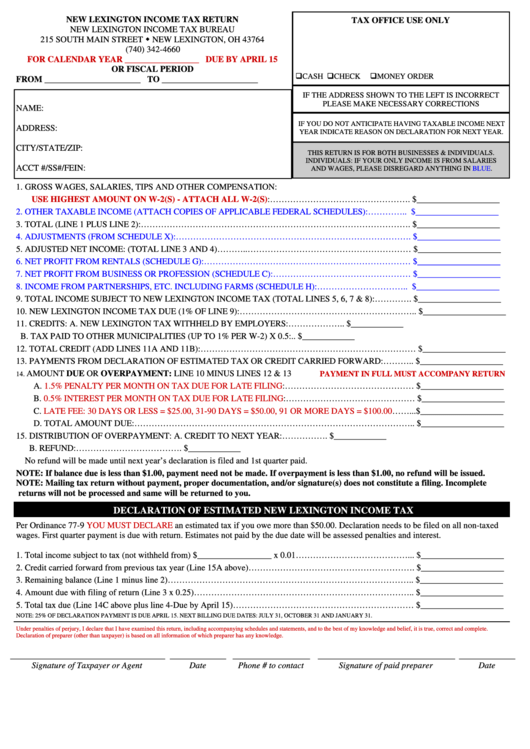

NEW LEXINGTON INCOME TAX RETURN

TAX OFFICE USE ONLY

NEW LEXINGTON INCOME TAX BUREAU

215 SOUTH MAIN STREET

NEW LEXINGTON, OH 43764

(740) 342-4660

FOR CALENDAR YEAR _________________ DUE BY APRIL 15

OR FISCAL PERIOD

CASH

CHECK

MONEY ORDER

FROM ______________________ TO ______________________

IF THE ADDRESS SHOWN TO THE LEFT IS INCORRECT

PLEASE MAKE NECESSARY CORRECTIONS

NAME:

IF YOU DO NOT ANTICIPATE HAVING TAXABLE INCOME NEXT

ADDRESS:

YEAR INDICATE REASON ON DECLARATION FOR NEXT YEAR.

CITY/STATE/ZIP:

THIS RETURN IS FOR BOTH BUSINESSES & INDIVIDUALS.

INDIVIDUALS: IF YOUR ONLY INCOME IS FROM SALARIES

ACCT #/SS#/FEIN:

AND WAGES, PLEASE DISREGARD ANYTHING IN BLUE.

1.

GROSS WAGES, SALARIES, TIPS AND OTHER COMPENSATION:

USE HIGHEST AMOUNT ON W-2(S) - ATTACH ALL

W-2(S):………………………………………….

$___________________

2.

OTHER TAXABLE INCOME (ATTACH COPIES OF APPLICABLE FEDERAL SCHEDULES):………….. $___________________

3.

TOTAL (LINE 1 PLUS LINE 2):…………………………………………………………………………………. $___________________

4.

ADJUSTMENTS (FROM SCHEDULE X):………………………………………………………………………. $___________________

5.

ADJUSTED NET INCOME: (TOTAL LINE 3 AND 4)………..………………………………………………… $___________________

6.

NET PROFIT FROM RENTALS (SCHEDULE G):……………………………………………………………… $___________________

7.

NET PROFIT FROM BUSINESS OR PROFESSION (SCHEDULE C):………………………………………… $___________________

8.

INCOME FROM PARTNERSHIPS, ETC. INCLUDING FARMS (SCHEDULE H):………………………….. $___________________

9.

TOTAL INCOME SUBJECT TO NEW LEXINGTON INCOME TAX (TOTAL LINES 5, 6, 7 & 8):…………. $___________________

10. NEW LEXINGTON INCOME TAX DUE (1% OF LINE 9):…………………………………………………….. $___________________

11. CREDITS: A. NEW LEXINGTON TAX WITHHELD BY EMPLOYERS:……………….. $____________

B. TAX PAID TO OTHER MUNICIPALITIES (UP TO 1% PER W-2) X 0.5:.. $____________

12. TOTAL CREDIT (ADD LINES 11A AND 11B):………………………………………………………………… $___________________

13. PAYMENTS FROM DECLARATION OF ESTIMATED TAX OR CREDIT CARRIED FORWARD:……….. $___________________

AMOUNT DUE OR OVERPAYMENT: LINE 10 MINUS LINES 12 & 13

PAYMENT IN FULL MUST ACCOMPANY RETURN

14.

A.

1.5% PENALTY PER MONTH ON TAX DUE FOR LATE

FILING:……………………………………… $___________________

B.

0.5% INTEREST PER MONTH ON TAX DUE FOR LATE

FILING:……………………………………… $___________________

C.

LATE FEE: 30 DAYS OR LESS = $25.00, 31-90 DAYS = $50.00, 91 OR MORE DAYS =

$100.00……...$___________________

D. TOTAL AMOUNT DUE:…………………………………………………………………………………….. $___________________

15. DISTRIBUTION OF OVERPAYMENT:

A. CREDIT TO NEXT YEAR:……………. $____________

B. REFUND:………………………………. $____________

No refund will be made until next year’s declaration is filed and 1st quarter paid.

NOTE: If balance due is less than $1.00, payment need not be made. If overpayment is less than $1.00, no refund will be issued.

NOTE: Mailing tax return without payment, proper documentation, and/or signature(s) does not constitute a filing. Incomplete

returns will not be processed and same will be returned to you.

DECLARATION OF ESTIMATED NEW LEXINGTON INCOME TAX

Per Ordinance 77-9

YOU MUST DECLARE

an estimated tax if you owe more than $50.00. Declaration needs to be filed on all non-taxed

wages. First quarter payment is due with return. Estimates not paid by the due date will be assessed penalties and interest.

1.

Total income subject to tax (not withheld from) $_________________ x 0.01…………………………………... $___________________

2.

Credit carried forward from previous tax year (Line 15A above)…………………………………………………. $___________________

3.

Remaining balance (Line 1 minus line 2)………………………………………………………………………….. $___________________

4.

Amount due with filing of return (Line 3 x 0.25)………………………………………………………………….. $___________________

5.

Total tax due (Line 14C above plus line 4-Due by April 15)……………………………………………………… $___________________

NOTE: 25% OF DECLARATION PAYMENT IS DUE APRIL 15. NEXT BILLING DUE DATES: JULY 31, OCTOBER 31 AND JANUARY 31.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct and complete.

Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

____________________________________________

________________

______________________

_______________________________________

________________

Signature of Taxpayer or Agent

Date

Phone # to contact

Signature of paid preparer

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1