New Lexington Income Tax Return Form 2015

ADVERTISEMENT

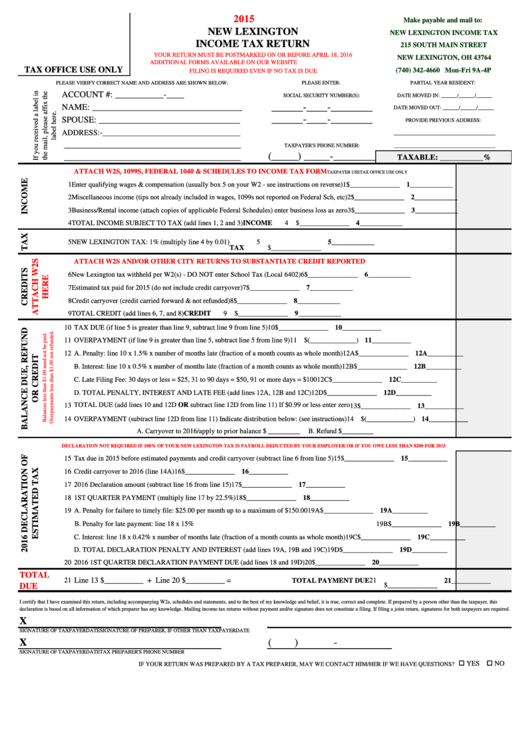

2015

Make payable and mail to:

NEW LEXINGTON

NEW LEXINGTON INCOME TAX

INCOME TAX RETURN

215 SOUTH MAIN STREET

YOUR RETURN MUST BE POSTMARKED ON OR BEFORE APRIL 18, 2016

NEW LEXINGTON, OH 43764

ADDITIONAL FORMS AVAILABLE ON OUR WEBSITE

TAX OFFICE USE ONLY

(740) 342-4660 Mon-Fri 9A-4P

FILING IS REQUIRED EVEN IF NO TAX IS DUE

PLEASE ENTER:

PARTIAL YEAR RESIDENT:

PLEASE VERIFY CORRECT NAME AND ADDRESS ARE SHOWN BELOW:

ACCOUNT #: ___________-____

SOCIAL SECURITY NUMBER(S):

DATE MOVED IN: ______/______/______

______-____-________

NAME: __________________________________

DATE MOVED OUT: ______/______/______

______-____-________

SPOUSE: ________________________________

PROVIDE PREVIOUS ADDRESS:

ADDRESS:-___________________________________

______________________________________

________________________________________

TAXPAYER'S PHONE NUMBER:

______________________________________

(_____) _____-________

________________________________________

TAXABLE: ___________%

ATTACH W2S, 1099S, FEDERAL 1040 & SCHEDULES TO INCOME TAX FORM

TAXPAYER USE

TAX OFFICE USE ONLY

1 Enter qualifying wages & compensation (usually box 5 on your W2 - see instructions on reverse)

1

$______________ 1____________

2 Miscellaneous income (tips not already included in wages, 1099s not reported on Federal Sch, etc)

2

$______________ 2____________

3 Business/Rental income (attach copies of applicable Federal Schedules) enter business loss as zero

3

$______________ 3____________

4 TOTAL INCOME SUBJECT TO TAX (add lines 1, 2 and 3)

INCOME

4

$______________ 4____________

5 NEW LEXINGTON TAX: 1% (multiply line 4 by 0.01)

5

5____________

TAX

$______________

ATTACH W2S AND/OR OTHER CITY RETURNS TO SUBSTANTIATE CREDIT REPORTED

6 New Lexington tax withheld per W2(s) - DO NOT enter School Tax (Local 6402)

6

$______________ 6____________

7 Estimated tax paid for 2015 (do not include credit carryover)

7

$______________ 7____________

8 Credit carryover (credit carried forward & not refunded)

8

$______________ 8____________

9 TOTAL CREDIT (add lines 6, 7, and 8)

CREDIT

9

$______________ 9____________

10 TAX DUE (if line 5 is greater than line 9, subtract line 9 from line 5)

10

$______________ 10___________

11 OVERPAYMENT (if line 9 is greater than line 5, subtract line 5 from line 9)

11 $(_____________) 11___________

12 A. Penalty: line 10 x 1.5% x number of months late (fraction of a month counts as whole month)

12A

$______________ 12A__________

B. Interest: line 10 x 0.5% x number of months late (fraction of a month counts as whole month)

12B

$______________ 12B__________

C. Late Filing Fee: 30 days or less = $25, 31 to 90 days = $50, 91 or more days = $100

12C

$______________ 12C__________

D. TOTAL PENALTY, INTEREST AND LATE FEE (add lines 12A, 12B and 12C)

12D

$______________ 12D__________

13 TOTAL DUE (add lines 10 and 12D OR subtract line 12D from line 11) If $0.99 or less enter zero

13

$______________ 13___________

14 OVERPAYMENT (subtract line 12D from line 11) Indicate distribution below: (see instructions)

14 $(_____________) 14___________

A. Carryover to 2016/apply to prior balance $ _________

B. Refund $_________

DECLARATION NOT REQUIRED IF 100% OF YOUR NEW LEXINGTON TAX IS PAYROLL DEDUCTED BY YOUR EMPLOYER OR IF YOU OWE LESS THAN $200 FOR 2015

15 Tax due in 2015 before estimated payments and credit carryover (subtract line 6 from line 5)

15

$______________ 15___________

16 Credit carryover to 2016 (line 14A)

16

$______________ 16___________

17 2016 Declaration amount (subtract line 16 from line 15)

17

$______________ 17___________

18 1ST QUARTER PAYMENT (multiply line 17 by 22.5%)

18

$______________ 18___________

19 A. Penalty for failure to timely file: $25.00 per month up to a maximum of $150.00

19A

$______________ 19A__________

B. Penalty for late payment: line 18 x 15%

19B

$______________ 19B__________

C. Interest: line 18 x 0.42% x number of months late (fraction of a month counts as whole month)

19C

$______________ 19C__________

D. TOTAL DECLARATION PENALTY AND INTEREST (add lines 19A, 19B and 19C)

19D

$______________ 19D__________

20 2016 1ST QUARTER DECLARATION PAYMENT DUE (add lines 18 and 19D)

20

$______________ 20___________

TOTAL

21

Line 13 $__________ + Line 20 $__________ =

TOTAL PAYMENT DUE

21

21___________

$______________

DUE

I certify that I have examined this return, including accompanying W2s, schedules and statements, and to the best of my knowledge and belief, it is true, correct and complete. If prepared by a person other than the taxpayer, this

declaration is based on all information of which preparer has any knowledge. Mailing income tax returns without payment and/or signature does not constitute a filing. If filing a joint return, signatures for both taxpayers are required.

X

SIGNATURE OF TAXPAYER

DATE

SIGNATURE OF PREPARER, IF OTHER THAN TAXPAYER

DATE

X

(

)

-

SIGNATURE OF TAXPAYER

DATE

TAX PREPARER'S PHONE NUMBER

o YES o NO

IF YOUR RETURN WAS PREPARED BY A TAX PREPARER, MAY WE CONTACT HIM/HER IF WE HAVE QUESTIONS?

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2