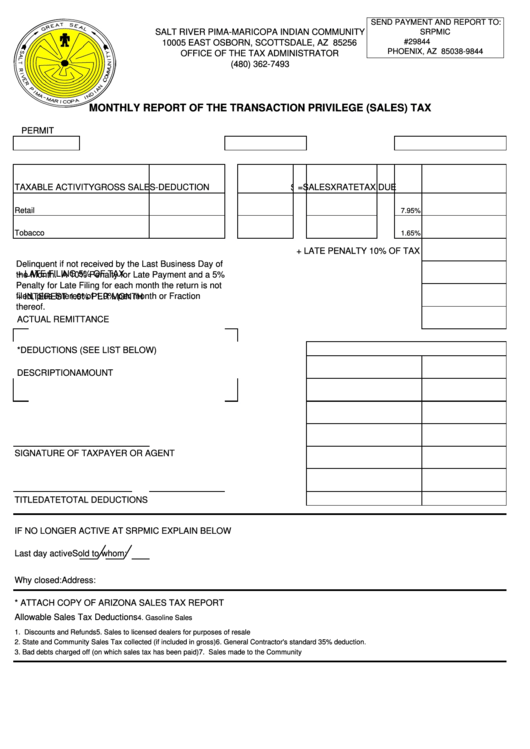

Salt River Pima-Maricopa Indian Community Monthly Report Of The Transaction Privilege (Sales) Tax Form

ADVERTISEMENT

SEND PAYMENT AND REPORT TO:

SALT RIVER PIMA-MARICOPA INDIAN COMMUNITY

SRPMIC

P.O. BOX #29844

10005 EAST OSBORN, SCOTTSDALE, AZ 85256

PHOENIX, AZ 85038-9844

OFFICE OF THE TAX ADMINISTRATOR

(480) 362-7493

MONTHLY REPORT OF THE TRANSACTION PRIVILEGE (SALES) TAX

PERMIT NO.

PERIOD COVERED

DUE DATE

TAXABLE

%

AMOUNT OF

TAXABLE ACTIVITY

GROSS SALES

- DEDUCTIONS =

SALES

X RATE

TAX DUE

Retail

7.95%

Tobacco

1.65%

+ LATE PENALTY 10% OF TAX

Delinquent if not received by the Last Business Day of

+ LATE FILING 5% OF TAX

the Month. A 10% Penalty for Late Payment and a 5%

Penalty for Late Filing for each month the return is not

filed, plus Interest of 1.0% per month or Fraction

+ INTEREST 1.0% PER MONTH

thereof.

ACTUAL REMITTANCE

*DEDUCTIONS (SEE LIST BELOW)

DESCRIPTION

AMOUNT

SIGNATURE OF TAXPAYER OR AGENT

TITLE

DATE

TOTAL DEDUCTIONS

IF NO LONGER ACTIVE AT SRPMIC EXPLAIN BELOW

Last day active

Sold to whom:

Why closed:

Address:

* ATTACH COPY OF ARIZONA SALES TAX REPORT

Allowable Sales Tax Deductions

4. Gasoline Sales

1. Discounts and Refunds

5. Sales to licensed dealers for purposes of resale

2. State and Community Sales Tax collected (if included in gross)

6. General Contractor's standard 35% deduction.

3. Bad debts charged off (on which sales tax has been paid)

7. Sales made to the Community

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1