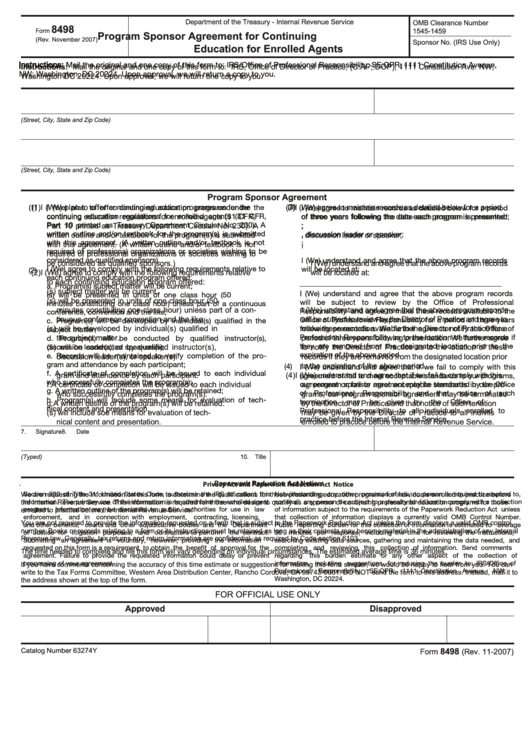

Department of the Treasury - Internal Revenue Service

OMB Clearance Number

8498

Form

1545-1459

Program Sponsor Agreement for Continuing

(Rev. November 2007)

Sponsor No. (IRS Use Only)

Education for Enrolled Agents

Instructions:

Mail the original and one copy of this form to: IRS/Office of Professional Responsibility; SE:OPR; 1111 Constitution Avenue,

Instructions: Mail the original and one copy of this form to: IRS, Office of Director of Practice, (C:AP;:DOP), 1111 Constitution Ave. NW,

NW; Washington, DC 20224. Upon approval, we will return a copy to you.

Washington DC 20224. Upon approval, we will return one copy to you.

1. Full Name of Sponsoring Organization

2. Telephone Number

3. Address (Street, City, State and Zip Code)

4. Individual to Contact Regarding Programs

5. Telephone Number

6. Address (Street, City, State and Zip Code)

Program Sponsor Agreement

(3)

(1) I (We) plan to offer continuing education programs under the

(3) I (We) agree to maintain records as detailed below for a period

(1)

I (We) plan to offer continuing education programs under the

I (We) agree to maintain records as detailed below for a period

continuing education regulations for enrolled agents (31 CFR,

continuing education regulations for enrolled agents (31 CFR,

of three years following the date each program is presented:

of three years following the date each program is presented;

Part 10 printed as Treasury Department Circular No. 230). A

Part 10 printed as Treasury Department Circular No. 230). A

a.The

a. The date and location of each program presented;

date

and

location

of each program presented;

written outline and/or textbook for the program(s) is submitted

b.The names of each instructor, discussion leader or speaker;

written outline and/or textbook for the program(s) is submitted

b. The names of each instructor, discussion leader or speaker;

with this agreement. (A written outline and/or textbook is not

c.The roster of individuals completing each program;

with this agreement. (A written outline and/or textbook is not

c. The roster of individuals completing each program;

required of professional organizations or societies wishing to be

d.The

written

outline

of

each

program

presentation.

required of professional organizations or societies wishing to

d. The written outline of each program presentation.

considered as qualified sponsors).

I (We) understand and agree that the above program records

be considered as qualified sponsors.)

I (We) understand and agree that the above program records

I (We) agree to comply with the following requirements relative to

will be located at:

(2)

(2) I (We) agree to comply with the following requirements relative

will be located at:

each continuing education program offered:

to each continuing education program offered:

a. Program(s) subject matter will be current;

a. Program(s) subject matter will be current.

I (We) understand and agree that the above program records

b.Program(s) will be presented in units of one class hour (50

b. Program(s) will be presented in units of one class hour (50

will be subject to review by the Office of Professional

minutes constituting one class hour) unless part of a continuous

minutes constituting one class hour) unless part of a con-

I (We) understand and agree that the above program records

Responsibility and agree to make these records available to the

conference, convention and the like;

tinuous conference convention and the like.

will be subject to review by the Director of Practice and agree to

Office of Professional Responsibility for a period of three years

c. Program(s) will be developed by individual(s) qualified in the

c. Program(s) will be developed by individual(s) qualified in

make these records available to the Director of Practice for a

following presentation. We further agree to notify the Office of

subject matter;

the subject matter.

Professional Responsibility as to the location of these records if

period of three years following presentation. We further agree

d. Program(s) will be conducted by qualified instructor(s),

they are removed from the designated location prior to the

d. Program(s) will be conducted by qualified instructor(s),

to notify the Director of Practice as to the location of these

discussion leader(s), or speakers(s);

expiration of the above period.

e. Records will be maintained to verify completion of the pro-

discussion leader(s), or speaker(s).

records if they are removed from the designated location prior

gram and attendance by each participant;

e. Records will be maintained to verify completion of the pro-

to the expiration of the above period.

(4)

I (We) understand and agree that if we fail to comply with this

f. A certificate of completion will be issued to each individual

gram and attendance by each participant.

(4) I (We) understand and agree that if we fail to comply with this

agreement or fail to meet acceptable standards in our programs,

who successfully completes the program(s);

f. A certificate of completion will be issued to each individual

our program sponsor agrement may be terminated by the Office

agreement or fail to meet acceptable standards in our pro-

g. A written outline of the program(s) will be retained;

of Professional Responsibility and that notice of such

who successfully completes the program(s).

grams, our program sponsor agreement may be terminated

h. Program(s) will include some means for evaluation of tec

h-

termination

may

be

given

by

the

Office of

g. A written outline of the program(s) will be retained.

by the Director of Practice and that notice of such tenation

nical content and presentation.

Professional Responsibility to all individuals enrolled to

h. Program(s) will include soe means for evaluation of tech-

may be given by the Director of Practice to all indivils

practice before the Internal Revenue Service.

nical content and presentation.

enrolled to practice before the Internal Revenue Service.

7.

Signature

8.

Date

9.

Name (Typed)

10.

Title

.

Paperwork Reduction Act Notice

Privacy Act and Paperwork Reduction Act Notice

Section 330 of Title 31, United States Code, authorizes the IRS to collect this

Notwithstanding any other provision of law, no person is required to respond to,

We are requesting the information on this form to determine the qualifications for those presenting education programs for individuals enrolled to practice before

the Internal Revenue Service. This information is required for those who desire to qualify as a sponsor of continuing professional education programs for those

information. The primary use of the information is to administer the enrolled agent

nor shall any person be subject to a penalty for failure to comply with a collection

enrolled to practice before the Internal Revenue Service.

program. Information may be disclosed to: public authorities for use in law

of information subject to the requirements of the Paperwork Reduction Act unless

enforcement,

and in

connection with employment,

contracting, licensing,

that collection of information displays a currently valid OMB Control Number.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control

and other benefits; courts and other adjudicative bodies and the Department

Public reporting burden for this collection of information is estimated to average

number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal

of Justice for litigation purposes; and contractors to perform

the contract.

36

minutes per response, including the time for reviewing the instructions,

Revenue law. Generally, tax returns and return information are confidential, as required by Code section 6103.

Submitting

an agreement is

voluntary,

however, providing

the information

searching existing data sources, gathering and maintaining the data needed, and

requested on this form is a requirement to obtain the benefit of approval for the

completing

and

reviewing

this

collection of information. Send comments

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is 36 minutes.

agreement. Failure to provide the requested information could delay or prevent

regarding

this burden estimate or any other aspect of the collection of

processing of your agreement.

information, including suggestions

for reducing the burden to: IRS/Office of

If you have comments concerning the accuracy of this time estimate or suggestions for making this form simpler, we would be happy to hear from you. You can

Professional

Responsibility,

SE:OPR;

1111 Constitution

Avenue,

NW;

write to the Tax Forms Committee, Western Area Distribution Center, Rancho Cordova, CA 95743-0001. DO NOT send the form to this address. Instead, mail it to

Washington, DC 20224.

the address shown at the top of the form.

FOR OFFICIAL USE ONLY

Approved

Disapproved

11. Name

12. Date

13. Name

14. Date

8498

Catalog Number 63274Y

Form

(Rev. 11-2007)

1

1