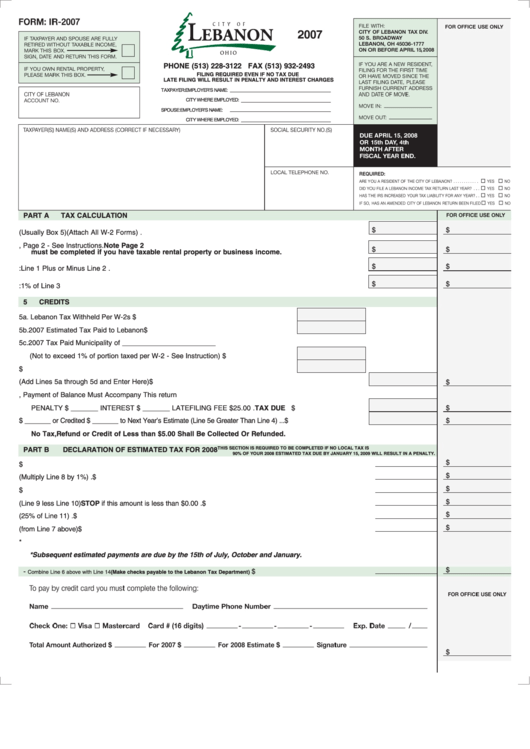

Form Ir-2007 - Lebanon Tax Calculation

ADVERTISEMENT

PHONE (513) 228-3122 FAX (513) 932-2493

FILING REQUIRED EVEN IF NO TAX DUE

LATE FILING WILL RESULT IN PENALTY AND INTEREST CHARGES

TAXPAYER: EMPLOYER’S NAME:

CITY WHERE EMPLOYED:

SPOUSE:

EMPLOYER’S NAME:

CITY WHERE EMPLOYED:

PART A

TAX CALCULATION

$

$

1. Total Qualifying Wages (Usually Box 5)(Attach All W-2 Forms) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Other Taxable Income and/or Deductions form line 21, Page 2 - See Instructions. Note Page 2

$

$

must be completed if you have taxable rental property or business income. . . . . . . . . . . . . . . . . . . . . . . .

$

$

3. Taxable Income: Line 1 Plus or Minus Line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

$

4. Lebanon Tax: 1% of Line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

CREDITS

5a. Lebanon Tax Withheld Per W-2s . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

5b. 2007 Estimated Tax Paid to Lebanon . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

5c. 2007 Tax Paid Municipality of ________________________

(Not to exceed 1% of portion taxed per W-2 - See Instruction) . . . . . . . . . . . . . . . . . . . . . $

5d. Prior Year Overpayment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

5e. Total Credits (Add Lines 5a through 5d and Enter Here) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

$

6. If Line 4 is Greater Than Line 5e, Payment of Balance Must Accompany This return

PENALTY $ _______ INTEREST $ _______ LATE FILING FEE $25.00 . . . . . . . . . . . . . . . . . . . . . . . TAX DUE $

$

7. Overpayment Refunded $ _______ or Credited $ _______ to Next Year’s Estimate (Line 5e Greater Than Line 4) . . . $

$

No Tax, Refund or Credit of Less than $5.00 Shall Be Collected Or Refunded.

THIS SECTION IS REQUIRED TO BE COMPLETED IF NO LOCAL TAX IS WITHHELD. FAILURE TO PAY

PART B

DECLARATION OF ESTIMATED TAX FOR 2008

90% OF YOUR 2008 ESTIMATED TAX DUE BY JANUARY 15, 2009 WILL RESULT IN A PENALTY.

$

8. Total estimated income subject to tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

$

9. Lebanon Income Tax Declared (Multiply Line 8 by 1%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

$

10. Estimated Taxes Withheld from Wages . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

$

11. Tax due after Withholding (Line 9 less Line 10) STOP if this amount is less than $0.00 . . . . . . . . . . . . . . . . . . . . . . . $

$

12. Declaration due (25% of Line 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

$

13. Less credits (from Line 7 above) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

14. Net estimated tax due if Line 12 minus Line 13 is greater than zero*

*Subsequent estimated payments are due by the 15th of July, October and January.

$

15. TOTAL AMOUNT DUE -

$

Combine Line 6 above with Line 14 (Make checks payable to the Lebanon Tax Department) . . . . . . . . . . . . . .

$

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2