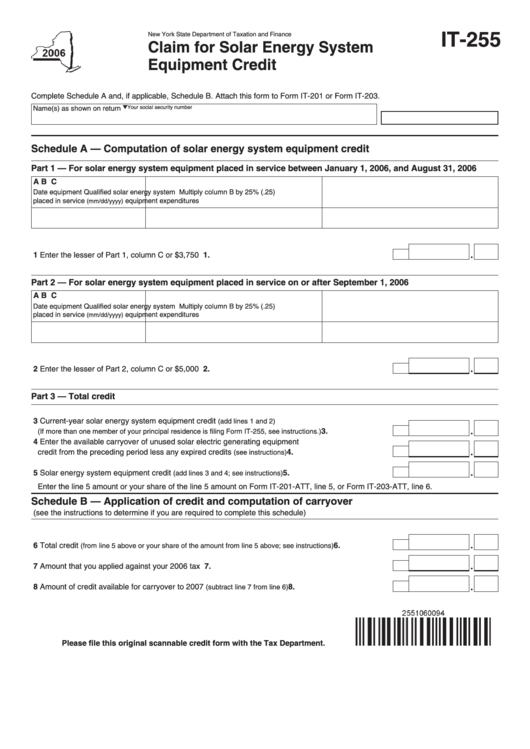

IT-255

New York State Department of Taxation and Finance

Claim for Solar Energy System

Equipment Credit

Complete Schedule A and, if applicable, Schedule B. Attach this form to Form IT-201 or Form IT-203.

Name(s) as shown on return

Your social security number

Schedule A — Computation of solar energy system equipment credit

Part 1 — For solar energy system equipment placed in service between January 1, 2006, and August 31, 2006

A

B

C

Date equipment

Qualified solar energy system

Multiply column B by 25% (.25)

placed in service

equipment expenditures

(mm/dd/yyyy)

1 Enter the lesser of Part 1, column C or $3,750 ....................................................................................

1.

Part 2 — For solar energy system equipment placed in service on or after September 1, 2006

A

B

C

Date equipment

Qualified solar energy system

Multiply column B by 25% (.25)

placed in service

equipment expenditures

(mm/dd/yyyy)

2 Enter the lesser of Part 2, column C or $5,000 ....................................................................................

2.

Part 3 — Total credit

3 Current-year solar energy system equipment credit

(add lines 1 and 2)

3.

........................

(If more than one member of your principal residence is filing Form IT-255, see instructions.)

4 Enter the available carryover of unused solar electric generating equipment

credit from the preceding period less any expired credits

.......................................

4.

(see instructions)

5 Solar energy system equipment credit

5.

..............................................

(add lines 3 and 4; see instructions)

Enter the line 5 amount or your share of the line 5 amount on Form IT-201-ATT, line 5, or Form IT-203-ATT, line 6.

Schedule B — Application of credit and computation of carryover

(see the instructions to determine if you are required to complete this schedule)

6 Total credit

6.

.......................

(from line 5 above or your share of the amount from line 5 above; see instructions)

7 Amount that you applied against your 2006 tax ...................................................................................

7.

8 Amount of credit available for carryover to 2007

...........................................

8.

(subtract line 7 from line 6)

Please file this original scannable credit form with the Tax Department.

1

1