Income Tax Return Form - Warren City - 2005

ADVERTISEMENT

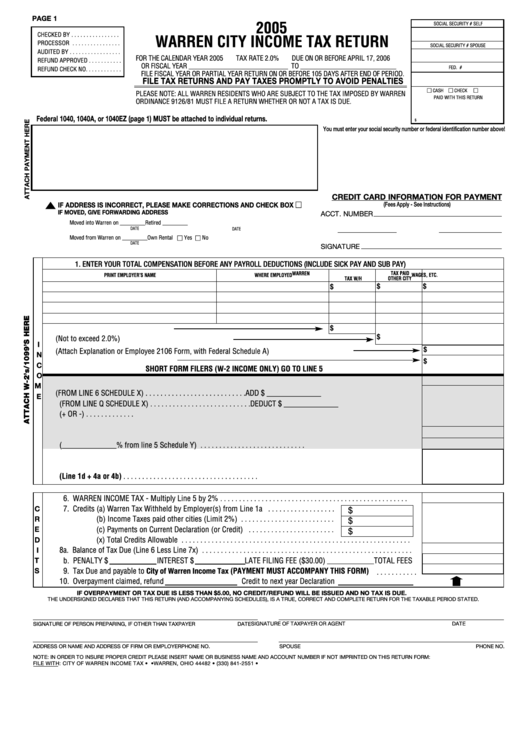

PAGE 1

2005

SOCIAL SECURITY # SELF

CHECKED BY . . . . . . . . . . . . . . . .

WARREN CITY INCOME TAX RETURN

PROCESSOR . . . . . . . . . . . . . . . .

SOCIAL SECURITY # SPOUSE

AUDITED BY . . . . . . . . . . . . . . . . .

FOR THE CALENDAR YEAR 2005

TAX RATE 2.0%

DUE ON OR BEFORE APRIL 17, 2006

REFUND APPROVED . . . . . . . . . . .

OR FISCAL YEAR _____________________________ TO ____________________________

FED. I.D. #

REFUND CHECK NO. . . . . . . . . . . .

FILE FISCAL YEAR OR PARTIAL YEAR RETURN ON OR BEFORE 105 DAYS AFTER END OF PERIOD.

FILE TAX RETURNS AND PAY TAXES PROMPTLY TO AVOID PENALTIES

□ CASH □ CHECK

□ M.O.

PLEASE NOTE: ALL WARREN RESIDENTS WHO ARE SUBJECT TO THE TAX IMPOSED BY WARREN

PAID WITH THIS RETURN

ORDINANCE 9126/81 MUST FILE A RETURN WHETHER OR NOT A TAX IS DUE.

Federal 1040, 1040A, or 1040EZ (page 1) MUST be attached to individual returns.

$

You must enter your social security number or federal identification number above!

CREDIT CARD INFORMATION FOR PAYMENT

IF ADDRESS IS INCORRECT, PLEASE MAKE CORRECTIONS AND CHECK BOX □

(Fees Apply - See Instructions)

IF MOVED, GIVE FORWARDING ADDRESS

ACCT. NUMBER

Moved into Warren on _________

Retired _________

DATE

DATE

AMT.

EXP. DATE

Own Rental □ Yes □ No

Moved from Warren on _________

DATE

SIGNATURE

1. ENTER YOUR TOTAL COMPENSATION BEFORE ANY PAYROLL DEDUCTIONS (INCLUDE SICK PAY AND SUB PAY)

WARREN

TAX PAID

WHERE EMPLOYED

WAGES, ETC.

PRINT EMPLOYER’S NAME

TAX W/H

OTHER CITY

$

$

$

$

1a. TOTAL WARREN TAX WITHHELD

$

1b. TOTAL TAX PAID OTHER CITIES (Not to exceed 2.0%)

I

$

1c. NON-TAXABLE INCOME (Attach Explanation or Employee 2106 Form, with Federal Schedule A)

N

1d. TOTAL WARREN TAXABLE WAGES

$

C

SHORT FORM FILERS (W-2 INCOME ONLY) GO TO LINE 5

O

2. TOTAL INCOME FROM PAGE 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

M

3a. ITEMS NOT DEDUCTIBLE (FROM LINE 6 SCHEDULE X) . . . . . . . . . . . . . . . . . . . . . . . . . . .ADD $ ______________

E

b. ITEMS NOT TAXABLE (FROM LINE Q SCHEDULE X) . . . . . . . . . . . . . . . . . . . . . . . . . . .DEDUCT $ ______________

c. DIFFERENCE BETWEEN LINES 3a or 3b TO BE ADDED TO OR SUBTRACTED FROM LINE 2 (+ OR -) . . . . . . . . . . . . .

4a. NET INCOME . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b. AMOUNT OF LINE 4a ALLOCABLE (______________% from line 5 Schedule Y) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. AMOUNT SUBJECT TO WARREN INCOME TAX (Line 1d + 4a or 4b)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. WARREN INCOME TAX - Multiply Line 5 by 2% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7. Credits (a) Warren Tax Withheld by Employer(s) from Line 1a . . . . . . . . . . . . . . . . . .

C

$

R

(b) Income Taxes paid other cities (Limit 2%) . . . . . . . . . . . . . . . . . . . . . . . . .

$

(c) Payments on Current Declaration (or Credit) . . . . . . . . . . . . . . . . . . . . . . .

E

$

D

(x) Total Credits Allowable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8a. Balance of Tax Due (Line 6 Less Line 7x) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

I

b. PENALTY $

INTEREST $

LATE FILING FEE ($30.00)

TOTAL FEES

T

S

9. Tax Due and payable to City of Warren Income Tax (PAYMENT MUST ACCOMPANY THIS FORM)

. . . . . . . . . . .

10. Overpayment claimed, refund

Credit to next year Declaration

IF OVERPAYMENT OR TAX DUE IS LESS THAN $5.00, NO CREDIT/REFUND WILL BE ISSUED AND NO TAX IS DUE.

THE UNDERSIGNED DECLARES THAT THIS RETURN (AND ACCOMPANYING SCHEDULES), IS A TRUE, CORRECT AND COMPLETE RETURN FOR THE TAXABLE PERIOD STATED.

SIGNATURE OF PERSON PREPARING, IF OTHER THAN TAXPAYER

DATE

SIGNATURE OF TAXPAYER OR AGENT

DATE

ADDRESS OR NAME AND ADDRESS OF FIRM OR EMPLOYER

PHONE NO.

SPOUSE

PHONE NO.

NOTE: IN ORDER TO INSURE PROPER CREDIT PLEASE INSERT NAME OR BUSINESS NAME AND ACCOUNT NUMBER IF NOT IMPRINTED ON THIS RETURN FORM:

FILE WITH: CITY OF WARREN INCOME TAX • P.O. BOX 230 • WARREN, OHIO 44482 • (330) 841-2551 •

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2