2006 Declaration Of Estimated Tax Worksheet - City Of Gallipolis

ADVERTISEMENT

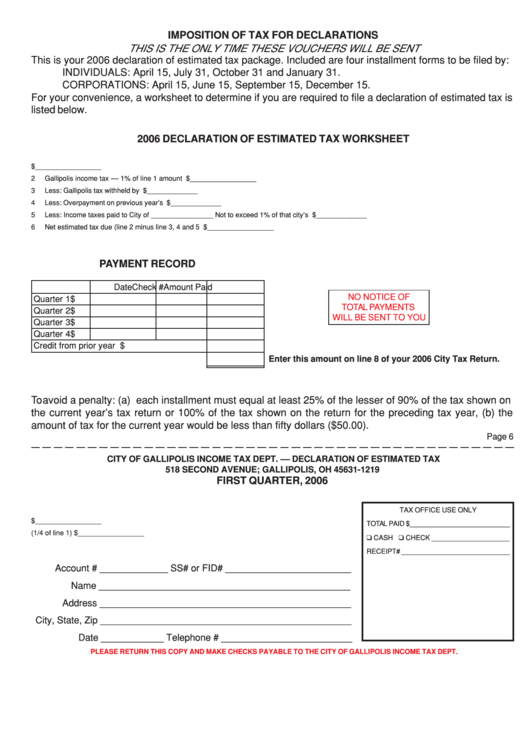

IMPOSITION OF TAX FOR DECLARATIONS

THIS IS THE ONLY TIME THESE VOUCHERS WILL BE SENT

This is your 2006 declaration of estimated tax package. Included are four installment forms to be filed by:

INDIVIDUALS: April 15, July 31, October 31 and January 31.

CORPORATIONS: April 15, June 15, September 15, December 15.

For your convenience, a worksheet to determine if you are required to file a declaration of estimated tax is

listed below.

2006 DECLARATION OF ESTIMATED TAX WORKSHEET

1.

Total income subject to Gallipolis Tax ................................................................................................................................................. $_________________

2

Gallipolis income tax –– 1% of line 1 amount ..................................................................................................................................... $_________________

3

Less: Gallipolis tax withheld by employers ............................................................................................................. $_____________

4

Less: Overpayment on previous year’s return ........................................................................................................ $_____________

5

Less: Income taxes paid to City of ________________ Not to exceed 1% of that city’s income .......................... $_____________

6

Net estimated tax due (line 2 minus line 3, 4 and 5 ............................................................................................................................ $_________________

PAYMENT RECORD

Date

Check #

Amount Paid

NO NOTICE OF

Quarter 1

$

TOTAL PAYMENTS

Quarter 2

$

WILL BE SENT TO YOU

Quarter 3

$

Quarter 4

$

Credit from prior year ..................................... $

Enter this amount on line 8 of your 2006 City Tax Return.

To avoid a penalty: (a) each installment must equal at least 25% of the lesser of 90% of the tax shown on

the current year’s tax return or 100% of the tax shown on the return for the preceding tax year, (b) the

amount of tax for the current year would be less than fifty dollars ($50.00).

Page 6

CITY OF GALLIPOLIS INCOME TAX DEPT. –– DECLARATION OF ESTIMATED TAX

518 SECOND AVENUE; GALLIPOLIS, OH 45631-1219

FIRST QUARTER, 2006

TAX OFFICE USE ONLY

1. Total Estimated Tax ............................................................................................ $_________________

TOTAL PAID $__________________________

2. Amount Enclosed (1/4 of line 1) ......................................................................... $_________________

❑ CASH ❑ CHECK ____________________

RECEIPT# ____________________________

Account # _____________ SS# or FID# ________________________

Name ________________________________________________

Address ________________________________________________

City, State, Zip ________________________________________________

Date ____________ Telephone # _________________________

PLEASE RETURN THIS COPY AND MAKE CHECKS PAYABLE TO THE CITY OF GALLIPOLIS INCOME TAX DEPT.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2