Tax Refunds For Extended Warranties On Motor Vehicles Form

ADVERTISEMENT

TAX REFUNDS FOR EXTENDED WARRANTIES ON MOTOR VEHICLES

The Arkansas Supreme Court has confirmed that extended vehicle warranties are not subject to sales tax. To

assist taxpayers in receiving a refund for these taxes, the Department of Finance & Administration has

established the following procedures to obtain a refund.

Extended Warranty Purchased with a Motor Vehicle (Tax Paid to the Revenue Office)

If the tax on the extended warranty was paid to the Revenue Office at the same time the tax on the vehicle was

paid, the following refund procedure shall apply:

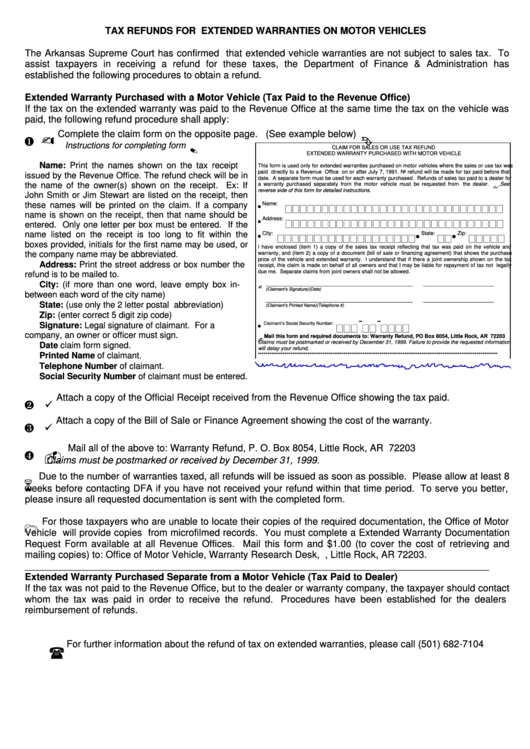

Complete the claim form on the opposite page. (See example below)

Instructions for completing form

CLAIM FOR SALES OR USE TAX REFUND

EXTENDED WARRANTY PURCHASED WITH MOTOR VEHICLE

Name: Print the names shown on the tax receipt

This form is used only for extended warranties purchased on motor vehicles where the sales or use tax was

paid directly to a Revenue Office on or after July 7, 1991. No refund will be made for tax paid before that

issued by the Revenue Office. The refund check will be in

date. A separate form must be used for each warranty purchased. Refunds of sales tax paid to a dealer for

the name of the owner(s) shown on the receipt. Ex: If

a warranty purchased separately from the motor vehicle must be requested from the dealer.

See

reverse side of this form for detailed instructions.

John Smith or Jim Stewart are listed on the receipt, then

these names will be printed on the claim. If a company

Name:

name is shown on the receipt, then that name should be

Address:

entered. Only one letter per box must be entered. If the

name listed on the receipt is too long to fit within the

City:

State:

Zip:

boxes provided, initials for the first name may be used, or

I have enclosed (item 1) a copy of the sales tax receipt reflecting that tax was paid on the vehicle and

the company name may be abbreviated.

warranty, and (item 2) a copy of a document (bill of sale or financing agreement) that shows the purchase

price of the vehicle and extended warranty. I understand that if there a joint ownership shown on the tax

Address: Print the street address or box number the

receipt, this claim is made on behalf of all owners and that I may be liable for repayment of tax not legally

due me. Separate claims from joint owners shall not be allowed.

refund is to be mailed to.

City: (if more than one word, leave empty box in-

__________________________________________________

________________________

(Claimant’s Signature)

(Date)

between each word of the city name)

__________________________________________________

________________________

State: (use only the 2 letter postal abbreviation)

(Claimant’s Printed Name)

(Telephone #)

Zip: (enter correct 5 digit zip code)

-

-

:

Claimant’s Social Security Number

Signature: Legal signature of claimant. For a

company, an owner or officer must sign.

Mail this form and required documents to: Warranty Refund, PO Box 8054, Little Rock, AR 72203

Claims must be postmarked or received by December 31, 1999. Failure to provide the requested information

Date claim form signed.

will delay your refund.

Printed Name of claimant.

******************************************************************************************************************************

Telephone Number of claimant.

Social Security Number of claimant must be entered.

Attach a copy of the Official Receipt received from the Revenue Office showing the tax paid.

Attach a copy of the Bill of Sale or Finance Agreement showing the cost of the warranty.

Mail all of the above to: Warranty Refund, P. O. Box 8054, Little Rock, AR 72203

Claims must be postmarked or received by December 31, 1999.

Due to the number of warranties taxed, all refunds will be issued as soon as possible. Please allow at least 8

weeks before contacting DFA if you have not received your refund within that time period. To serve you better,

please insure all requested documentation is sent with the completed form.

For those taxpayers who are unable to locate their copies of the required documentation, the Office of Motor

Vehicle will provide copies from microfilmed records. You must complete a Extended Warranty Documentation

Request Form available at all Revenue Offices. Mail this form and $1.00 (to cover the cost of retrieving and

mailing copies) to: Office of Motor Vehicle, Warranty Research Desk, P.O. Box 8096, Little Rock, AR 72203.

_______________________________________________________________________________________

Extended Warranty Purchased Separate from a Motor Vehicle (Tax Paid to Dealer)

If the tax was not paid to the Revenue Office, but to the dealer or warranty company, the taxpayer should contact

whom the tax was paid in order to receive the refund. Procedures have been established for the dealers

reimbursement of refunds.

For further information about the refund of tax on extended warranties, please call (501) 682-7104

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1