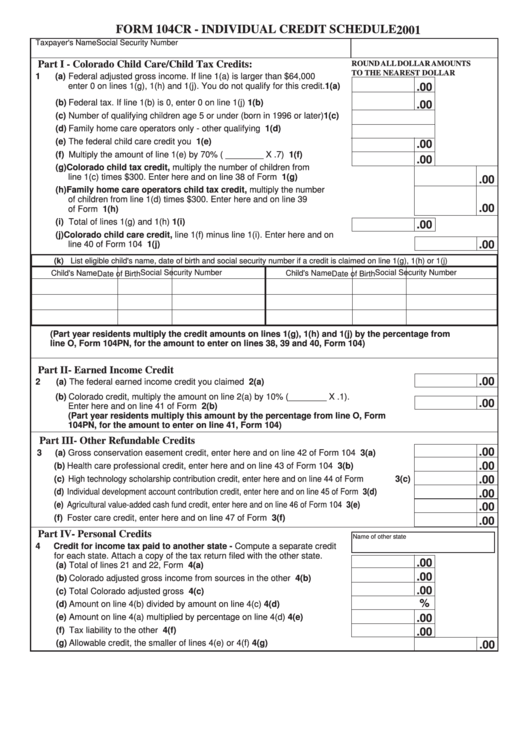

Form 104cr - Individual Credit Schedule 2001

ADVERTISEMENT

FORM 104CR - INDIVIDUAL CREDIT SCHEDULE

2001

Taxpayer's Name

Social Security Number

Part I - Colorado Child Care/Child Tax Credits:

ROUND ALL DOLLAR AMOUNTS

TO THE NEAREST DOLLAR

1

(a) Federal adjusted gross income. If line 1(a) is larger than $64,000

enter 0 on lines 1(g), 1(h) and 1(j). You do not qualify for this credit . 1(a)

.00

(b) Federal tax. If line 1(b) is 0, enter 0 on line 1(j) ................................. 1(b)

.00

(c) Number of qualifying children age 5 or under (born in 1996 or later) 1(c)

(d) Family home care operators only - other qualifying children ............. 1(d)

(e) The federal child care credit you claimed .......................................... 1(e)

.00

(f) Multiply the amount of line 1(e) by 70% ( ________ X .7) .................. 1(f)

.00

(g) Colorado child tax credit, multiply the number of children from

line 1(c) times $300. Enter here and on line 38 of Form 104 ....................................... 1(g)

.00

(h) Family home care operators child tax credit, multiply the number

of children from line 1(d) times $300. Enter here and on line 39

.00

of Form 104 .................................................................................................................. 1(h)

(i) Total of lines 1(g) and 1(h) .................................................................. 1(i)

.00

(j) Colorado child care credit, line 1(f) minus line 1(i). Enter here and on

.00

line 40 of Form 104 ....................................................................................................... 1(j)

(k) List eligible child's name, date of birth and social security number if a credit is claimed on line 1(g), 1(h) or 1(j)

Social Security Number

Social Security Number

Child's Name

Child's Name

Date of Birth

Date of Birth

(Part year residents multiply the credit amounts on lines 1(g), 1(h) and 1(j) by the percentage from

line O, Form 104PN, for the amount to enter on lines 38, 39 and 40, Form 104)

Part II- Earned Income Credit

.00

2

(a) The federal earned income credit you claimed ............................................................ 2(a)

(b) Colorado credit, multiply the amount on line 2(a) by 10% (________ X .1).

.00

Enter here and on line 41 of Form 104 ........................................................................ 2(b)

(Part year residents multiply this amount by the percentage from line O, Form

104PN, for the amount to enter on line 41, Form 104)

Part III- Other Refundable Credits

.00

3

(a) Gross conservation easement credit, enter here and on line 42 of Form 104 .............. 3(a)

.00

(b) Health care professional credit, enter here and on line 43 of Form 104 ....................... 3(b)

(c) High technology scholarship contribution credit, enter here and on line 44 of Form 104 ..... 3(c)

.00

(d) Individual development account contribution credit, enter here and on line 45 of Form 104 ....... 3(d)

.00

(e) Agricultural value-added cash fund credit, enter here and on line 46 of Form 104 ...................... 3(e)

.00

(f) Foster care credit, enter here and on line 47 of Form 104 ............................................. 3(f)

.00

Part IV- Personal Credits

Name of other state

4

Credit for income tax paid to another state - Compute a separate credit

for each state. Attach a copy of the tax return filed with the other state.

.00

(a) Total of lines 21 and 22, Form 104 .................................................... 4(a)

.00

(b) Colorado adjusted gross income from sources in the other state ...... 4(b)

.00

(c) Total Colorado adjusted gross income .............................................. 4(c)

%

(d) Amount on line 4(b) divided by amount on line 4(c) ........................... 4(d)

(e) Amount on line 4(a) multiplied by percentage on line 4(d) ................. 4(e)

.00

(f) Tax liability to the other state .............................................................. 4(f)

.00

(g) Allowable credit, the smaller of lines 4(e) or 4(f) .......................................................... 4(g)

.00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2