Form 135-A - New/expanded Business Facility And Enterprise Zone: Application For Subsequently Claiming Tax Benefits

ADVERTISEMENT

lB54!

,

~, 19-

LEASE

TYPE

0

0

(

)

4c. 0 Individual Proprietorship

O/a OWNERSHIP YEAR END

c

-

-

F

-

-

2

-

-

%

!z

-

-

t

z

p

c

g

,

,19-$

$

Z

,

)

19-$

$

P

g

6c. 3rd year: Beginning

,

)

19-$

$

6c

Z

,19

- Ending

,19-$

$

6

,

,19-$

$

g

,

,19-$

$

P

,

)

19-$

$

6g

iT

F

,

)

19-$

$

fi

0

,

,19-$

$

Sj. 10th year: Beginning

,

)

19-$

$

6j

MoDED-135-A

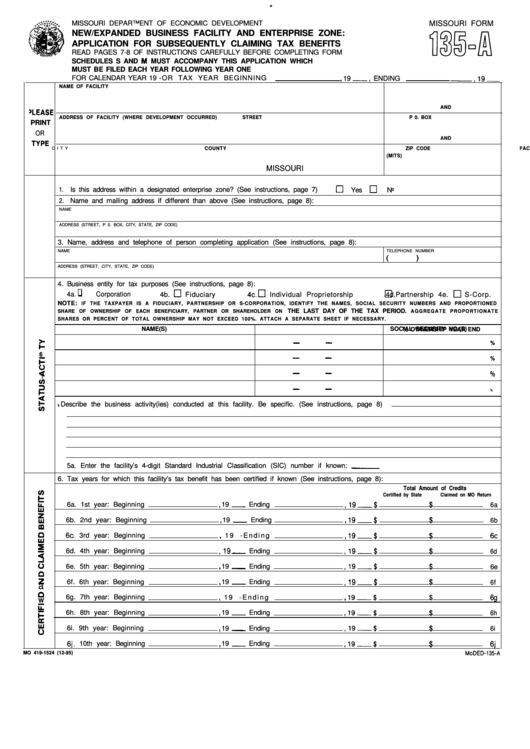

MISSOURI DEPARTMENT OF ECONOMIC DEVELOPMENT

MISSOURI FORM

NEW/EXPANDED BUSINESS FACILITY AND ENTERPRISE ZONE:

APPLICATION FOR SUBSEQUENTLY CLAIMING TAX BENEFITS

READ PAGES 7-8 OF INSTRUCTIONS CAREFULLY BEFORE COMPLETING FORM

SCHEDULES S AND M MUST ACCOMPANY THIS APPLICATION WHICH

MUST BE FILED EACH YEAR FOLLOWING YEAR ONE

FOR CALENDAR YEAR 19 -OR TAX YEAR BEGINNING

19 -, ENDING

NAME OF FACILITY

FACILITY FEDERAL I.D. NO.

AND

ADDRESS OF FACILITY (WHERE DEVELOPMENT OCCURRED)

STREET

P 0. BOX

TAXPAYER FEDERAL I.D. NO.

PRINT

OR

AND

COUNTY

ZIP CODE

C I T Y

FACILITY MISSOURI TAX I.D. NO.

(MITS)

MISSOURI

1. Is this address within a designated enterprise zone? (See instructions, page 7)

Yes

No

2. Name and mailing address if different than above (See instructions, page 8):

NAME

ADDRESS (STREET, P 0. BOX, CITY, STATE, ZIP CODE)

3. Name, address and telephone of person completing application (See instructions, page 8):

NAME

TELEPHONE NUMBER

ADDRESS (STREET, CITY, STATE, ZIP CODE)

4. Business entity for tax purposes (See instructions, page 8):

q

4a.

Corporation

4b. 0 Fiduciary

4d. 0 Partnership 4e. 0 S-Corp.

NOTE:

IF THE TAXPAYER IS A FIDUCIARY, PARTNERSHIP OR S-CORPORATION, IDENTIFY THE NAMES, SOCIAL SECURITY NUMBERS AND PROPORTIONED

THE LAST DAY OF THE TAX PERIOD.

SHARE OF OWNERSHIP OF EACH BENEFICIARY, PARTNER OR SHAREHOLDER ON

A G G R E G A T E P R O P O R T I O N A T E

SHARES OR PERCENT OF TOTAL OWNERSHIP MAY NOT EXCEED 100%. ATTACH A SEPARATE SHEET IF NECESSARY.

NAME(S)

SOCIAL SECURITY NO.(S)

%

6

%

I

%

Describe the business activity(ies) conducted at this facility. Be specific. (See instructions, page 8)

5.

5a. Enter the facility’ s 4-digit Standard Industrial Classification (SIC) number if known: _

6. Tax years for which this facility’ s tax benefit has been certified if known (See instructions, page 8):

Total Amount of Credits

Certified by State

Claimed on MO Return

6a. 1st year: Beginning

19 _ Ending

6a

6b. 2nd year: Beginning

19 - Ending

6b

1 9 - E n d i n g

6d. 4th year: Beginning

6d

6e. 5th year: Beginning

19 _ Ending

6e

6f. 6th year: Beginning

19 - Ending

6f

a

6g. 7th year: Beginning

1 9 - E n d i n g

W

6h. 8th year: Beginning

19 _ Ending

6h

6i. 9th year: Beginning

19 _ Ending

6i

19 _ Ending

MO 419-1524 (12-95)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2