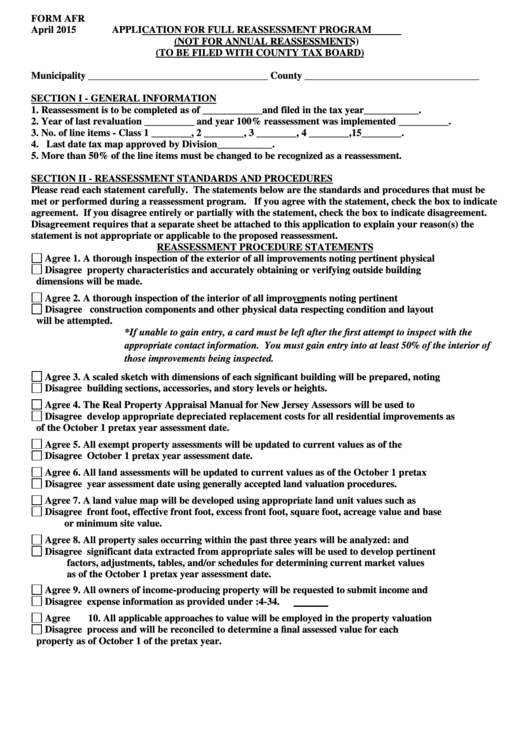

FORM AFR

April 2015

APPLICATION FOR FULL REASSESSMENT PROGRAM

(NOT FOR ANNUAL REASSESSMENTS)

(TO BE FILED WITH COUNTY TAX BOARD)

Municipality ____________________________________

County ___________________________________

SECTION I - GENERAL INFORMATION

1.

Reassessment is to be completed as of ____________and filed in the tax year___________.

2.

Year of last revaluation __________ and year 100% reassessment was implemented __________.

3.

No. of line items - Class 1 ________, 2 ________, 3 ________, 4 ________,15________.

4.

Last date tax map approved by Division___________.

5.

More than 50% of the line items must be changed to be recognized as a reassessment.

SECTION II - REASSESSMENT STANDARDS AND PROCEDURES

Please read each statement carefully. The statements below are the standards and procedures that must be

met or performed during a reassessment program. If you agree with the statement, check the box to indicate

agreement. If you disagree entirely or partially with the statement, check the box to indicate disagreement.

Disagreement requires that a separate sheet be attached to this application to explain your reason(s) the

statement is not appropriate or applicable to the proposed reassessment.

REASSESSMENT PROCEDURE STATEMENTS

Agree

1.

A thorough inspection of the exterior of all improvements noting pertinent physical

Disagree

property characteristics and accurately obtaining or verifying outside building

dimensions will be made.

Agree

2.

A thorough inspection of the interior of all improvements noting pertinent

Disagree

construction components and other physical data respecting condition and layout

will be attempted.

*If unable to gain entry, a card must be left after the first attempt to inspect with the

appropriate contact information. You must gain entry into at least 50% of the interior of

those improvements being inspected.

Agree

3.

A scaled sketch with dimensions of each significant building will be prepared, noting

Disagree

building sections, accessories, and story levels or heights.

Agree

4.

The Real Property Appraisal Manual for New Jersey Assessors will be used to

Disagree

develop appropriate depreciated replacement costs for all residential improvements as

of the October 1 pretax year assessment date.

Agree

5.

All exempt property assessments will be updated to current values as of the

Disagree

October 1 pretax year assessment date.

Agree

6.

All land assessments will be updated to current values as of the October 1 pretax

Disagree

year assessment date using generally accepted land valuation procedures.

Agree

7.

A land value map will be developed using appropriate land unit values such as

Disagree

front foot, effective front foot, excess front foot, square foot, acreage value and base

or minimum site value.

Agree

8.

All property sales occurring within the past three years will be analyzed: and

Disagree

significant data extracted from appropriate sales will be used to develop pertinent

factors, adjustments, tables, and/or schedules for determining current market values

as of the October 1 pretax year assessment date.

Agree

9.

All owners of income-producing property will be requested to submit income and

Disagree

expense information as provided under N.J.S.A. 54:4-34.

Agree

10.

All applicable approaches to value will be employed in the property valuation

Disagree

process and will be reconciled to determine a final assessed value for each

property as of October 1 of the pretax year.

1

1 2

2