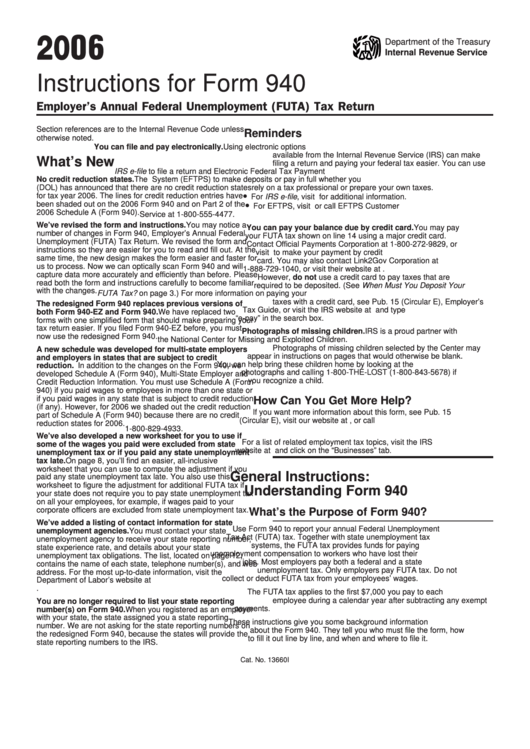

Instructions For Form 940 - Employer'S Annual Federal Unemployment (Futa) Tax Return - 2006

ADVERTISEMENT

2006

Department of the Treasury

Internal Revenue Service

Instructions for Form 940

Employer’s Annual Federal Unemployment (FUTA) Tax Return

Section references are to the Internal Revenue Code unless

Reminders

otherwise noted.

You can file and pay electronically. Using electronic options

available from the Internal Revenue Service (IRS) can make

What’s New

filing a return and paying your federal tax easier. You can use

IRS e-file to file a return and Electronic Federal Tax Payment

No credit reduction states. The U.S. Department of Labor

System (EFTPS) to make deposits or pay in full whether you

(DOL) has announced that there are no credit reduction states

rely on a tax professional or prepare your own taxes.

•

for tax year 2006. The lines for credit reduction entries have

For IRS e-file, visit for additional information.

•

been shaded out on the 2006 Form 940 and on Part 2 of the

For EFTPS, visit or call EFTPS Customer

2006 Schedule A (Form 940).

Service at 1-800-555-4477.

We’ve revised the form and instructions. You may notice a

You can pay your balance due by credit card. You may pay

number of changes in Form 940, Employer’s Annual Federal

your FUTA tax shown on line 14 using a major credit card.

Unemployment (FUTA) Tax Return. We revised the form and

Contact Official Payments Corporation at 1-800-272-9829, or

instructions so they are easier for you to read and fill out. At the

visit to make your payment by credit

same time, the new design makes the form easier and faster for

card. You may also contact Link2Gov Corporation at

us to process. Now we can optically scan Form 940 and will

1-888-729-1040, or visit their website at

capture data more accurately and efficiently than before. Please

However, do not use a credit card to pay taxes that are

read both the form and instructions carefully to become familiar

required to be deposited. (See When Must You Deposit Your

with the changes.

FUTA Tax? on page 3.) For more information on paying your

taxes with a credit card, see Pub. 15 (Circular E), Employer’s

The redesigned Form 940 replaces previous versions of

Tax Guide, or visit the IRS website at and type

both Form 940-EZ and Form 940. We have replaced two

“e-pay” in the search box.

forms with one simplified form that should make preparing your

tax return easier. If you filed Form 940-EZ before, you must

Photographs of missing children. IRS is a proud partner with

now use the redesigned Form 940.

the National Center for Missing and Exploited Children.

Photographs of missing children selected by the Center may

A new schedule was developed for multi-state employers

appear in instructions on pages that would otherwise be blank.

and employers in states that are subject to credit

You can help bring these children home by looking at the

reduction. In addition to the changes on the Form 940, we

photographs and calling 1-800-THE-LOST (1-800-843-5678) if

developed Schedule A (Form 940), Multi-State Employer and

you recognize a child.

Credit Reduction Information. You must use Schedule A (Form

940) if you paid wages to employees in more than one state or

if you paid wages in any state that is subject to credit reduction

How Can You Get More Help?

(if any). However, for 2006 we shaded out the credit reduction

If you want more information about this form, see Pub. 15

part of Schedule A (Form 940) because there are no credit

(Circular E), visit our website at , or call

reduction states for 2006.

1-800-829-4933.

We’ve also developed a new worksheet for you to use if

For a list of related employment tax topics, visit the IRS

some of the wages you paid were excluded from state

website at and click on the “Businesses” tab.

unemployment tax or if you paid any state unemployment

tax late. On page 8, you’ll find an easier, all-inclusive

worksheet that you can use to compute the adjustment if you

General Instructions:

paid any state unemployment tax late. You also use this

worksheet to figure the adjustment for additional FUTA tax if

Understanding Form 940

your state does not require you to pay state unemployment tax

on all your employees, for example, if wages paid to your

corporate officers are excluded from state unemployment tax.

What’s the Purpose of Form 940?

We’ve added a listing of contact information for state

Use Form 940 to report your annual Federal Unemployment

unemployment agencies. You must contact your state

Tax Act (FUTA) tax. Together with state unemployment tax

unemployment agency to receive your state reporting number,

systems, the FUTA tax provides funds for paying

state experience rate, and details about your state

unemployment compensation to workers who have lost their

unemployment tax obligations. The list, located on page 12,

jobs. Most employers pay both a federal and a state

contains the name of each state, telephone number(s), and web

unemployment tax. Only employers pay FUTA tax. Do not

address. For the most up-to-date information, visit the

collect or deduct FUTA tax from your employees’ wages.

Department of Labor’s website at

doleta.gov.

The FUTA tax applies to the first $7,000 you pay to each

employee during a calendar year after subtracting any exempt

You are no longer required to list your state reporting

payments.

number(s) on Form 940. When you registered as an employer

with your state, the state assigned you a state reporting

These instructions give you some background information

number. We are not asking for the state reporting numbers on

about the Form 940. They tell you who must file the form, how

the redesigned Form 940, because the states will provide the

to fill it out line by line, and when and where to file it.

state reporting numbers to the IRS.

Cat. No. 13660I

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12