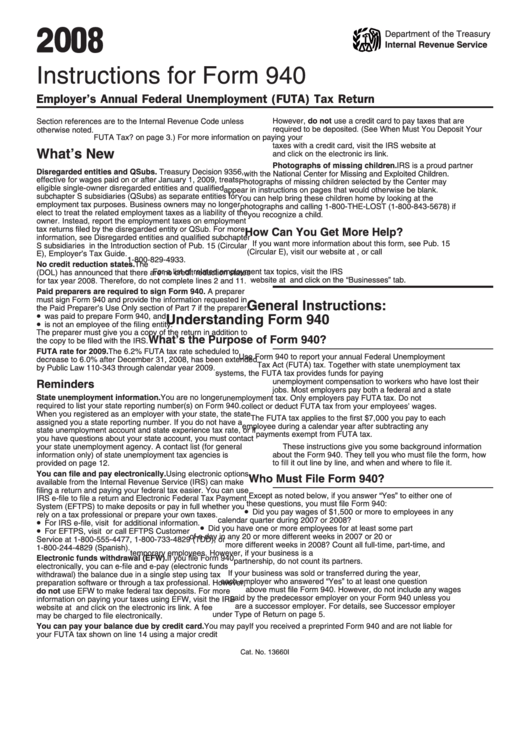

Instructions For Form 940 - Employer'S Annual Federal Unemployment (Futa) Tax Return - 2008

ADVERTISEMENT

2 0 08

Department of the Treasury

Internal Revenue Service

Instructions for Form 940

Employer’s Annual Federal Unemployment (FUTA) Tax Return

However, do not use a credit card to pay taxes that are

Section references are to the Internal Revenue Code unless

required to be deposited. (See When Must You Deposit Your

otherwise noted.

FUTA Tax? on page 3.) For more information on paying your

taxes with a credit card, visit the IRS website at

What’s New

and click on the electronic irs link.

Photographs of missing children. IRS is a proud partner

Disregarded entities and QSubs. Treasury Decision 9356,

with the National Center for Missing and Exploited Children.

effective for wages paid on or after January 1, 2009, treats

Photographs of missing children selected by the Center may

eligible single-owner disregarded entities and qualified

appear in instructions on pages that would otherwise be blank.

subchapter S subsidiaries (QSubs) as separate entities for

You can help bring these children home by looking at the

employment tax purposes. Business owners may no longer

photographs and calling 1-800-THE-LOST (1-800-843-5678) if

elect to treat the related employment taxes as a liability of the

you recognize a child.

owner. Instead, report the employment taxes on employment

tax returns filed by the disregarded entity or QSub. For more

How Can You Get More Help?

information, see Disregarded entities and qualified subchapter

If you want more information about this form, see Pub. 15

S subsidiaries in the Introduction section of Pub. 15 (Circular

(Circular E), visit our website at , or call

E), Employer’s Tax Guide.

1-800-829-4933.

No credit reduction states. The U.S. Department of Labor

For a list of related employment tax topics, visit the IRS

(DOL) has announced that there are no credit reduction states

website at and click on the “Businesses” tab.

for tax year 2008. Therefore, do not complete lines 2 and 11.

Paid preparers are required to sign Form 940. A preparer

must sign Form 940 and provide the information requested in

General Instructions:

the Paid Preparer’s Use Only section of Part 7 if the preparer:

•

was paid to prepare Form 940, and

Understanding Form 940

•

is not an employee of the filing entity.

The preparer must give you a copy of the return in addition to

What’s the Purpose of Form 940?

the copy to be filed with the IRS.

FUTA rate for 2009. The 6.2% FUTA tax rate scheduled to

Use Form 940 to report your annual Federal Unemployment

decrease to 6.0% after December 31, 2008, has been extended

Tax Act (FUTA) tax. Together with state unemployment tax

by Public Law 110-343 through calendar year 2009.

systems, the FUTA tax provides funds for paying

unemployment compensation to workers who have lost their

Reminders

jobs. Most employers pay both a federal and a state

State unemployment information. You are no longer

unemployment tax. Only employers pay FUTA tax. Do not

required to list your state reporting number(s) on Form 940.

collect or deduct FUTA tax from your employees’ wages.

When you registered as an employer with your state, the state

The FUTA tax applies to the first $7,000 you pay to each

assigned you a state reporting number. If you do not have a

employee during a calendar year after subtracting any

state unemployment account and state experience tax rate, or if

payments exempt from FUTA tax.

you have questions about your state account, you must contact

These instructions give you some background information

your state unemployment agency. A contact list (for general

about the Form 940. They tell you who must file the form, how

information only) of state unemployment tax agencies is

to fill it out line by line, and when and where to file it.

provided on page 12.

You can file and pay electronically. Using electronic options

Who Must File Form 940?

available from the Internal Revenue Service (IRS) can make

filing a return and paying your federal tax easier. You can use

Except as noted below, if you answer “Yes” to either one of

IRS e-file to file a return and Electronic Federal Tax Payment

these questions, you must file Form 940:

System (EFTPS) to make deposits or pay in full whether you

•

Did you pay wages of $1,500 or more to employees in any

rely on a tax professional or prepare your own taxes.

•

calendar quarter during 2007 or 2008?

For IRS e-file, visit for additional information.

•

•

Did you have one or more employees for at least some part

For EFTPS, visit or call EFTPS Customer

of a day in any 20 or more different weeks in 2007 or 20 or

Service at 1-800-555-4477, 1-800-733-4829 (TDD), or

more different weeks in 2008? Count all full-time, part-time, and

1-800-244-4829 (Spanish).

temporary employees. However, if your business is a

Electronic funds withdrawal (EFW). If you file Form 940

partnership, do not count its partners.

electronically, you can e-file and e-pay (electronic funds

If your business was sold or transferred during the year,

withdrawal) the balance due in a single step using tax

each employer who answered “Yes” to at least one question

preparation software or through a tax professional. However,

above must file Form 940. However, do not include any wages

do not use EFW to make federal tax deposits. For more

paid by the predecessor employer on your Form 940 unless you

information on paying your taxes using EFW, visit the IRS

are a successor employer. For details, see Successor employer

website at and click on the electronic irs link. A fee

under Type of Return on page 5.

may be charged to file electronically.

You can pay your balance due by credit card. You may pay

If you received a preprinted Form 940 and are not liable for

your FUTA tax shown on line 14 using a major credit card.

FUTA tax for 2008 because you made no payments to

Cat. No. 13660I

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12