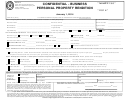

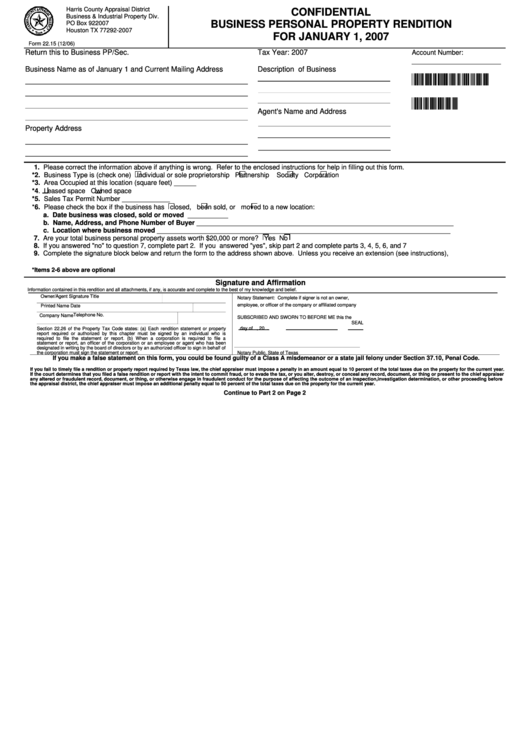

Form 22.15 - Confidential Business Personal Property Rendition For January 1, 2007 - Harris County Appraisal District

ADVERTISEMENT

Harris County Appraisal District

CONFIDENTIAL

Business & Industrial Property Div.

BUSINESS PERSONAL PROPERTY RENDITION

PO Box 922007

Houston TX 77292-2007

FOR JANUARY 1, 2007

Form 22.15 (12/06)

Return this to Business PP/Sec.

Tax Year: 2007

Account Number:

______________________

Business Name as of January 1 and Current Mailing Address

Description of Business

*NEWPP130*

*2007*

Agent's Name and Address

Property Address

1. Please correct the information above if anything is wrong. Refer to the enclosed instructions for help in filling out this form.

*2. Business Type is (check one)

Individual or sole proprietorship

Partnership

Society

Corporation

*3. Area Occupied at this location (square feet) ______

*4.

Leased space

Owned space

*5. Sales Tax Permit Number _____________

*6. Please check the box if the business has

closed,

been sold, or

moved to a new location:

a. Date business was closed, sold or moved ___________

b. Name, Address, and Phone Number of Buyer ______________________________________________________________________

c. Location where business moved ________________________________________________________________________________

7. Are your total business personal property assets worth $20,000 or more?

Yes

No

8. If you answered "no" to question 7, complete part 2. If you answered "yes", skip part 2 and complete parts 3, 4, 5, 6, and 7

9. Complete the signature block below and return the form to the address shown above. Unless you receive an extension (see instructions),

*Items 2-6 above are optional

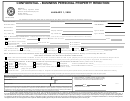

Signature and Affirmation

Information contained in this rendition and all attachments, if any, is accurate and complete to the best of my knowledge and belief.

Owner/Agent Signature

Title

Notary Statement: Complete if signer is not an owner,

employee, or officer of the company or affiliated company

Printed Name

Date

Telephone No.

Company Name

SUBSCRIBED AND SWORN TO BEFORE ME this the

SEAL

Section 22.26 of the Property Tax Code states: (a) Each rendition statement or property

day of

, 20

.

report required or authorized by this chapter must be signed by an individual who is

required to file the statement or report. (b) When a corporation is required to file a

statement or report, an officer of the corporation or an employee or agent who has been

designated in writing by the board of directors or by an authorized officer to sign in behalf of

the corporation must sign the statement or report.

Notary Public, State of Texas

If you make a false statement on this form, you could be found guilty of a Class A misdemeanor or a state jail felony under Section 37.10, Penal Code.

If you fail to timely file a rendition or property report required by Texas law, the chief appraiser must impose a penalty in an amount equal to 10 percent of the total taxes due on the property for the current year.

If the court determines that you filed a false rendition or report with the intent to commit fraud, or to evade the tax, or you alter, destroy, or conceal any record, document, or thing or present to the chief appraiser

any altered or fraudulent record, document, or thing, or otherwise engage in fraudulent conduct for the purpose of affecting the outcome of an inspection, investigation determination, or other proceeding before

the appraisal district, the chief appraiser must impose an additional penalty equal to 50 percent of the total taxes due on the property for the current year.

Continue to Part 2 on Page 2

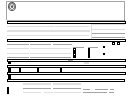

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

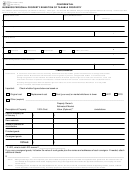

1

1 2

2 3

3 4

4 5

5 6

6