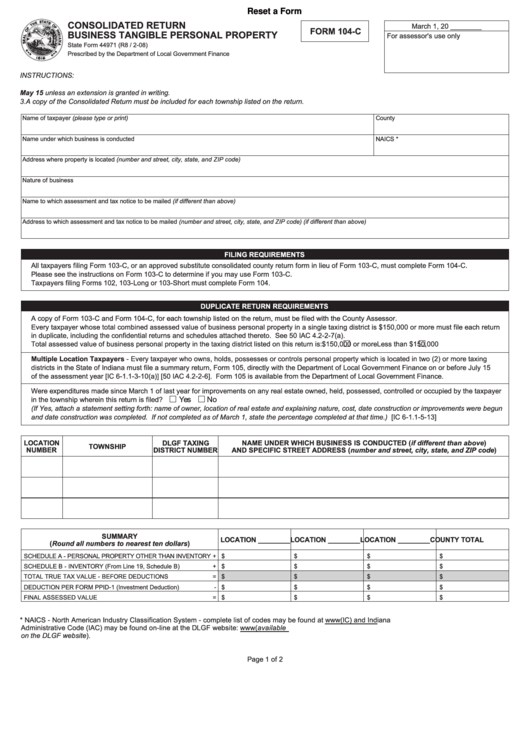

Reset a Form

CONSOLIDATED RETURN

March 1, 20 ________

FORM 104-C

BUSINESS TANGIBLE PERSONAL PROPERTY

For assessor's use only

State Form 44971 (R8 / 2-08)

Prescribed by the Department of Local Government Finance

INSTRUCTIONS:

1. This form must accompany a Consolidated Business Tangible Personal Property Return.

2. This form must be filed with the County Assessor not later than May 15 unless an extension is granted in writing.

3. A copy of the Consolidated Return must be included for each township listed on the return.

Name of taxpayer (please type or print)

County

Name under which business is conducted

NAICS *

Address where property is located (number and street, city, state, and ZIP code)

Nature of business

Name to which assessment and tax notice to be mailed (if different than above)

Address to which assessment and tax notice to be mailed (number and street, city, state, and ZIP code) (if different than above)

FILING REQUIREMENTS

All taxpayers filing Form 103-C, or an approved substitute consolidated county return form in lieu of Form 103-C, must complete Form 104-C.

Please see the instructions on Form 103-C to determine if you may use Form 103-C.

T axpayers filing Forms 102, 103-Long or 103-Short must complete Form 104.

DUPLICATE RETURN REQUIREMENTS

A copy of Form 103-C and Form 104-C, for each township listed on the return, must be filed with the County Assessor.

Every taxpayer whose total combined assessed value of business personal property in a single taxing district is $150,000 or more must file each return

in duplicate, including the confidential returns and schedules attached thereto. See 50 IAC 4.2-2-7(a).

T otal assessed value of business personal property in the taxing district listed on this return is:

$150,000 or more

Less than $150,000

Multiple Location Taxpayers - Every taxpayer who owns, holds, possesses or controls personal property which is located in two (2) or more taxing

districts in the State of Indiana must file a summary return, Form 105, directly with the Department of Local Government Finance on or before July 15

of the assessment year [IC 6-1.1-3-10(a)] [50 IAC 4.2-2-6]. Form 105 is available from the Department of Local Government Finance.

Were expenditures made since March 1 of last year for improvements on any real estate owned, held, possessed, controlled or occupied by the taxpayer

Yes

No

in the township wherein this return is filed?

(If Yes, attach a statement setting forth: name of owner, location of real estate and explaining nature, cost, date construction or improvements were begun

and date construction was completed. If not completed as of March 1, state the percentage completed at that time.) [IC 6-1.1-5-13]

LOCATION

DLGF TAXING

NAME UNDER WHICH BUSINESS IS CONDUCTED (if different than above)

TOWNSHIP

NUMBER

DISTRICT NUMBER

AND SPECIFIC STREET ADDRESS (number and street, city, state, and ZIP code)

SUMMARY

LOCATION ________ LOCATION ________ LOCATION ________

COUNTY TOTAL

(Round all numbers to nearest ten dollars)

SCHEDULE A - PERSONAL PROPERTY OTHER THAN INVENTORY

+

$

$

$

$

SCHEDULE B - INVENTORY (From Line 19, Schedule B)

+

$

$

$

$

TOTAL TRUE TAX VALUE - BEFORE DEDUCTIONS

=

$

$

$

$

DEDUCTION PER FORM PPID-1 (Investment Deduction)

-

$

$

$

$

FINAL ASSESSED VALUE

=

$

$

$

$

* NAICS - North American Industry Classification System - complete list of codes may be found at The Indiana Code (IC) and Indiana

Administrative Code (IAC) may be found on-line at the DLGF website: For further questions contact the Township Assessor (available

on the DLGF website).

Page 1 of 2

1

1 2

2