Form W-3 - City Of Springdale Withholding Tax Reconciliation 2007

ADVERTISEMENT

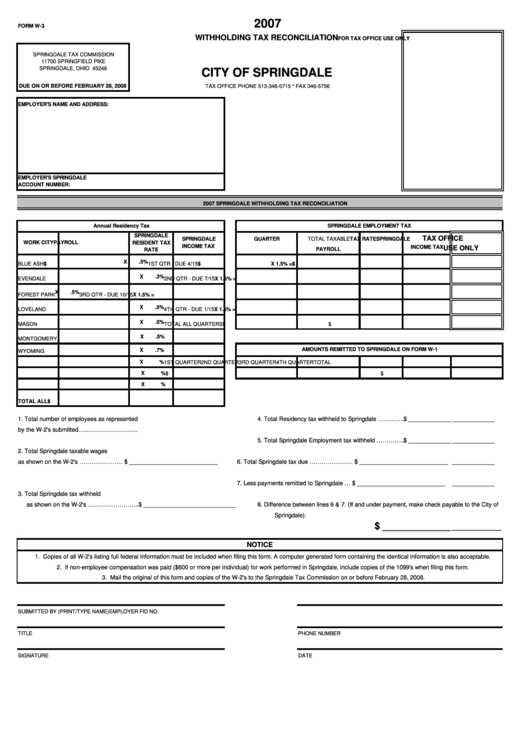

2007

FORM W-3

WITHHOLDING TAX RECONCILIATION

FOR TAX OFFICE USE ONLY

SPRINGDALE TAX COMMISSION

11700 SPRINGFIELD PIKE

SPRINGDALE, OHIO 45246

CITY OF SPRINGDALE

DUE ON OR BEFORE FEBRUARY 28, 2008

TAX OFFICE PHONE 513-346-5715 * FAX 346-5756

EMPLOYER'S NAME AND ADDRESS:

EMPLOYER'S SPRINGDALE

ACCOUNT NUMBER:

2007 SPRINGDALE WITHHOLDING TAX RECONCILIATION

Annual Residency Tax

SPRINGDALE EMPLOYMENT TAX

SPRINGDALE

TAX OFFICE

SPRINGDALE

QUARTER

TOTAL TAXABLE

TAX RATE

SPRINGDALE

WORK CITY

PAYROLL

RESIDENT TAX

INCOME TAX

INCOME TAX

USE ONLY

PAYROLL

RATE

X

.5%

BLUE ASH

$

1ST QTR - DUE 4/15

$

X 1.5% =

$

X

.3%

EVENDALE

2ND QTR - DUE 7/15

X 1.5% =

X

.5%

FOREST PARK

3RD QTR - DUE 10/15

X 1.5% =

X

.5%

LOVELAND

4TH QTR - DUE 1/15

X 1.5% =

X

.5%

MASON

TOTAL ALL QUARTERS $

$

X

.5%

MONTGOMERY

AMOUNTS REMITTED TO SPRINGDALE ON FORM W-1

X

.7%

WYOMING

X

%

1ST QUARTER

2ND QUARTER

3RD QUARTER

4TH QUARTER

TOTAL

X

%

$

$

X

%

TOTAL ALL

$

1. Total number of employees as represented

4. Total Residency tax withheld to Springdale ……...…..$ __________________________

_____________

by the W-2's submitted………………………….... __________________

5. Total Springdale Employment tax withheld …………..$ __________________________

_____________

2. Total Springdale taxable wages

as shown on the W-2's ………….……….... $ ___________________________

6. Total Springdale tax due …………….……....$ ___________________________

_____________

7. Less payments remitted to Springdale ….....$ ___________________________

_____________

3. Total Springdale tax withheld

as shown on the W-2's ……………………..$ ______________________________________________

8. Difference between lines 6 & 7. (If and under payment, make check payable to the City of

Springdale).

$ ________________________

_____________

NOTICE

1. Copies of all W-2's listing full federal information must be included when filing this form. A computer generated form containing the identical information is also acceptable.

2. If non-employee compensation was paid ($600 or more per individual) for work performed in Springdale, include copies of the 1099's when filing this form.

3. Mail the original of this form and copies of the W-2's to the Springdale Tax Commission on or before February 28, 2008.

SUBMITTED BY (PRINT/TYPE NAME)

EMPLOYER FID NO.

TITLE

PHONE NUMBER

SIGNATURE

DATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1