WARNING:

To protect against the possibility

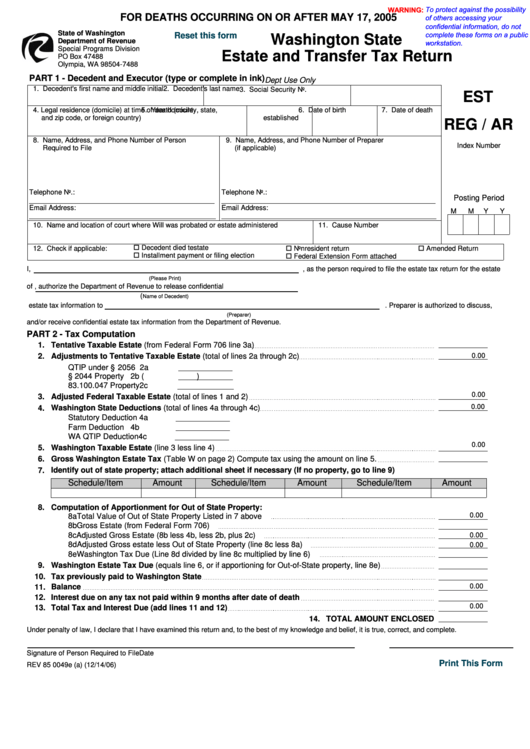

FOR DEATHS OCCURRING ON OR AFTER MAY 17, 2005

of others accessing your

confidential information, do not

State of Washington

complete these forms on a public

Reset this form

Washington State

Department of Revenue

workstation.

Special Programs Division

Estate and Transfer Tax Return

PO Box 47488

Olympia, WA 98504-7488

PART 1 - Decedent and Executor (type or complete in ink)

Dept Use Only

1. Decedent's first name and middle initial

2. Decedent's last name

3. Social Security No.

EST

4. Legal residence (domicile) at time of death (county, state,

5. Year domicile

6. Date of birth

7. Date of death

and zip code, or foreign country)

established

REG / AR

8. Name, Address, and Phone Number of Person

9. Name, Address, and Phone Number of Preparer

Index Number

Required to File

(if applicable)

Telephone No.:

Telephone No.:

Posting Period

Email Address:

Email Address:

M

M

Y

Y

10. Name and location of court where Will was probated or estate administered

11. Cause Number

Decedent died testate

12. Check if applicable:

Nonresident return

Amended Return

Installment payment or filing election

Federal Extension Form attached

I,

, as the person required to file the estate tax return for the estate

(Please Print)

of

, authorize the Department of Revenue to release confidential

(

Name of Decedent)

estate tax information to

. Preparer is authorized to discuss,

(Preparer)

and/or receive confidential estate tax information from the Department of Revenue.

PART 2 - Tax Computation

1.

Tentative Taxable Estate (from Federal Form 706 line 3a)

0.00

2.

Adjustments to Tentative Taxable Estate (total of lines 2a through 2c)

QTIP under § 2056

2a

§ 2044 Property

2b (

)

83.100.047 Property

2c

0.00

3.

Adjusted Federal Taxable Estate (total of lines 1 and 2)

0.00

4.

Washington State Deductions (total of lines 4a through 4c)

Statutory Deduction

4a

Farm Deduction

4b

WA QTIP Deduction

4c

0.00

5.

Washington Taxable Estate (line 3 less line 4)

6.

Gross Washington Estate Tax (Table W on page 2) Compute tax using the amount on line 5.

7.

Identify out of state property; attach additional sheet if necessary (If no property, go to line 9)

Schedule/Item

Amount

Schedule/Item

Amount

Schedule/Item

Amount

8.

Computation of Apportionment for Out of State Property:

0.00

8a

Total Value of Out of State Property Listed in 7 above

8b

Gross Estate (from Federal Form 706)

8c

Adjusted Gross Estate (8b less 4b, less 2b, plus 2c)

0.00

8d

Adjusted Gross estate less Out of State Property (line 8c less 8a)

0.00

8e

Washington Tax Due (Line 8d divided by line 8c multiplied by line 6)

9.

Washington Estate Tax Due (equals line 6, or if apportioning for Out-of-State property, line 8e)

10.

Tax previously paid to Washington State

0.00

11.

Balance

12.

Interest due on any tax not paid within 9 months after date of death

0.00

13.

Total Tax and Interest Due (add lines 11 and 12)

14.

TOTAL AMOUNT ENCLOSED

Under penalty of law, I declare that I have examined this return and, to the best of my knowledge and belief, it is true, correct, and complete.

Signature of Person Required to File

Date

Print This Form

REV 85 0049e (a) (12/14/06)

1

1