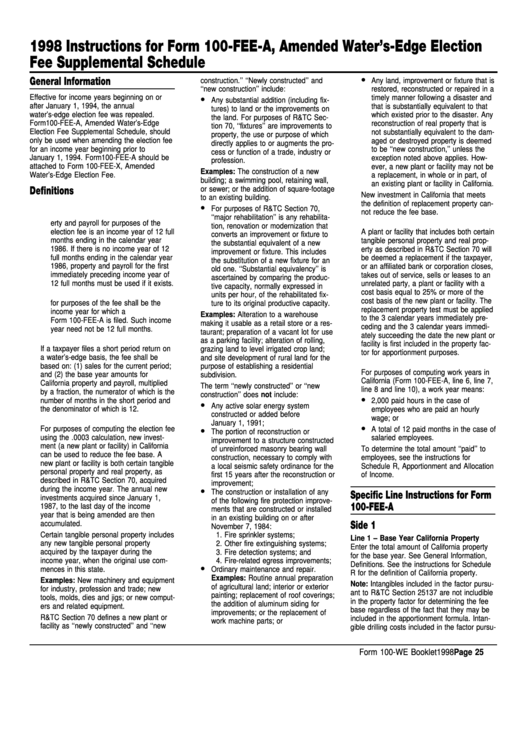

Instructions For Form 100-Fee-A, Amended Water'S-Edge Election Fee Supplemental Schedule 1998

ADVERTISEMENT

1998 Instructions for Form 100-FEE-A, Amended Water’s-Edge Election

Fee Supplemental Schedule

•

General Information

construction.’’ ‘‘Newly constructed’’ and

Any land, improvement or fixture that is

‘‘new construction’’ include:

restored, reconstructed or repaired in a

•

Effective for income years beginning on or

timely manner following a disaster and

Any substantial addition (including fix-

after January 1, 1994, the annual

that is substantially equivalent to that

tures) to land or the improvements on

water’s-edge election fee was repealed.

which existed prior to the disaster. Any

the land. For purposes of R&TC Sec-

Form 100-FEE-A, Amended Water’s-Edge

reconstruction of real property that is

tion 70, ‘‘fixtures’’ are improvements to

Election Fee Supplemental Schedule, should

not substantially equivalent to the dam-

property, the use or purpose of which

only be used when amending the election fee

aged or destroyed property is deemed

directly applies to or augments the pro-

for an income year beginning prior to

to be ‘‘new construction,’’ unless the

cess or function of a trade, industry or

January 1, 1994. Form 100-FEE-A should be

exception noted above applies. How-

profession.

attached to Form 100-FEE-X, Amended

ever, a new plant or facility may not be

Examples: The construction of a new

Water’s-Edge Election Fee.

a replacement, in whole or in part, of

building; a swimming pool, retaining wall,

an existing plant or facility in California.

or sewer; or the addition of square-footage

Definitions

New investment in California that meets

to an existing building.

1. Base Year

the definition of replacement property can-

•

For purposes of R&TC Section 70,

not reduce the fee base.

A. The base year used to calculate prop-

‘‘major rehabilitation’’ is any rehabilita-

erty and payroll for purposes of the

4. Replacement Property

tion, renovation or modernization that

election fee is an income year of 12 full

A plant or facility that includes both certain

converts an improvement or fixture to

months ending in the calendar year

tangible personal property and real prop-

the substantial equivalent of a new

1986. If there is no income year of 12

erty as described in R&TC Section 70 will

improvement or fixture. This includes

full months ending in the calendar year

be deemed a replacement if the taxpayer,

the substitution of a new fixture for an

1986, property and payroll for the first

or an affiliated bank or corporation closes,

old one. ‘‘Substantial equivalency’’ is

immediately preceding income year of

takes out of service, sells or leases to an

ascertained by comparing the produc-

12 full months must be used if it exists.

unrelated party, a plant or facility with a

tive capacity, normally expressed in

cost basis equal to 25% or more of the

B. The base year used to calculate sales

units per hour, of the rehabilitated fix-

cost basis of the new plant or facility. The

for purposes of the fee shall be the

ture to its original productive capacity.

replacement property test must be applied

income year for which a

Examples: Alteration to a warehouse

to the 3 calendar years immediately pre-

Form 100-FEE-A is filed. Such income

making it usable as a retail store or a res-

ceding and the 3 calendar years immedi-

year need not be 12 full months.

taurant; preparation of a vacant lot for use

ately succeeding the date the new plant or

2. Short Period Return

as a parking facility; alteration of rolling,

facility is first included in the property fac-

If a taxpayer files a short period return on

grazing land to level irrigated crop land;

tor for apportionment purposes.

a water’s-edge basis, the fee shall be

and site development of rural land for the

5. California Work Years

based on: (1) sales for the current period;

purpose of establishing a residential

For purposes of computing work years in

and (2) the base year amounts for

subdivision.

California (Form 100-FEE-A, line 6, line 7,

California property and payroll, multiplied

The term ‘‘newly constructed’’ or ‘‘new

line 8 and line 10), a work year means:

by a fraction, the numerator of which is the

construction’’ does not include:

•

number of months in the short period and

2,000 paid hours in the case of

•

Any active solar energy system

the denominator of which is 12.

employees who are paid an hourly

constructed or added before

wage; or

3. New Investment in California

January 1, 1991;

•

•

For purposes of computing the election fee

A total of 12 paid months in the case of

The portion of reconstruction or

using the .0003 calculation, new invest-

salaried employees.

improvement to a structure constructed

ment (a new plant or facility) in California

of unreinforced masonry bearing wall

To determine the total amount ‘‘paid’’ to

can be used to reduce the fee base. A

construction, necessary to comply with

employees, see the instructions for

new plant or facility is both certain tangible

a local seismic safety ordinance for the

Schedule R, Apportionment and Allocation

personal property and real property, as

first 15 years after the reconstruction or

of Income.

described in R&TC Section 70, acquired

improvement;

•

during the income year. The annual new

The construction or installation of any

Specific Line Instructions for Form

investments acquired since January 1,

of the following fire protection improve-

1987, to the last day of the income

100-FEE-A

ments that are constructed or installed

year that is being amended are then

in an existing building on or after

accumulated.

Side 1

November 7, 1984:

Certain tangible personal property includes

1. Fire sprinkler systems;

Line 1 – Base Year California Property

any new tangible personal property

2. Other fire extinguishing systems;

Enter the total amount of California property

acquired by the taxpayer during the

3. Fire detection systems; and

for the base year. See General Information,

income year, when the original use com-

4. Fire-related egress improvements;

Definitions. See the instructions for Schedule

•

mences in this state.

Ordinary maintenance and repair.

R for the definition of California property.

Examples: Routine annual preparation

Examples: New machinery and equipment

Note: Intangibles included in the factor pursu-

of agricultural land; interior or exterior

for industry, profession and trade; new

ant to R&TC Section 25137 are not includible

painting; replacement of roof coverings;

tools, molds, dies and jigs; or new comput-

in the property factor for determining the fee

the addition of aluminum siding for

ers and related equipment.

base regardless of the fact that they may be

improvements; or the replacement of

R&TC Section 70 defines a new plant or

included in the apportionment formula. Intan-

work machine parts; or

facility as ‘‘newly constructed’’ and ‘‘new

gible drilling costs included in the factor pursu-

Form 100-WE Booklet 1998 Page 25

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2