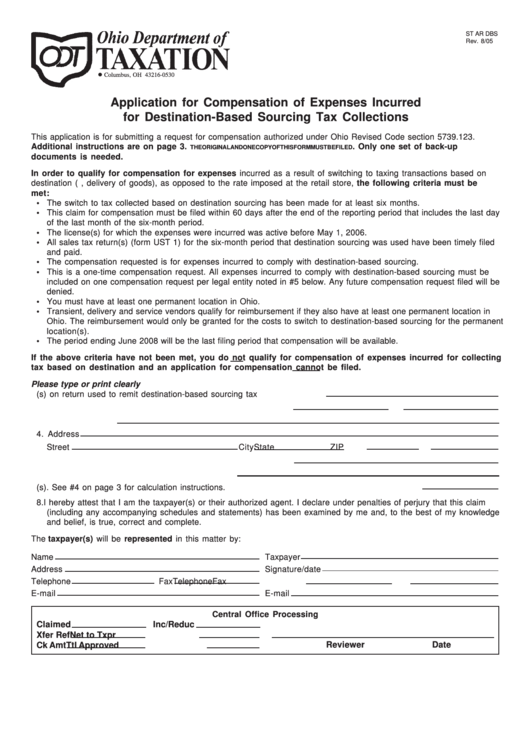

ST AR DBS

Rev. 8/05

Reset Form

P.O. Box 530

Columbus, OH 43216-0530

tax.ohio.gov

Application for Compensation of Expenses Incurred

for Destination-Based Sourcing Tax Collections

This application is for submitting a request for compensation authorized under Ohio Revised Code section 5739.123.

Additional instructions are on page 3.

. Only one set of back-up

THE ORIGINAL AND ONE COPY OF THIS FORM MUST BE FILED

documents is needed.

In order to qualify for compensation for expenses incurred as a result of switching to taxing transactions based on

destination (e.g., delivery of goods), as opposed to the rate imposed at the retail store, the following criteria must be

met:

• The switch to tax collected based on destination sourcing has been made for at least six months.

• This claim for compensation must be filed within 60 days after the end of the reporting period that includes the last day

of the last month of the six-month period.

• The license(s) for which the expenses were incurred was active before May 1, 2006.

• All sales tax return(s) (form UST 1) for the six-month period that destination sourcing was used have been timely filed

and paid.

• The compensation requested is for expenses incurred to comply with destination-based sourcing.

• This is a one-time compensation request. All expenses incurred to comply with destination-based sourcing must be

included on one compensation request per legal entity noted in #5 below. Any future compensation request filed will be

denied.

• You must have at least one permanent location in Ohio.

• Transient, delivery and service vendors qualify for reimbursement if they also have at least one permanent location in

Ohio. The reimbursement would only be granted for the costs to switch to destination-based sourcing for the permanent

location(s).

• The period ending June 2008 will be the last filing period that compensation will be available.

If the above criteria have not been met, you do not qualify for compensation of expenses incurred for collecting

tax based on destination and an application for compensation cannot be filed.

Please type or print clearly

1. License number(s) on return used to remit destination-based sourcing tax

2. First six months tax based on destination sourcing was remitted

to

3. Name of applicant

4. Address

Street

City

State

ZIP

5. Federal employer identification number or social security number

6. Total cost to switch to destination-based sourcing

7. Amount requested for compensation on purchase(s). See #4 on page 3 for calculation instructions.

8. I hereby attest that I am the taxpayer(s) or their authorized agent. I declare under penalties of perjury that this claim

(including any accompanying schedules and statements) has been examined by me and, to the best of my knowledge

and belief, is true, correct and complete.

The taxpayer(s) will be represented in this matter by:

Name

Taxpayer

Address

Signature/date

Telephone

Fax

Telephone

Fax

E-mail

E-mail

Central Office Processing

Claimed

Inc/Reduc

Xfer Ref

Net to Txpr

Reviewer

Date

Ck Amt

Ttl Approved

1

1 2

2