Staple forms here

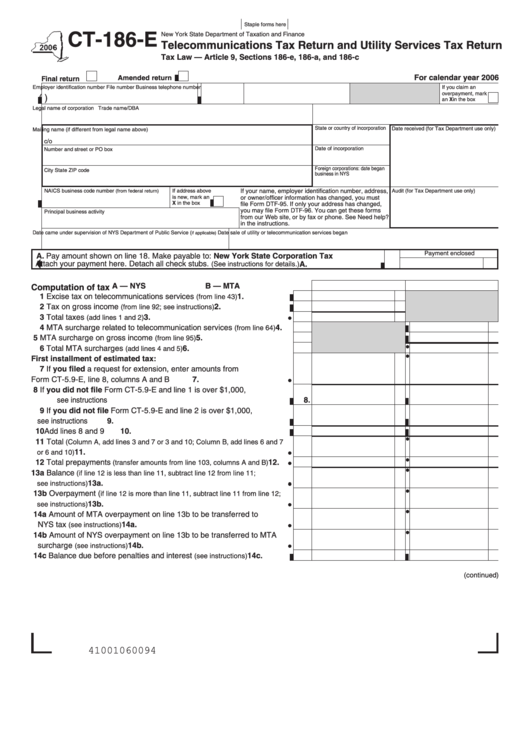

CT-186-E

New York State Department of Taxation and Finance

Telecommunications Tax Return and Utility Services Tax Return

Tax Law — Article 9, Sections 186-e, 186-a, and 186-c

For calendar year 2006

Amended return

Final return

Employer identification number

File number

Business telephone number

If you claim an

overpayment, mark

(

)

an X in the box

Legal name of corporation

Trade name/DBA

State or country of incorporation

Date received (for Tax Department use only)

Mailing name (if different from legal name above)

c/o

Date of incorporation

Number and street or PO box

Foreign corporations: date began

City

State

ZIP code

business in NYS

If your name, employer identification number, address,

NAICS business code number

(from federal return)

If address above

Audit (for Tax Department use only)

is new, mark an

or owner/officer information has changed, you must

X in the box

file Form DTF-95. If only your address has changed,

you may file Form DTF-96. You can get these forms

Principal business activity

from our Web site, or by fax or phone. See Need help?

in the instructions.

Date came under supervision of NYS Department of Public Service (

Date sale of utility or telecommunication services began

if applicable)

Payment enclosed

A. Pay amount shown on line 18. Make payable to: New York State Corporation Tax

Attach your payment here. Detach all check stubs.

A.

(See instructions for details.)

A — NYS

B — MTA

Computation of tax

1 Excise tax on telecommunications services

....................

1.

(from line 43)

2 Tax on gross income

2.

................................

(from line 92; see instructions)

3 Total taxes

3.

................................................................

(add lines 1 and 2)

4 MTA surcharge related to telecommunication services

....

4.

(from line 64)

5 MTA surcharge on gross income

......................................

5.

(from line 95)

6 Total MTA surcharges

...............................................

6.

(add lines 4 and 5)

First installment of estimated tax:

7 If you filed a request for extension, enter amounts from

7.

Form CT-5.9-E, line 8, columns A and B ..........................................

8 If you did not file Form CT-5.9-E and line 1 is over $1,000,

see instructions .........................................................................................

8.

9 If you did not file Form CT-5.9-E and line 2 is over $1,000,

9.

see instructions...................................................................................

10 Add lines 8 and 9 .................................................................................

10.

11 Total

(Column A, add lines 3 and 7 or 3 and 10; Column B, add lines 6 and 7

........................................................................................

11.

or 6 and 10)

12 Total prepayments

.......

12.

(transfer amounts from line 103, columns A and B)

13a Balance

(if line 12 is less than line 11, subtract line 12 from line 11;

13a.

..................................................................................

see instructions)

13b Overpayment (

if line 12 is more than line 11, subtract line 11 from line 12;

................................................................................... 13b.

see instructions)

14a Amount of MTA overpayment on line 13b to be transferred to

NYS tax

...................................................................

14a.

(see instructions)

14b Amount of NYS overpayment on line 13b to be transferred to MTA

................................................................ 14b.

surcharge

(see instructions)

14c Balance due before penalties and interest

.................

14c.

(see instructions)

(continued)

41001060094

1

1 2

2 3

3 4

4 5

5 6

6