Form Dr-145 - Instructions For Filing Oil Production Monthly Tax Return

ADVERTISEMENT

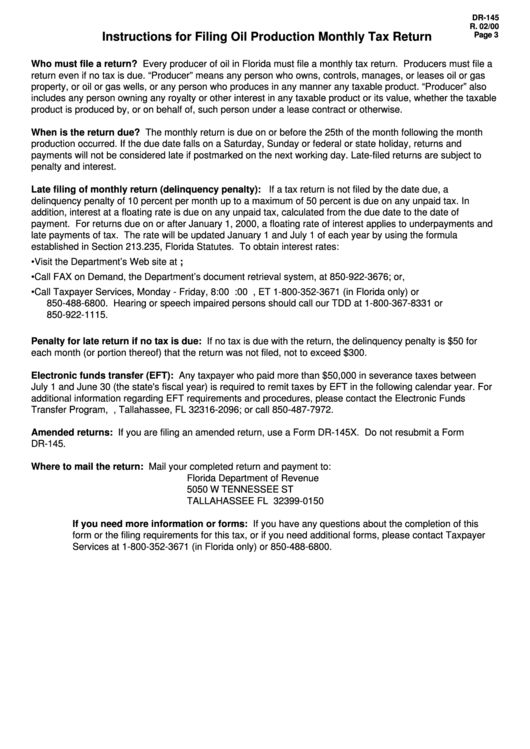

DR-145

R. 02/00

Page 3

Instructions for Filing Oil Production Monthly Tax Return

Who must file a return? Every producer of oil in Florida must file a monthly tax return. Producers must file a

return even if no tax is due. “Producer” means any person who owns, controls, manages, or leases oil or gas

property, or oil or gas wells, or any person who produces in any manner any taxable product. “Producer” also

includes any person owning any royalty or other interest in any taxable product or its value, whether the taxable

product is produced by, or on behalf of, such person under a lease contract or otherwise.

When is the return due? The monthly return is due on or before the 25th of the month following the month

production occurred. If the due date falls on a Saturday, Sunday or federal or state holiday, returns and

payments will not be considered late if postmarked on the next working day. Late-filed returns are subject to

penalty and interest.

Late filing of monthly return (delinquency penalty): If a tax return is not filed by the date due, a

delinquency penalty of 10 percent per month up to a maximum of 50 percent is due on any unpaid tax. In

addition, interest at a floating rate is due on any unpaid tax, calculated from the due date to the date of

payment. For returns due on or after January 1, 2000, a floating rate of interest applies to underpayments and

late payments of tax. The rate will be updated January 1 and July 1 of each year by using the formula

established in Section 213.235, Florida Statutes. To obtain interest rates:

•

Visit the Department’s Web site at

•

Call FAX on Demand, the Department’s document retrieval system, at 850-922-3676; or,

•

Call Taxpayer Services, Monday - Friday, 8:00 a.m. to 5:00 p.m., ET 1-800-352-3671 (in Florida only) or

850-488-6800. Hearing or speech impaired persons should call our TDD at 1-800-367-8331 or

850-922-1115.

Penalty for late return if no tax is due: If no tax is due with the return, the delinquency penalty is $50 for

each month (or portion thereof) that the return was not filed, not to exceed $300.

Electronic funds transfer (EFT): Any taxpayer who paid more than $50,000 in severance taxes between

July 1 and June 30 (the state's fiscal year) is required to remit taxes by EFT in the following calendar year. For

additional information regarding EFT requirements and procedures, please contact the Electronic Funds

Transfer Program, P.O. Box 2096, Tallahassee, FL 32316-2096; or call 850-487-7972.

Amended returns: If you are filing an amended return, use a Form DR-145X. Do not resubmit a Form

DR-145.

Where to mail the return: Mail your completed return and payment to:

Florida Department of Revenue

5050 W TENNESSEE ST

TALLAHASSEE FL 32399-0150

If you need more information or forms: If you have any questions about the completion of this

form or the filing requirements for this tax, or if you need additional forms, please contact Taxpayer

Services at 1-800-352-3671 (in Florida only) or 850-488-6800.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2