Form Pa-971 (10-09) - Innocent Spouse Relief - Relief From Joint Liability Page 10

ADVERTISEMENT

Instructions for completing PA 8857

This example explains how Janie Boulder completes Form PA 8857 to request relief from joint liability. See Sample

Form PA 8857.

Janie and Joe Boulder filed a joint tax return for 2007. Joe did not report a $5,000 award he won that year. They

received a Notice of Assessment for additional tax of $154 plus penalty and interest. Subsequently, the Department

initiated collection activities to collect the tax, interest, penalty and other charges resulting from the understatement

of tax.

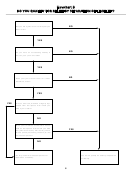

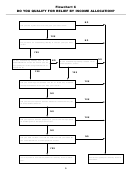

Janie applies the conditions listed under relief from an understatement of tax due to an erroneous item on Page 2 to

see if she qualifies for relief.

1. Janie meets the first condition because the joint tax return they filed has an understatement of tax.

2. Janie believes she meets the second condition. She did not know about the award and had no reason to know

about it because of the secretive way Joe conducted his financial affairs.

3. Janie believes she meets the third condition. She believes it would be unfair to be held liable for the tax because

she did not benefit from the award. Joe spent it on personal items for his use only.

Because Janie believes she qualifies for relief from the understatement of tax, she files Form PA 8857 with the

Department. She fills in her name, address, Social Security Number, and daytime phone number. She fills out the rest

of the form as follows:

Line 1. Janie enters “2007" because this is the tax year for which she is requesting relief.

Line 2. She enters the name, address, Social Security Number, and daytime phone number of her spouse.

Line 3. She checks the Yes box because she received a Department notice for additional tax.

Lines 4-6. Janie checks the No box on each of these lines because she and Joe were not divorced, separated,

or living apart during the last 12 months.

Line 7. Janie does not check the box on this line because she checked the No boxes on Lines 4, 5, and 6.

Line 8. Janie checks the Yes box on this line because the income items all belonged to her husband. She com-

pletes PA 12507, Innocent Spouse Statement (not illustrated) explaining why she feels she qualifies for relief

from the understatement of tax.

Line 9. Janie checks the No box on this line because she does not have an underpayment of tax.

Signing and mailing Form PA 8857. Janie signs and dates the form. She attaches the PA 12507, Innocent

Spouse Statement, PA 12510, Questionnaire for Spousal Relief from Joint Liability for Requesting Spouse and

REV-488, Statement of Financial Condition for Individuals. Finally, she mails the completed forms to the

Department of Revenue’s Office of Taxpayers’ Rights Advocate.

.

10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11