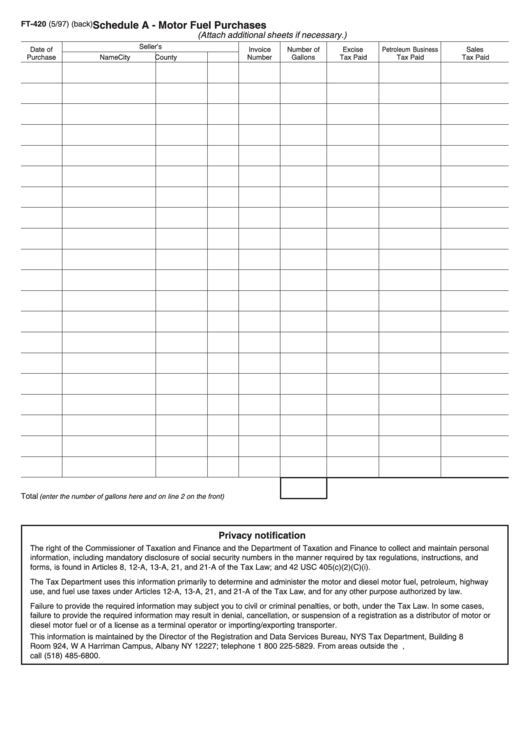

Form Ft-420 - Schedule A - Motor Fuel Purchases

ADVERTISEMENT

FT-420 (5/97) (back)

Schedule A - Motor Fuel Purchases

(Attach additional sheets if necessary.)

Seller’s

Date of

Invoice

Number of

Excise

Petroleum Business

Sales

Purchase

Name

City

County

Number

Gallons

Tax Paid

Tax Paid

Tax Paid

Total

......................

(enter the number of gallons here and on line 2 on the front)

Privacy notification

The right of the Commissioner of Taxation and Finance and the Department of Taxation and Finance to collect and maintain personal

information, including mandatory disclosure of social security numbers in the manner required by tax regulations, instructions, and

forms, is found in Articles 8, 12-A, 13-A, 21, and 21-A of the Tax Law; and 42 USC 405(c)(2)(C)(i).

The Tax Department uses this information primarily to determine and administer the motor and diesel motor fuel, petroleum, highway

use, and fuel use taxes under Articles 12-A, 13-A, 21, and 21-A of the Tax Law, and for any other purpose authorized by law.

Failure to provide the required information may subject you to civil or criminal penalties, or both, under the Tax Law. In some cases,

failure to provide the required information may result in denial, cancellation, or suspension of a registration as a distributor of motor or

diesel motor fuel or of a license as a terminal operator or importing/exporting transporter.

This information is maintained by the Director of the Registration and Data Services Bureau, NYS Tax Department, Building 8

Room 924, W A Harriman Campus, Albany NY 12227; telephone 1 800 225-5829. From areas outside the U.S. and outside Canada,

call (518) 485-6800.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1