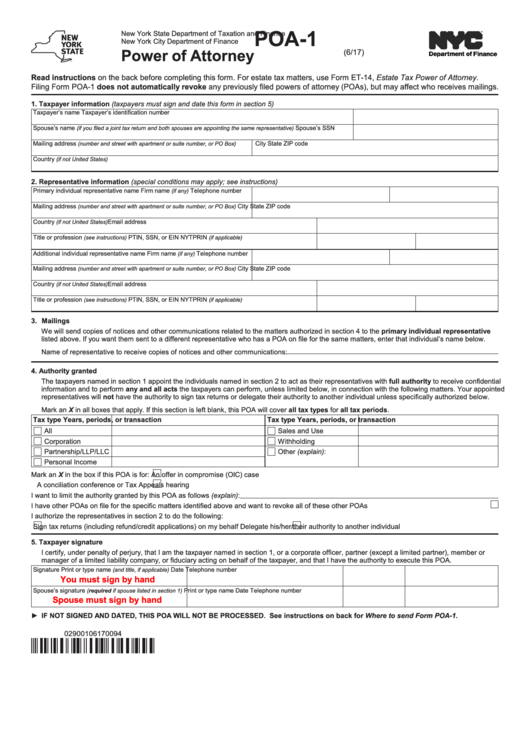

POA-1

New York State Department of Taxation and Finance

New York City Department of Finance

Power of Attorney

(6/17)

Read instructions on the back before completing this form. For estate tax matters, use Form ET-14, Estate Tax Power of Attorney.

Filing Form POA-1 does not automatically revoke any previously filed powers of attorney (POAs), but may affect who receives mailings.

1. Taxpayer information (taxpayers must sign and date this form in section 5)

Taxpayer’s name

Taxpayer’s identification number

Spouse’s name

Spouse’s SSN

(if you filed a joint tax return and both spouses are appointing the same representative)

Mailing address

City

State

ZIP code

(number and street with apartment or suite number, or PO Box)

Country

(if not United States)

2. Representative information (special conditions may apply; see instructions)

Primary individual representative name

Firm name

Telephone number

(if any)

Mailing address

City

State

ZIP code

(number and street with apartment or suite number, or PO Box)

Country

Email address

(if not United States)

Title or profession

PTIN, SSN, or EIN

NYTPRIN

(see instructions)

(if applicable)

Additional individual representative name

Firm name

Telephone number

(if any)

Mailing address

City

State

ZIP code

(number and street with apartment or suite number, or PO Box)

Country

Email address

(if not United States)

Title or profession

PTIN, SSN, or EIN

NYTPRIN

(see instructions)

(if applicable)

3. Mailings

We will send copies of notices and other communications related to the matters authorized in section 4 to the primary individual representative

listed above. If you want them sent to a different representative who has a POA on file for the same matters, enter that individual’s name below.

Name of representative to receive copies of notices and other communications:

4. Authority granted

The taxpayers named in section 1 appoint the individuals named in section 2 to act as their representatives with full authority to receive confidential

information and to perform any and all acts the taxpayers can perform, unless limited below, in connection with the following matters. Your appointed

representatives will not have the authority to sign tax returns or delegate their authority to another individual unless specifically authorized below.

Mark an X in all boxes that apply. If this section is left blank, this POA will cover all tax types for all tax periods.

Tax type

Years, periods, or transaction

Tax type

Years, periods, or transaction

All

Sales and Use

Corporation

Withholding

Partnership/LLP/LLC

Other (explain):

Personal Income

Mark an X in the box if this POA is for:

An offer in compromise (OIC) case

A conciliation conference or Tax Appeals hearing

I want to limit the authority granted by this POA as follows (explain):

I have other POAs on file for the specific matters identified above and want to revoke all of these other POAs ...............................................................

I authorize the representatives in section 2 to do the following:

Sign tax returns (including refund/credit applications) on my behalf

Delegate his/her/their authority to another individual

5. Taxpayer signature

I certify, under penalty of perjury, that I am the taxpayer named in section 1, or a corporate officer, partner (except a limited partner), member or

manager of a limited liability company, or fiduciary acting on behalf of the taxpayer, and that I have the authority to execute this POA.

Signature

Print or type name

Date

Telephone number

(and title, if applicable)

You must sign by hand

Spouse’s signature

Print or type name

Date

Telephone number

(required if spouse listed in section 1)

Spouse must sign by hand

► IF NOT SIGNED AND DATED, THIS POA WILL NOT BE PROCESSED.

See instructions on back for Where to send Form POA-1.

02900106170094

1

1