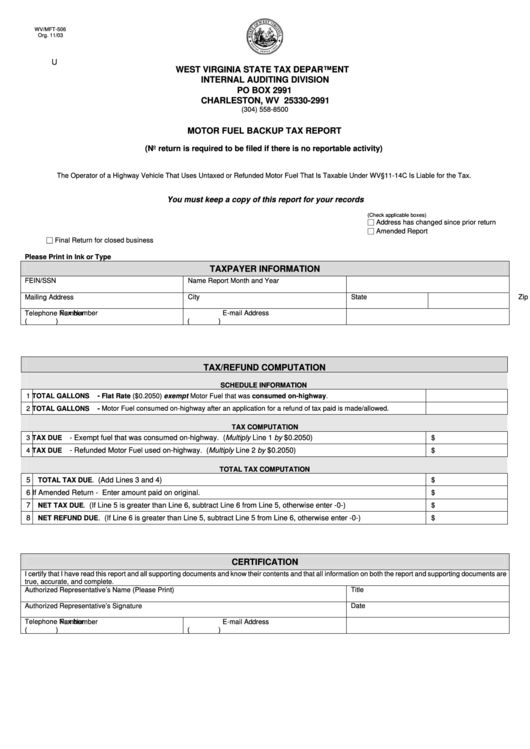

Form Wv/mft-506 - Motor Fuel Backup Tax Report - West Virginia State Tax Department

ADVERTISEMENT

WV/MFT-506

Org. 11/03

U

WEST VIRGINIA STATE TAX DEPARTMENT

INTERNAL AUDITING DIVISION

PO BOX 2991

CHARLESTON, WV 25330-2991

(304) 558-8500

MOTOR FUEL BACKUP TAX REPORT

(No return is required to be filed if there is no reportable activity)

The Operator of a Highway Vehicle That Uses Untaxed or Refunded Motor Fuel That Is Taxable Under WV§11-14C Is Liable for the Tax.

You must keep a copy of this report for your records

(Check applicable boxes)

□ Address has changed since prior return

□ Amended Report

□ Final Return for closed business

Please Print in Ink or Type

TAXPAYER INFORMATION

FEIN/SSN

Name

Report Month and Year

Mailing Address

City

State

Zip Code

Telephone Number

Fax Number

E-mail Address

(

)

(

)

TAX/REFUND COMPUTATION

SCHEDULE INFORMATION

1

-

TOTAL GALLONS

Flat Rate ($0.2050) exempt Motor Fuel that was consumed on-highway.

-

2

TOTAL GALLONS

Motor Fuel consumed on-highway after an application for a refund of tax paid is made/allowed.

TAX COMPUTATION

- Exempt fuel that was consumed on-highway. (Multiply Line 1 by $0.2050)

3

TAX DUE

$

4

TAX DUE

- Refunded Motor Fuel used on-highway. (Multiply Line 2 by $0.2050)

$

TOTAL TAX COMPUTATION

5

TOTAL TAX DUE

. (Add Lines 3 and 4)

$

6 If Amended Return - Enter amount paid on original.

$

7

. (If Line 5 is greater than Line 6, subtract Line 6 from Line 5, otherwise enter -0-)

NET TAX DUE

$

8

. (If Line 6 is greater than Line 5, subtract Line 5 from Line 6, otherwise enter -0-)

NET REFUND DUE

$

CERTIFICATION

I certify that I have read this report and all supporting documents and know their contents and that all information on both the report and supporting documents are

true, accurate, and complete.

Authorized Representative’s Name (Please Print)

Title

Authorized Representative’s Signature

Date

Telephone Number

Fax Number

E-mail Address

(

)

(

)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2