Moving Reimbursement Payroll Report Form

ADVERTISEMENT

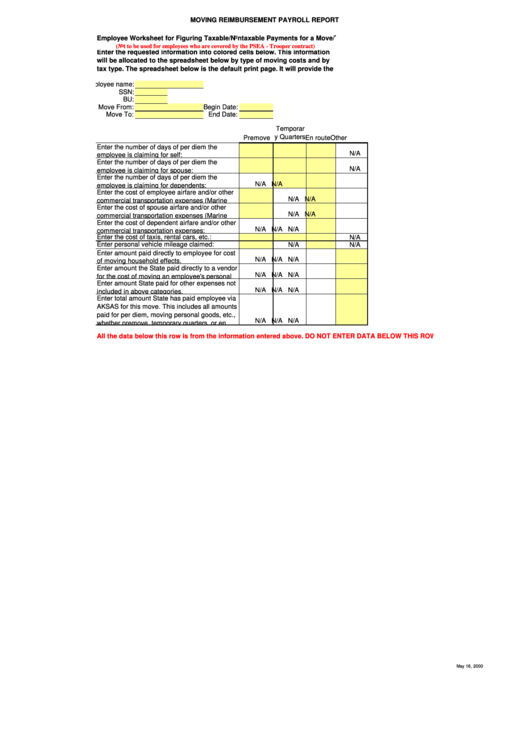

MOVING REIMBURSEMENT PAYROLL REPORT

Employee Worksheet for Figuring Taxable/Nontaxable Payments for a Move/Transfer

(Not to be used for employees who are covered by the PSEA - Trooper contract)

Enter the requested information into colored cells below. This information

will be allocated to the spreadsheet below by type of moving costs and by

tax type. The spreadsheet below is the default print page. It will provide the

Employee name:

SSN:

BU:

Move From:

Begin Date:

Move To:

End Date:

Temporar

y Quarters En route

Premove

Other

Enter the number of days of per diem the

N/A

employee is claiming for self:

Enter the number of days of per diem the

N/A

employee is claiming for spouse:

Enter the number of days of per diem the

N/A

N/A

employee is claiming for dependents:

Enter the cost of employee airfare and/or other

N/A

N/A

commercial transportation expenses (Marine

Enter the cost of spouse airfare and/or other

N/A

N/A

commercial transportation expenses (Marine

Enter the cost of dependent airfare and/or other

N/A

N/A

N/A

commercial transportation expenses:

Enter the cost of taxis, rental cars, etc.:

N/A

Enter personal vehicle mileage claimed:

N/A

N/A

Enter amount paid directly to employee for cost

N/A

N/A

N/A

of moving household effects.

Enter amount the State paid directly to a vendor

N/A

N/A

N/A

for the cost of moving an employee's personal

Enter amount State paid for other expenses not

N/A

N/A

N/A

included in above categories.

Enter total amount State has paid employee via

AKSAS for this move. This includes all amounts

paid for per diem, moving personal goods, etc.,

N/A

N/A

N/A

whether premove, temporary quarters, or en

All the data below this row is from the information entered above. DO NOT ENTER DATA BELOW THIS ROW.

May 16, 2000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2