Application For Extension Of Time To File Springfield Income Tax Business Return - City Of Springfield

ADVERTISEMENT

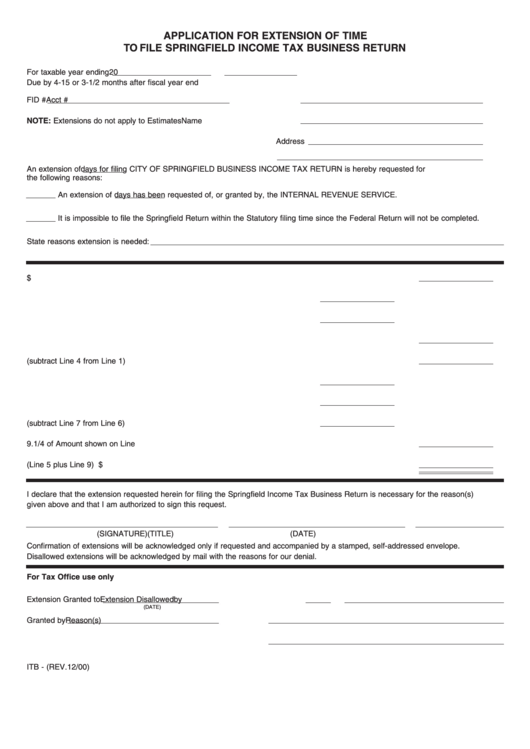

APPLICATION FOR EXTENSION OF TIME

TO FILE SPRINGFIELD INCOME TAX BUSINESS RETURN

For taxable year ending

20

Due by 4-15 or 3-1/2 months after fiscal year end

FID #

Acct #

NOTE: Extensions do not apply to Estimates

Name

Address

An extension of

days for filing CITY OF SPRINGFIELD BUSINESS INCOME TAX RETURN is hereby requested for

the following reasons:

An extension of

days has been requested of, or granted by, the INTERNAL REVENUE SERVICE.

It is impossible to file the Springfield Return within the Statutory filing time since the Federal Return will not be completed.

State reasons extension is needed:

1. Total Springfield Income Tax Liability for Tax Year to be Extended ................................................................ $

2. Springfield Income Tax Withheld........................................................................

3. Tax Credits ........................................................................................................

4. Add Lines 2 and 3 ..........................................................................................................................................

5. Tax Due (subtract Line 4 from Line 1) ............................................................................................................

6. Estimated Springfield Income Tax Liability for Following Year ..........................

7. Springfield Income Tax to be Withheld for Following Year ................................

8. Balance Due on Following Year Estimated Tax (subtract Line 7 from Line 6)....

9. 1/4 of Amount shown on Line 8 ......................................................................................................................

10. Total Due with this Application (Line 5 plus Line 9) ...................................................................................... $

I declare that the extension requested herein for filing the Springfield Income Tax Business Return is necessary for the reason(s)

given above and that I am authorized to sign this request.

(SIGNATURE)

(TITLE)

(DATE)

Confirmation of extensions will be acknowledged only if requested and accompanied by a stamped, self-addressed envelope.

Disallowed extensions will be acknowledged by mail with the reasons for our denial.

For Tax Office use only

Extension Granted to

Extension Disallowed

by

(DATE)

Granted by

Reason(s)

ITB - (REV. 12/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1