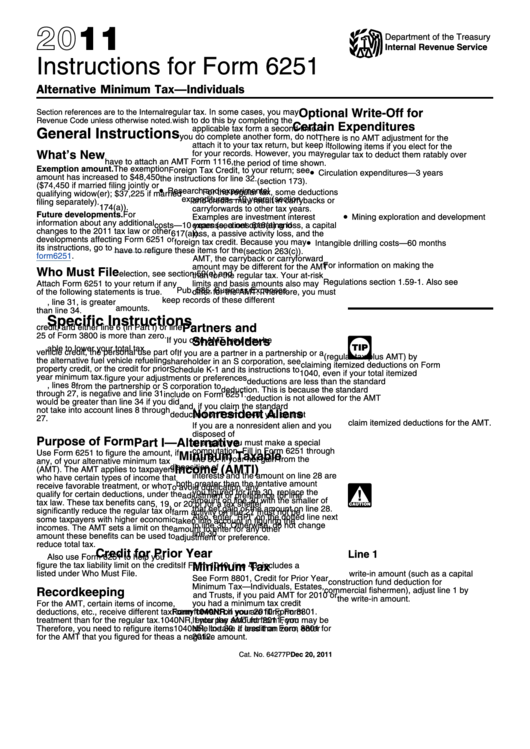

Instructions For Form 6251 - Alternative Minimum Tax-Individuals - 2011

ADVERTISEMENT

2011

Department of the Treasury

Internal Revenue Service

Instructions for Form 6251

Alternative Minimum Tax—Individuals

Optional Write-Off for

regular tax. In some cases, you may

Section references are to the Internal

Revenue Code unless otherwise noted.

wish to do this by completing the

Certain Expenditures

applicable tax form a second time. If

General Instructions

you do complete another form, do not

There is no AMT adjustment for the

attach it to your tax return, but keep it

following items if you elect for the

What’s New

for your records. However, you may

regular tax to deduct them ratably over

have to attach an AMT Form 1116,

the period of time shown.

Exemption amount. The exemption

Foreign Tax Credit, to your return; see

•

Circulation expenditures — 3 years

amount has increased to $48,450

the instructions for line 32.

(section 173).

($74,450 if married filing jointly or

•

Research and experimental

For the regular tax, some deductions

qualifying widow(er); $37,225 if married

expenditures — 10 years (section

and credits may result in carrybacks or

filing separately).

174(a)).

carryforwards to other tax years.

Future developments. For

•

Mining exploration and development

Examples are investment interest

information about any additional

costs — 10 years (sections 616(a) and

expense, a net operating loss, a capital

changes to the 2011 tax law or other

loss, a passive activity loss, and the

617(a)).

developments affecting Form 6251 or

•

foreign tax credit. Because you may

Intangible drilling costs — 60 months

its instructions, go to

have to refigure these items for the

(section 263(c)).

form6251.

AMT, the carryback or carryforward

For information on making the

amount may be different for the AMT

Who Must File

election, see section 59(e) and

than for the regular tax. Your at-risk

Regulations section 1.59-1. Also see

limits and basis amounts also may

Attach Form 6251 to your return if any

Pub. 535, Business Expenses.

differ for the AMT. Therefore, you must

of the following statements is true.

keep records of these different

1. Form 6251, line 31, is greater

amounts.

than line 34.

Specific Instructions

2. You claim any general business

Partners and

credit, and either line 6 (in Part I) or line

25 of Form 3800 is more than zero.

Shareholders

If you owe AMT, you may be

3. You claim the qualified electric

able to lower your total tax

TIP

vehicle credit, the personal use part of

If you are a partner in a partnership or a

(regular tax plus AMT) by

the alternative fuel vehicle refueling

shareholder in an S corporation, see

claiming itemized deductions on Form

property credit, or the credit for prior

Schedule K-1 and its instructions to

1040, even if your total itemized

year minimum tax.

figure your adjustments or preferences

deductions are less than the standard

4. The total of Form 6251, lines 8

from the partnership or S corporation to

deduction. This is because the standard

through 27, is negative and line 31

include on Form 6251.

deduction is not allowed for the AMT

would be greater than line 34 if you did

and, if you claim the standard

not take into account lines 8 through

Nonresident Aliens

deduction on Form 1040, you cannot

27.

claim itemized deductions for the AMT.

If you are a nonresident alien and you

disposed of U.S. real property interests

Purpose of Form

Part I—Alternative

at a gain, you must make a special

computation. Fill in Form 6251 through

Use Form 6251 to figure the amount, if

Minimum Taxable

line 30. If your net gain from the

any, of your alternative minimum tax

Income (AMTI)

disposition of U.S. real property

(AMT). The AMT applies to taxpayers

interests and the amount on line 28 are

who have certain types of income that

both greater than the tentative amount

receive favorable treatment, or who

To avoid duplication, any

you figured for line 30, replace the

qualify for certain deductions, under the

!

adjustment or preference for line

amount on line 30 with the smaller of

tax law. These tax benefits can

5, 19, or 20 or for a tax shelter

CAUTION

that net gain or the amount on line 28.

significantly reduce the regular tax of

farm activity on line 27 must not be

Also, enter “RPI” on the dotted line next

some taxpayers with higher economic

taken into account in figuring the

to line 30. Otherwise, do not change

incomes. The AMT sets a limit on the

amount to enter for any other

line 30.

amount these benefits can be used to

adjustment or preference.

reduce total tax.

Credit for Prior Year

Line 1

Also use Form 6251 to help you

Minimum Tax

figure the tax liability limit on the credits

If Form 1040, line 43, includes a

listed under Who Must File.

write-in amount (such as a capital

See Form 8801, Credit for Prior Year

construction fund deduction for

Minimum Tax — Individuals, Estates,

Recordkeeping

commercial fishermen), adjust line 1 by

and Trusts, if you paid AMT for 2010 or

the write-in amount.

For the AMT, certain items of income,

you had a minimum tax credit

deductions, etc., receive different tax

carryforward on your 2010 Form 8801.

Form 1040NR. If you are filing Form

If you pay AMT for 2011, you may be

treatment than for the regular tax.

1040NR, enter the amount from Form

able to take a credit on Form 8801 for

Therefore, you need to refigure items

1040NR, line 39. If less than zero, enter

2012.

for the AMT that you figured for the

as a negative amount.

Dec 20, 2011

Cat. No. 64277P

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12