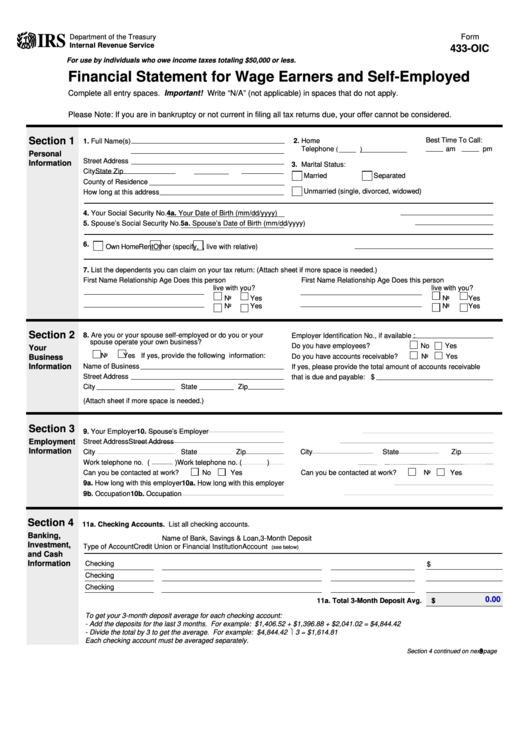

Form 433-Oic - Financial Statement For Wage Earners And Self-Employed

ADVERTISEMENT

Form

IRS

Department of the Treasury

Internal Revenue Service

433-OIC

For use by individuals who owe income taxes totaling $50,000 or less.

Financial Statement for Wage Earners and Self-Employed

Complete all entry spaces. Important! Write “N/A” (not applicable) in spaces that do not apply.

Please Note: If you are in bankruptcy or not current in filing all tax returns due, your offer cannot be considered.

Section 1

2. Home

Best Time To Call:

1. Full Name(s)

Telephone

am

pm

(

)

Personal

Street Address

Information

3. Marital Status:

City

State

Zip

Married

Separated

County of Residence

Unmarried (single, divorced, widowed)

How long at this address

4. Your Social Security No.

4a. Your Date of Birth (mm/dd/yyyy)

5. Spouse’s Social Security No.

5a. Spouse’s Date of Birth (mm/dd/yyyy)

6.

Own Home

Rent

Other (specify, i.e. share rent, live with relative)

7. List the dependents you can claim on your tax return: (Attach sheet if more space is needed.)

First Name

Relationship

Age

Does this person

First Name

Relationship

Age

Does this person

live with you?

live with you?

No

Yes

No

Yes

No

Yes

No

Yes

Section 2

8. Are you or your spouse self-employed or do you or your

Employer Identification No., if available :

spouse operate your own business?

Do you have employees?

No

Yes

Your

No

Yes If yes, provide the following information:

Do you have accounts receivable?

No

Yes

Business

Information

Name of Business

If yes, please provide the total amount of accounts receivable

Street Address

that is due and payable: $

City

State

Zip

(Attach sheet if more space is needed.)

Section 3

9. Your Employer

10. Spouse’s Employer

Employment

Street Address

Street Address

Information

City

State

Zip

City

State

Zip

Work telephone no. (

)

Work telephone no. (

)

Can you be contacted at work?

No

Yes

Can you be contacted at work?

No

Yes

9a. How long with this employer

10a. How long with this employer

9b. Occupation

10b. Occupation

Section 4

11a. Checking Accounts. List all checking accounts.

Banking,

Name of Bank, Savings & Loan,

3-Month Deposit

Investment,

Type of Account

Credit Union or Financial Institution

Account No.

Average

(see below)

and Cash

Information

Checking

$

Checking

Checking

0.00

11a. Total 3-Month Deposit Avg.

$

To get your 3-month deposit average for each checking account:

- Add the deposits for the last 3 months. For example: $1,406.52 + $1,396.88 + $2,041.02 = $4,844.42

- Divide the total by 3 to get the average. For example: $4,844.42 3 = $1,614.81

Each checking account must be averaged separately.

9

Section 4 continued on next page

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4