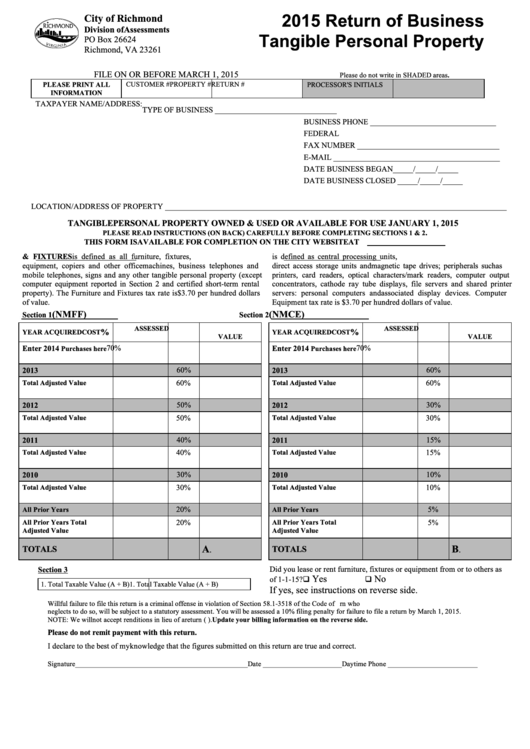

2015 Return of Business

City of Richmond

Division of Assessments

Tangible Personal Property

PO Box 26624

Richmond, VA 23261

FILE ON OR BEFORE MARCH 1, 2015

Please do not write in SHADED areas.

CUSTOMER #

PROPERTY #

RETURN #

PLEASE PRINT ALL

PROCESSOR'S INITIALS

INFORMATION

TAXPAYER NAME/ADDRESS:

TYPE OF BUSINESS ______________________________

BUSINESS PHONE _______________________________

FEDERAL I.D. ____________________________________

FAX NUMBER ___________________________________

E-MAIL _________________________________________

DATE BUSINESS BEGAN _____/_____/_____

DATE BUSINESS CLOSED _____/_____/_____

LOCATION/ADDRESS OF PROPERTY ____________________________________________________________________________________

TANGIBLE PERSONAL PROPERTY OWNED & USED OR AVAILABLE FOR USE JANUARY 1, 2015

.

PLEASE READ INSTRUCTIONS (ON BACK) CAREFULLY BEFORE COMPLETING SECTIONS 1 & 2

THIS FORM IS AVAILABLE FOR COMPLETION ON THE CITY WEBSITE AT

1.

FURNITURE & FIXTURES is defined as all furniture, fixtures,

2. COMPUTER EQUIPMENT is defined as central processing units,

equipment, copiers and other office machines, business telephones and

direct access storage units and magnetic tape drives; peripherals such as

mobile telephones, signs and any other tangible personal property (except

printers, card readers, optical characters/mark readers, computer output

computer equipment reported in Section 2 and certified short-term rental

concentrators, cathode ray tube displays, file servers and shared printer

property). The Furniture and Fixtures tax rate is $3.70 per hundred dollars

servers: personal computers and associated display devices. Computer

of value.

Equipment tax rate is $3.70 per hundred dollars of value.

(NMFF)

(NMCE)

Section 1

Section 2

ASSESSED

ASSESSED

%

%

YEAR ACQUIRED

COST

YEAR ACQUIRED

COST

VALUE

VALUE

Enter 2014

70%

Enter 2014

70%

Purchases here

Purchases here

2013

60%

2013

60%

60%

60%

Total Adjusted Value

Total Adjusted Value

50%

30%

2012

2012

50%

30%

Total Adjusted Value

Total Adjusted Value

40%

15%

2011

2011

40%

15%

Total Adjusted Value

Total Adjusted Value

30%

10%

2010

2010

30%

10%

Total Adjusted Value

Total Adjusted Value

20%

5%

All Prior Years

All Prior Years

All Prior Years Total

20%

All Prior Years Total

5%

Adjusted Value

Adjusted Value

A

B

TOTALS

TOTALS

.

.

Did you lease or rent furniture, fixtures or equipment from or to others as

Section 3

Yes

No

of 1-1-15?

q

q

1. Total Taxable Value (A + B)

1. Total Taxable Value (A + B)

If yes, see instructions on reverse side.

Willful failure to file this return is a criminal offense in violation of Section 58.1-3518 of the Code of Virginia. Any taxpayer required to file a return who

neglects to do so, will be subject to a statutory assessment. You will be assessed a 10% filing penalty for failure to file a return by March 1, 2015.

NOTE: We will not accept renditions in lieu of a return (i.e. 762). Update your billing information on the reverse side.

Please do not remit payment with this return.

I declare to the best of my knowledge that the figures submitted on this return are true and correct.

Signature________________________________________________ Date ______________________ Daytime Phone _________________________

1

1 2

2 3

3 4

4