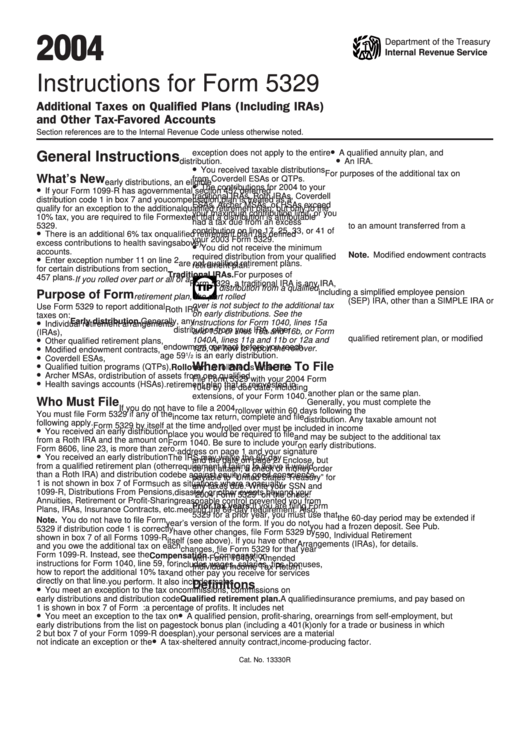

Instructions For Form 5329 Additional Taxes On Qualified Plans And Other Tax-Favored Accounts - 2004

ADVERTISEMENT

04

2 0

Department of the Treasury

Internal Revenue Service

Instructions for Form 5329

Additional Taxes on Qualified Plans (Including IRAs)

and Other Tax-Favored Accounts

Section references are to the Internal Revenue Code unless otherwise noted.

•

exception does not apply to the entire

A qualified annuity plan, and

General Instructions

•

distribution.

An IRA.

•

You received taxable distributions

For purposes of the additional tax on

What’s New

from Coverdell ESAs or QTPs.

early distributions, an eligible

•

•

The contributions for 2004 to your

If your Form 1099-R has a

governmental section 457 deferred

traditional IRAs, Roth IRAs, Coverdell

distribution code 1 in box 7 and you

compensation plan is treated as a

ESAs, Archer MSAs, or HSAs exceed

qualify for an exception to the additional

qualified retirement plan, but only to the

your maximum contribution limit, or you

10% tax, you are required to file Form

extent that a distribution is attributable

had a tax due from an excess

5329.

to an amount transferred from a

•

contribution on line 17, 25, 33, or 41 of

There is an additional 6% tax on

qualified retirement plan (as defined

your 2003 Form 5329.

excess contributions to health savings

above).

•

You did not receive the minimum

accounts.

Note. Modified endowment contracts

•

required distribution from your qualified

Enter exception number 11 on line 2

are not qualified retirement plans.

retirement plan.

for certain distributions from section

Traditional IRAs. For purposes of

457 plans.

If you rolled over part or all of a

Form 5329, a traditional IRA is any IRA,

TIP

distribution from a qualified

including a simplified employee pension

Purpose of Form

retirement plan, the part rolled

(SEP) IRA, other than a SIMPLE IRA or

over is not subject to the additional tax

Use Form 5329 to report additional

Roth IRA.

on early distributions. See the

taxes on:

•

Early distribution. Generally, any

instructions for Form 1040, lines 15a

Individual retirement arrangements

distribution from your IRA, other

and 15b or lines 16a and 16b, or Form

(IRAs),

•

qualified retirement plan, or modified

1040A, lines 11a and 11b or 12a and

Other qualified retirement plans,

•

endowment contract before you reach

12b, for how to report the rollover.

Modified endowment contracts,

•

age 59

1

/

is an early distribution.

Coverdell ESAs,

2

•

When and Where To File

Qualified tuition programs (QTPs),

Rollover. A rollover is a tax-free

•

Archer MSAs, or

distribution of assets from one qualified

File Form 5329 with your 2004 Form

•

Health savings accounts (HSAs).

retirement plan that is reinvested in

1040 by the due date, including

another plan or the same plan.

extensions, of your Form 1040.

Who Must File

Generally, you must complete the

If you do not have to file a 2004

rollover within 60 days following the

You must file Form 5329 if any of the

income tax return, complete and file

distribution. Any taxable amount not

following apply.

Form 5329 by itself at the time and

•

rolled over must be included in income

You received an early distribution

place you would be required to file

and may be subject to the additional tax

from a Roth IRA and the amount on

Form 1040. Be sure to include your

on early distributions.

Form 8606, line 23, is more than zero.

address on page 1 and your signature

•

You received an early distribution

The IRS may waive the 60-day

and the date on page 2. Enclose, but

from a qualified retirement plan (other

requirement if failing to waive it would

do not attach, a check or money order

than a Roth IRA) and distribution code

be against equity or good conscience,

payable to “United States Treasury” for

1 is not shown in box 7 of Form

such as situations where a casualty,

any taxes due. Write your SSN and

1099-R, Distributions From Pensions,

disaster, or other events beyond your

“2004 Form 5329” on the check.

Annuities, Retirement or Profit-Sharing

reasonable control prevented you from

Prior tax years. If you are filing Form

Plans, IRAs, Insurance Contracts, etc.

meeting the 60-day requirement. Also,

5329 for a prior year, you must use that

the 60-day period may be extended if

Note. You do not have to file Form

year’s version of the form. If you do not

you had a frozen deposit. See Pub.

5329 if distribution code 1 is correctly

have other changes, file Form 5329 by

590, Individual Retirement

shown in box 7 of all Forms 1099-R

itself (see above). If you have other

Arrangements (IRAs), for details.

and you owe the additional tax on each

changes, file Form 5329 for that year

Form 1099-R. Instead, see the

Compensation. Compensation

with Form 1040X, Amended U.S.

instructions for Form 1040, line 59, for

includes wages, salaries, tips, bonuses,

Individual Income Tax Return.

how to report the additional 10% tax

and other pay you receive for services

directly on that line.

you perform. It also includes sales

Definitions

•

You meet an exception to the tax on

commissions, commissions on

early distributions and distribution code

Qualified retirement plan. A qualified

insurance premiums, and pay based on

1 is shown in box 7 of Form 1099-R.

retirement plan includes:

a percentage of profits. It includes net

•

•

You meet an exception to the tax on

A qualified pension, profit-sharing, or

earnings from self-employment, but

early distributions from the list on page

stock bonus plan (including a 401(k)

only for a trade or business in which

2 but box 7 of your Form 1099-R does

plan),

your personal services are a material

•

not indicate an exception or the

A tax-sheltered annuity contract,

income-producing factor.

Cat. No. 13330R

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6