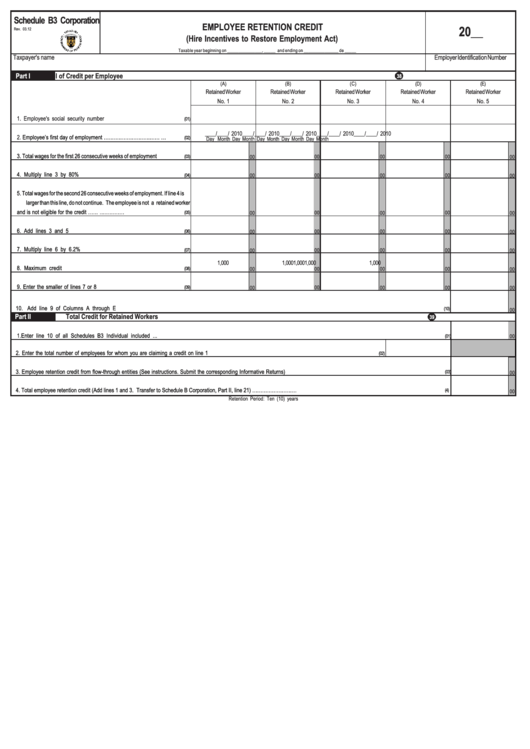

Schedule B3 Corporation - Employee Retention Credit - 2012

ADVERTISEMENT

Schedule B3 Corporation

EMPLOYEE RETENTION CREDIT

20__

Rev. 03.12

(Hire Incentives to Restore Employment Act)

Taxable year beginning on _______________, _____ and ending on _______________ de _____

Taxpayer's name

Employer Identification Number

Part I

Detail of Credit per Employee

38

(A)

(B)

(C)

(D)

(E)

Retained Worker

Retained Worker

Retained Worker

Retained Worker

Retained Worker

No. 5

No. 1

No. 2

No. 3

No. 4

1. Employee's social security number .....................................................

(01)

____/____/ 2010

____/____/ 2010

____/____/ 2010

____/____/ 2010

____/____/ 2010

2.

Employee’s first day of employment ……………………….……............…

(02)

Day Month

Day Month

Day Month

Day Month

Day Month

3. Total wages for the first 26 consecutive weeks of employment .................

(03)

00

00

00

00

00

4. Multiply line 3 by 80% ......................................................................

00

00

00

(04)

00

00

5. Total wages for the second 26 consecutive weeks of employment. If line 4 is

larger than this line, do not continue. The employee is not a retained worker

and is not eligible for the credit ……......................................……………

(05)

00

00

00

00

00

6. Add lines 3 and 5 .............................................................................

(06)

00

00

00

00

00

7. Multiply line 6 by 6.2% ....................................................................

00

00

00

(07)

00

00

1,000

1,000

1,000

1,000

1,000

8. Maximum credit ...............................................................................

00

(08)

00

00

00

00

9. Enter the smaller of lines 7 or 8 ...........................................................

(09)

00

00

00

00

00

10. Add line 9 of Columns A through E ..........................................................................................................................................................................................................................

(10)

00

Part II

Total Credit for Retained Workers

39

1.Enter line 10 of all Schedules B3 Individual included

......................................................................................................................................................................................................

(01)

00

2. Enter the total number of employees for whom you are claiming a credit on line 1 .....................................................................................................................

(02)

3. Employee retention credit from flow-through entities (See instructions. Submit the corresponding Informative Returns) ............................................................................................................

(03)

00

4. Total employee retention credit (Add lines 1 and 3. Transfer to Schedule B Corporation, Part II, line 21) ……………………….....................................................................................................

(4)

00

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1