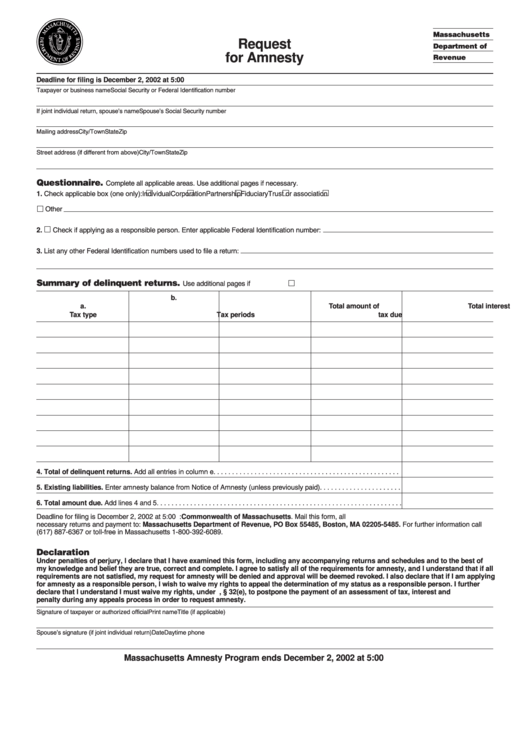

Massachusetts

Request

Department of

for Amnesty

Revenue

Deadline for filing is December 2, 2002 at 5:00 p.m. Review instructions prior to completing this application.

Taxpayer or business name

Social Security or Federal Identification number

If joint individual return, spouse’s name

Spouse’s Social Security number

Mailing address

City/Town

State

Zip

Street address (if different from above)

City/Town

State

Zip

Questionnaire.

Complete all applicable areas. Use additional pages if necessary.

1. Check applicable box (one only):

Individual

Corporation

Partnership

Fiduciary

Trust or association

Other

2.

Check if applying as a responsible person. Enter applicable Federal Identification number:

3. List any other Federal Identification numbers used to file a return:

Summary of delinquent returns.

Use additional pages if necessary.

Check if attaching additional pages.

b.

c.

d.

e.

a.

Total amount of

Total interest

Total due

Tax type

Tax periods

tax due

due

Add columns c and d

4. Total of delinquent returns. Add all entries in column e . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. Existing liabilities. Enter amnesty balance from Notice of Amnesty (unless previously paid). . . . . . . . . . . . . . . . . . . . . .

6. Total amount due. Add lines 4 and 5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Deadline for filing is December 2, 2002 at 5:00 p.m.. Make check or money order payable to: Commonwealth of Massachusetts. Mail this form, all

necessary returns and payment to: Massachusetts Department of Revenue, PO Box 55485, Boston, MA 02205-5485. For further information call

(617) 887-6367 or toll-free in Massachusetts 1-800-392-6089.

Declaration

Under penalties of perjury, I declare that I have examined this form, including any accompanying returns and schedules and to the best of

my knowledge and belief they are true, correct and complete. I agree to satisfy all of the requirements for amnesty, and I understand that if all

requirements are not satisfied, my request for amnesty will be denied and approval will be deemed revoked. I also declare that if I am applying

for amnesty as a responsible person, I wish to waive my rights to appeal the determination of my status as a responsible person. I further

declare that I understand I must waive my rights, under G.L. c. 62C, § 32(e), to postpone the payment of an assessment of tax, interest and

penalty during any appeals process in order to request amnesty.

Signature of taxpayer or authorized official

Print name

Title (if applicable)

Spouse’s signature (if joint individual return)

Date

Daytime phone

Massachusetts Amnesty Program ends December 2, 2002 at 5:00 p.m.

1

1