Form Tp-1 - Tobacco Products Tax Return - Illinois Department Of Revenue

ADVERTISEMENT

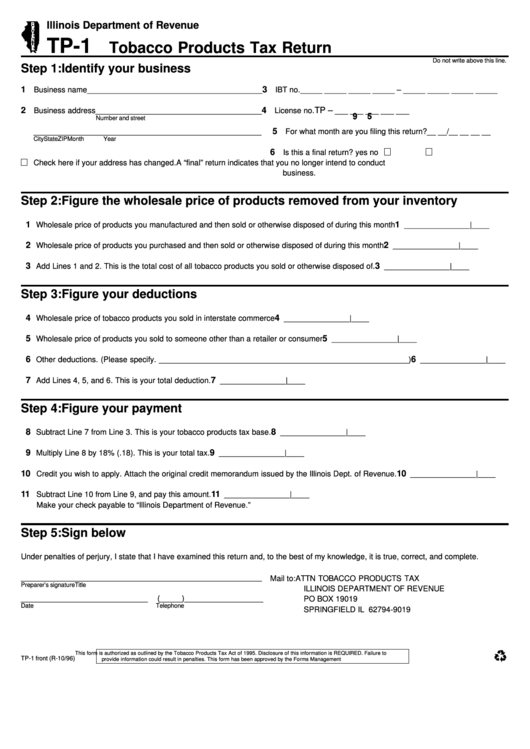

Illinois Department of Revenue

TP-1

Tobacco Products Tax Return

Do not write above this line.

Step 1: Identify your business

1

3

Business name________________________________________

IBT no. _____ _____ _____ _____ – _____ _____ _____ _____

2

4

TP –

Business address______________________________________

License no.

___ ___ ___ ___ ___

Number and street

5

____________________________________________________

For what month are you filing this return?

__ __/__ __ __ __

City

State

ZIP

Month

Year

6

Is this a final return?

yes

no

Check here if your address has changed.

A “final” return indicates that you no longer intend to conduct

business.

Step 2: Figure the wholesale price of products removed from your inventory

1

1

Wholesale price of products you manufactured and then sold or otherwise disposed of during this month

_______________|____

2

2

Wholesale price of products you purchased and then sold or otherwise disposed of during this month

_______________|____

3

3

Add Lines 1 and 2. This is the total cost of all tobacco products you sold or otherwise disposed of.

_______________|____

Step 3: Figure your deductions

4

4

Wholesale price of tobacco products you sold in interstate commerce

_______________|____

5

5

Wholesale price of products you sold to someone other than a retailer or consumer

_______________|____

6

6

Other deductions. (Please specify. _________________________________________________________)

_______________|____

7

7

Add Lines 4, 5, and 6. This is your total deduction.

_______________|____

Step 4: Figure your payment

8

8

Subtract Line 7 from Line 3. This is your tobacco products tax base.

_______________|____

9

9

Multiply Line 8 by 18% (.18). This is your total tax.

_______________|____

10

10

Credit you wish to apply. Attach the original credit memorandum issued by the Illinois Dept. of Revenue.

_______________|____

11

11

Subtract Line 10 from Line 9, and pay this amount.

_______________|____

Make your check payable to “Illinois Department of Revenue.”

Step 5: Sign below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

_______________________________________________________

Mail to:

ATTN TOBACCO PRODUCTS TAX

Preparer’s signature

Title

ILLINOIS DEPARTMENT OF REVENUE

_____________________________

(_____)__________________

PO BOX 19019

Date

Telephone

SPRINGFIELD IL 62794-9019

This form is authorized as outlined by the Tobacco Products Tax Act of 1995. Disclosure of this information is REQUIRED. Failure to

TP-1 front (R-10/96)

provide information could result in penalties. This form has been approved by the Forms Management Center.

IL-492-3268

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1