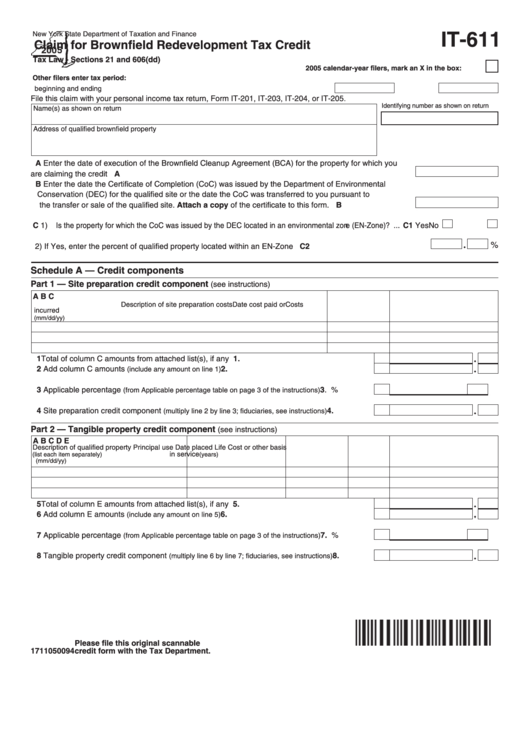

IT-611

New York State Department of Taxation and Finance

Claim for Brownfield Redevelopment Tax Credit

Tax Law - Sections 21 and 606(dd)

2005 calendar-year filers, mark an X in the box:

Other filers enter tax period:

beginning

and ending

File this claim with your personal income tax return, Form IT-201, IT-203, IT-204, or IT-205.

Identifying number as shown on return

Name(s) as shown on return

Address of qualified brownfield property

A Enter the date of execution of the Brownfield Cleanup Agreement (BCA) for the property for which you

are claiming the credit.......................................................................................................................... A

B Enter the date the Certificate of Completion (CoC) was issued by the Department of Environmental

Conservation (DEC) for the qualified site or the date the CoC was transferred to you pursuant to

the transfer or sale of the qualified site. Attach a copy of the certificate to this form.......................... B

C 1) Is the property for which the CoC was issued by the DEC located in an environmental zone (EN-Zone)? ... C1

Yes

No

%

2) If Yes, enter the percent of qualified property located within an EN-Zone ............................................ C2

Schedule A — Credit components

Part 1 — Site preparation credit component

(see instructions)

A

B

C

Description of site preparation costs

Date cost paid or

Costs

incurred

(mm/dd/yy)

1 Total of column C amounts from attached list(s), if any...............................................................

1.

2 Add column C amounts

2.

...................................................................

(include any amount on line 1)

3 Applicable percentage

.......................

3.

%

(from Applicable percentage table on page 3 of the instructions)

4 Site preparation credit component

...................

4.

(multiply line 2 by line 3; fiduciaries, see instructions)

Part 2 — Tangible property credit component

(see instructions)

A

B

C

D

E

Description of qualified property

Principal use

Date placed

Life

Cost or other basis

in service

(list each item separately)

(years)

(mm/dd/yy)

5 Total of column E amounts from attached list(s), if any...............................................................

5.

6 Add column E amounts

...................................................................

6.

(include any amount on line 5)

7 Applicable percentage

7.

......................

%

(from Applicable percentage table on page 3 of the instructions)

8 Tangible property credit component

.................

8.

(multiply line 6 by line 7; fiduciaries, see instructions)

Please file this original scannable

1711050094

credit form with the Tax Department.

1

1 2

2 3

3