Form 403(B) - Plan Checklist Sheet

ADVERTISEMENT

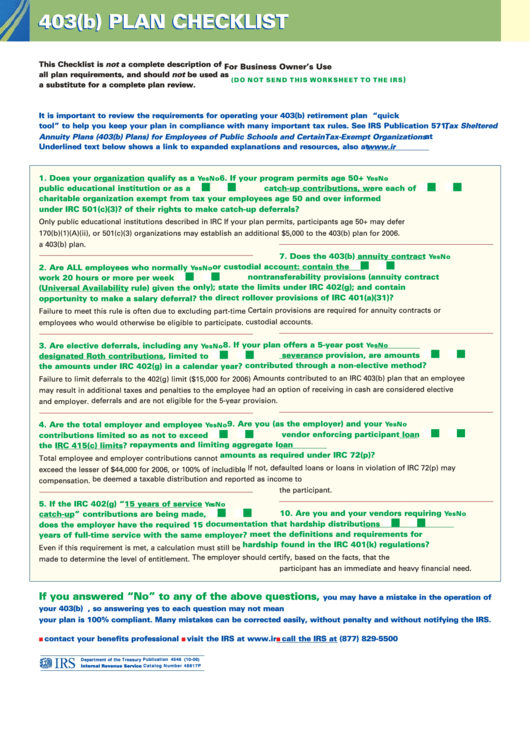

403(b) PLAN CHECKLIST

403(b) PLAN CHECKLIST

This Checklist is not a complete description of

For Business Owner’s Use

all plan requirements, and should not be used as

)

( D O N OT S E N D T H I S W O R K S H E E T TO T H E I R S

a substitute for a complete plan review.

It is important to review the requirements for operating your 403(b) retirement plan annually. This checklist is a “quick

tool” to help you keep your plan in compliance with many important tax rules. See IRS Publication 571, Tax Sheltered

Annuity Plans (403(b) Plans) for Employees of Public Schools and Certain Tax-Exempt Organizations at

Underlined text below shows a link to expanded explanations and resources, also at

1. Does your organization qualify as a

6. If your program permits age 50+

Yes No

Yes No

■

■

■

■

■

■

■

■

public educational institution or as a

catch-up contributions, were each of

charitable organization exempt from tax

your employees age 50 and over informed

under IRC 501(c)(3)?

of their rights to make catch-up deferrals?

Only public educational institutions described in IRC

If your plan permits, participants age 50+ may defer

170(b)(1)(A)(ii), or 501(c)(3) organizations may establish

an additional $5,000 to the 403(b) plan for 2006.

a 403(b) plan.

7. Does the 403(b) annuity contract

Yes No

■

■

■

■

or custodial account: contain the

2. Are ALL employees who normally

Yes No

■

■

■

■

nontransferability provisions (annuity contract

work 20 hours or more per week

only); state the limits under IRC 402(g); and contain

(Universal Availability rule) given the

the direct rollover provisions of IRC 401(a)(31)?

opportunity to make a salary deferral?

Certain provisions are required for annuity contracts or

Failure to meet this rule is often due to excluding part-time

custodial accounts.

employees who would otherwise be eligible to participate.

8. If your plan offers a 5-year post

3. Are elective deferrals, including any

Yes No

Yes No

■

■

■

■

■

■

■

■

severance provision, are amounts

designated Roth contributions, limited to

contributed through a non-elective method?

the amounts under IRC 402(g) in a calendar year?

Amounts contributed to an IRC 403(b) plan that an employee

Failure to limit deferrals to the 402(g) limit ($15,000 for 2006)

had an option of receiving in cash are considered elective

may result in additional taxes and penalties to the employee

deferrals and are not eligible for the 5-year provision.

and employer.

9. Are you (as the employer) and your

4. Are the total employer and employee

Yes No

Yes No

■

■

■

■

■

■

■

■

vendor enforcing participant loan

contributions limited so as not to exceed

repayments and limiting aggregate loan

the IRC 415(c) limits?

amounts as required under IRC 72(p)?

Total employee and employer contributions cannot

If not, defaulted loans or loans in violation of IRC 72(p) may

exceed the lesser of $44,000 for 2006, or 100% of includible

be deemed a taxable distribution and reported as income to

compensation.

the participant.

5. If the IRC 402(g) “15 years of service

Yes No

■

■

■

■

10. Are you and your vendors requiring

catch-up” contributions are being made,

Yes No

■

■

■

■

documentation that hardship distributions

does the employer have the required 15

meet the definitions and requirements for

years of full-time service with the same employer?

hardship found in the IRC 401(k) regulations?

Even if this requirement is met, a calculation must still be

The employer should certify, based on the facts, that the

made to determine the level of entitlement.

participant has an immediate and heavy financial need.

If you answered “No” to any of the above questions,

you may have a mistake in the operation of

your 403(b) plan. This list is only a guide to a more compliant plan, so answering yes to each question may not mean

your plan is 100% compliant. Many mistakes can be corrected easily, without penalty and without notifying the IRS.

contact your benefits professional

visit the IRS at

call the IRS at (877) 829-5500

■

■

■

Publication 4546 (10-06)

Department of the Treasury

Internal Revenue Service

Catalog Number 48817P

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1