Form Pit-S - New Mexico Supplemental Schedule For Dependent Exemptions In Excess Of Five - 2009

ADVERTISEMENT

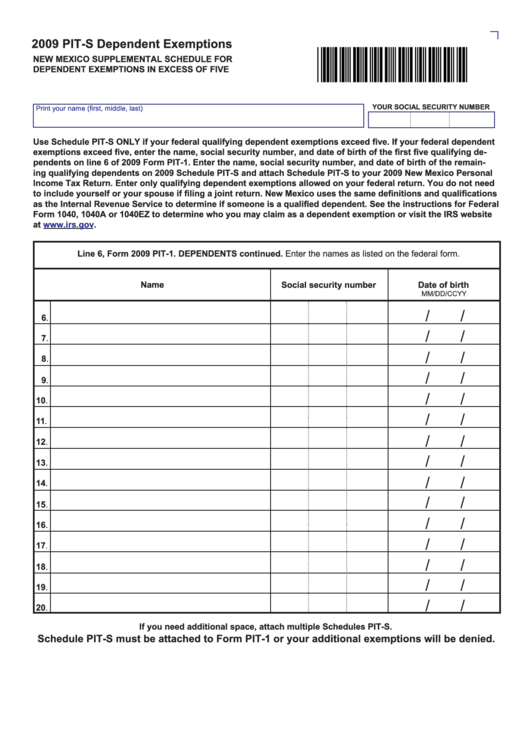

2009 PIT-S Dependent Exemptions

*90260200*

NEW MEXICO SUPPLEMENTAL SCHEDULE FOR

DEPENDENT EXEMPTIONS IN EXCESS OF FIVE

YOUR SOCIAL SECURITY NUMbER

Print your name (first, middle, last)

Use Schedule PIT-S ONLY if your federal qualifying dependent exemptions exceed five. If your federal dependent

exemptions exceed five, enter the name, social security number, and date of birth of the first five qualifying de-

pendents on line 6 of 2009 Form PIT-1. Enter the name, social security number, and date of birth of the remain-

ing qualifying dependents on 2009 Schedule PIT-S and attach Schedule PIT-S to your 2009 New Mexico Personal

Income Tax Return. Enter only qualifying dependent exemptions allowed on your federal return. You do not need

to include yourself or your spouse if filing a joint return. New Mexico uses the same definitions and qualifications

as the Internal Revenue Service to determine if someone is a qualified dependent. See the instructions for Federal

Form 1040, 1040A or 1040EZ to determine who you may claim as a dependent exemption or visit the IRS website

at

Line 6, Form 2009 PIT-1. DEPENDENTS continued. Enter the names as listed on the federal form.

Name

Social security number

Date of birth

MM/DD/CCYY

/

/

6.

/

/

7.

/

/

8.

/

/

9.

/

/

10.

/

/

11.

/

/

12.

/

/

13.

/

/

14.

/

/

15.

/

/

16.

/

/

17

.

/

/

18.

/

/

19.

/

/

20.

If you need additional space, attach multiple Schedules PIT-S.

Schedule PIT-S must be attached to Form PIT-1 or your additional exemptions will be denied.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1