Form M-4x - Instructions

ADVERTISEMENT

MINNESOTA Department of Revenue

Instructions for Form M-4X

For additional information, refer to the forms and instructions for the tax year you are amending.

Completing the form

Line 9

If you amend your federal tax return or if

the Internal Revenue Service (IRS) makes

Fill in the amount of any charitable

Fill in the tax year you are amending at the

an adjustment to your federal return, you

contributions.

top of the form. If you do not, your return

must notifiy the Department of Revenue

will be sent back to you for completion.

Line 11

within 180 days. Failure to report federal

If Column A or C are less than zero, enter

Columns A, B and C

changes on an amended return,

zero. For Column B, subtract Column A

Form M-4X, within 180 days will result in

Lines 1-19

from Column C.

a penalty of 10 percent of any additional

Column A: Fill in the amounts shown on

tax due.

your original return or as later adjusted by

Line 12

an amended return or audit report.

Regular franchise tax. Figure the tax

Use Form M-4X to make a claim for refund

on the corrected amount on line 11 of

as well as to report changes to your

Column B: Fill in the increases or

column C.

Minnesota liability.

decreases you are making. On a separate

_

For tax years beginning before 1982, the

sheet, explain all changes in detail. If the

Attach a copy of your amended federal

tax rate is 12 percent.

change involves an item that the corpora-

_

return or notice of adjustment to your

For tax years beginning after 1981 and

tion tax return (or its instructions) requires

Form M-4X.

before 1987, refer to your original return

the corporation to support, attach the

and calculate your tax following

appropriate schedule, statement or form to

When to file

Schedule E. Attach a copy of your

Form M-4X.

calculation.

File Form M-4X only after you have filed

_

Column C: Fill in the corrected totals after

For tax years beginning after 1986 and

your original return. You may file

the increases or decreases shown in column

before 1990, the tax rate is 9.5 percent.

Form M-4X within three-and-one-half

_

B. If there are no changes, fill in the

For tax years beginning after 1989, the

years after the return was due or within

amount from column A.

tax rate is 9.8 percent.

one year from the date of an order assess-

ing tax, whichever is later. If you received

Line 1

Line 13

an extension of time to file your original

Fill in the amount of your Minnesota net

Factors alternative minimum tax. For

return and you filed it by the extended due

income or loss before apportionment.

tax years beginning after 1986 and before

date, you have up to three-and-one-half

1990, the alternative minimum tax was

Line 7

years from the extended due date to file

based on your corporation’s property,

the amended return, Form M-4X.

Enter Minnesota nonapportionable income

payroll and sales in Minnesota. Unitary

as a negative, i.e. ($100). Enter Minnesota

groups must complete Schedule AMT-U.

Refunds

nonapportionable loss as a positive, i.e.

$100.

If you make a claim for a refund and the

Department of Revenue does not act on it

Line 8

within six months of the date filed, you

Fill in the amount of any deductions for

may bring an action in the district court or

dividends received.

(continued on back)

the tax court.

Signature

The amended return must be signed by a

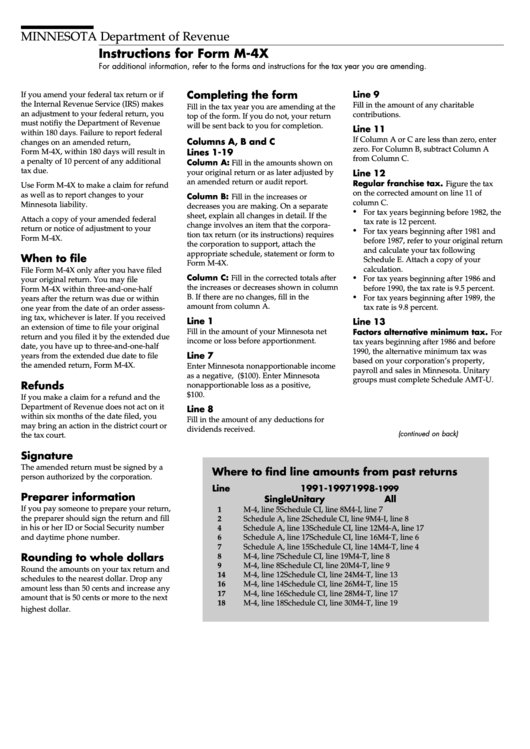

Where to find line amounts from past returns

person authorized by the corporation.

Line

1991-1997

1998

-1999

Preparer information

Single

Unitary

All

If you pay someone to prepare your return,

1

M-4, line 5

Schedule CI, line 8

M4-I, line 7

the preparer should sign the return and fill

2

Schedule A, line 2

Schedule CI, line 9

M4-I, line 8

in his or her ID or Social Security number

4

Schedule A, line 13

Schedule CI, line 12

M4-A, line 17

and daytime phone number.

6

Schedule A, line 17

Schedule CI, line 16

M4-T, line 6

7

Schedule A, line 15

Schedule CI, line 14

M4-T, line 4

Rounding to whole dollars

8

M-4, line 7

Schedule CI, line 19

M4-T, line 8

9

M-4, line 8

Schedule CI, line 20

M4-T, line 9

Round the amounts on your tax return and

14

M-4, line 12

Schedule CI, line 24

M4-T, line 13

schedules to the nearest dollar. Drop any

16

M-4, line 14

Schedule CI, line 26

M4-T, line 15

amount less than 50 cents and increase any

17

M-4, line 16

Schedule CI, line 28

M4-T, line 17

amount that is 50 cents or more to the next

18

M-4, line 18

Schedule CI, line 30

M4-T, line 19

highest dollar.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2