Instructions For Form 8233

ADVERTISEMENT

Department of the Treasury

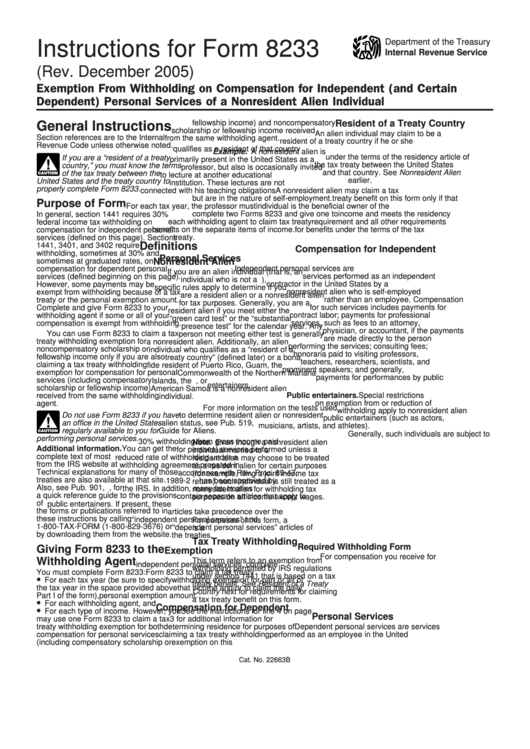

Instructions for Form 8233

Internal Revenue Service

(Rev. December 2005)

Exemption From Withholding on Compensation for Independent (and Certain

Dependent) Personal Services of a Nonresident Alien Individual

fellowship income) and noncompensatory

Resident of a Treaty Country

General Instructions

scholarship or fellowship income received

An alien individual may claim to be a

Section references are to the Internal

from the same withholding agent.

resident of a treaty country if he or she

Revenue Code unless otherwise noted.

qualifies as a resident of that country

Example. A nonresident alien is

under the terms of the residency article of

If you are a “resident of a treaty

primarily present in the United States as a

!

the tax treaty between the United States

country,” you must know the terms

professor, but also is occasionally invited

and that country. See Nonresident Alien

of the tax treaty between the

CAUTION

to lecture at another educational

earlier.

United States and the treaty country to

institution. These lectures are not

properly complete Form 8233.

connected with his teaching obligations

A nonresident alien may claim a tax

but are in the nature of self-employment.

treaty benefit on this form only if that

Purpose of Form

For each tax year, the professor must

individual is the beneficial owner of the

complete two Forms 8233 and give one to

income and meets the residency

In general, section 1441 requires 30%

each withholding agent to claim tax treaty

requirement and all other requirements

federal income tax withholding on

compensation for independent personal

benefits on the separate items of income.

for benefits under the terms of the tax

services (defined on this page). Sections

treaty.

Definitions

1441, 3401, and 3402 require

Compensation for Independent

withholding, sometimes at 30% and

Personal Services

sometimes at graduated rates, on

Nonresident Alien

Independent personal services are

compensation for dependent personal

If you are an alien individual (that is, an

services performed as an independent

services (defined beginning on this page).

individual who is not a U.S. citizen),

However, some payments may be

contractor in the United States by a

specific rules apply to determine if you

exempt from withholding because of a tax

nonresident alien who is self-employed

are a resident alien or a nonresident alien

treaty or the personal exemption amount.

rather than an employee. Compensation

for tax purposes. Generally, you are a

Complete and give Form 8233 to your

for such services includes payments for

resident alien if you meet either the

contract labor; payments for professional

withholding agent if some or all of your

“green card test” or the “substantial

services, such as fees to an attorney,

compensation is exempt from withholding.

presence test” for the calendar year. Any

physician, or accountant, if the payments

You can use Form 8233 to claim a tax

person not meeting either test is generally

are made directly to the person

treaty withholding exemption for

a nonresident alien. Additionally, an alien

performing the services; consulting fees;

noncompensatory scholarship or

individual who qualifies as a “resident of a

honoraria paid to visiting professors,

fellowship income only if you are also

treaty country” (defined later) or a bona

teachers, researchers, scientists, and

claiming a tax treaty withholding

fide resident of Puerto Rico, Guam, the

prominent speakers; and generally,

exemption for compensation for personal

Commonwealth of the Northern Mariana

payments for performances by public

services (including compensatory

Islands, the U.S. Virgin Islands, or

entertainers.

scholarship or fellowship income)

American Samoa is a nonresident alien

Public entertainers. Special restrictions

received from the same withholding

individual.

on exemption from or reduction of

agent.

For more information on the tests used

withholding apply to nonresident alien

Do not use Form 8233 if you have

to determine resident alien or nonresident

public entertainers (such as actors,

!

an office in the United States

alien status, see Pub. 519, U.S. Tax

musicians, artists, and athletes).

regularly available to you for

Guide for Aliens.

CAUTION

Generally, such individuals are subject to

performing personal services.

30% withholding from gross income paid

Note. Even though a nonresident alien

Additional information. You can get the

for personal services performed unless a

individual married to a U.S. citizen or

complete text of most U.S. tax treaties

reduced rate of withholding under a

resident alien may choose to be treated

from the IRS website at

withholding agreement prepared in

as a resident alien for certain purposes

Technical explanations for many of those

accordance with Rev. Proc. 89-47,

(for example, filing a joint income tax

treaties are also available at that site.

1989-2 C.B. 598, has been approved by

return), such individual is still treated as a

Also, see Pub. 901, U.S. Tax Treaties, for

the IRS. In addition, many tax treaties

nonresident alien for withholding tax

a quick reference guide to the provisions

contain separate articles that apply to

purposes on all income except wages.

of U.S. tax treaties. You can get any of

public entertainers. If present, these

U.S. Person

the forms or publications referred to in

articles take precedence over the

these instructions by calling

“independent personal services” and

For purposes of this form, a U.S. person

1-800-TAX-FORM (1-800-829-3676) or

“dependent personal services” articles of

is a U.S. citizen or resident alien.

by downloading them from the website.

the treaties.

Tax Treaty Withholding

Required Withholding Form

Giving Form 8233 to the

Exemption

For compensation you receive for

Withholding Agent

This term refers to an exemption from

independent personal services, complete

withholding permitted by IRS regulations

You must complete Form 8233:

Form 8233 to claim a tax treaty

•

under section 1441 that is based on a tax

For each tax year (be sure to specify

withholding exemption for part or all of

treaty benefit. See Resident of a Treaty

the tax year in the space provided above

that income and/or to claim the daily

Country next for requirements for claiming

Part I of the form),

personal exemption amount.

•

a tax treaty benefit on this form.

For each withholding agent, and

Compensation for Dependent

•

For each type of income. However, you

See the instructions for line 4 on page

Personal Services

may use one Form 8233 to claim a tax

3 for additional information for

treaty withholding exemption for both

determining residence for purposes of

Dependent personal services are services

compensation for personal services

claiming a tax treaty withholding

performed as an employee in the United

(including compensatory scholarship or

exemption on this form.

States by a nonresident alien. Dependent

Cat. No. 22663B

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4