Instructions For Form 5227

ADVERTISEMENT

02

2 0

Department of the Treasury

Internal Revenue Service

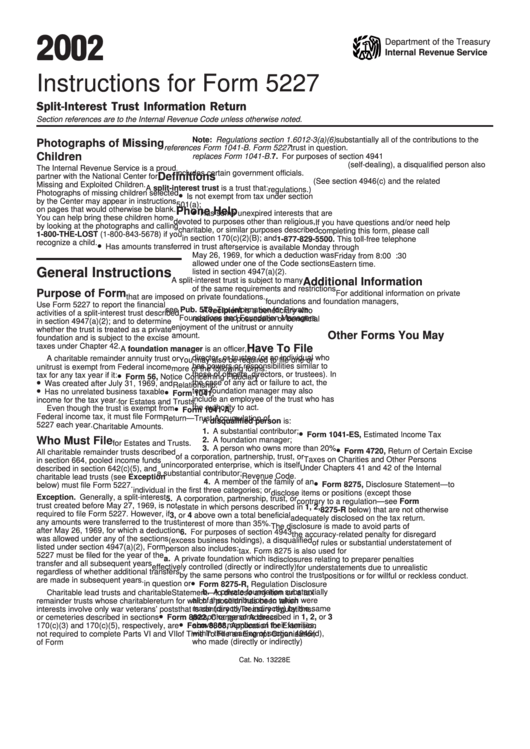

Instructions for Form 5227

Split-Interest Trust Information Return

Section references are to the Internal Revenue Code unless otherwise noted.

Note: Regulations section 1.6012-3(a)(6)

substantially all of the contributions to the

Photographs of Missing

references Form 1041-B. Form 5227

trust in question.

Children

replaces Form 1041-B.

7. For purposes of section 4941

(self-dealing), a disqualified person also

The Internal Revenue Service is a proud

includes certain government officials.

Definitions

partner with the National Center for

(See section 4946(c) and the related

Missing and Exploited Children.

A split-interest trust is a trust that:

regulations.)

Photographs of missing children selected

•

Is not exempt from tax under section

by the Center may appear in instructions

501(a);

on pages that would otherwise be blank.

•

Phone Help

Has some unexpired interests that are

You can help bring these children home

devoted to purposes other than religious,

If you have questions and/or need help

by looking at the photographs and calling

charitable, or similar purposes described

completing this form, please call

1-800-THE-LOST (1-800-843-5678) if you

in section 170(c)(2)(B); and

1-877-829-5500. This toll-free telephone

recognize a child.

•

Has amounts transferred in trust after

service is available Monday through

May 26, 1969, for which a deduction was

Friday from 8:00 a.m. to 6:30 p.m.

allowed under one of the Code sections

Eastern time.

General Instructions

listed in section 4947(a)(2).

A split-interest trust is subject to many

Additional Information

of the same requirements and restrictions

Purpose of Form

For additional information on private

that are imposed on private foundations.

foundations and foundation managers,

Use Form 5227 to report the financial

see Pub. 578, Tax Information for Private

A recipient is a beneficiary who

activities of a split-interest trust described

Foundations and Foundation Managers.

receives the possession or beneficial

in section 4947(a)(2); and to determine

enjoyment of the unitrust or annuity

whether the trust is treated as a private

Other Forms You May

amount.

foundation and is subject to the excise

taxes under Chapter 42.

Have To File

A foundation manager is an officer,

director, or trustee (or an individual who

A charitable remainder annuity trust or

You may also be required to file one or

has powers or responsibilities similar to

unitrust is exempt from Federal income

more of the following forms:

•

those of officers, directors, or trustees). In

tax for any tax year if it:

Form 56, Notice Concerning Fiduciary

•

the case of any act or failure to act, the

Was created after July 31, 1969, and

Relationship.

•

•

term foundation manager may also

Has no unrelated business taxable

Form 1041, U.S. Income Tax Return

include an employee of the trust who has

income for the tax year.

for Estates and Trusts.

•

the authority to act.

Even though the trust is exempt from

Form 1041-A, U.S. Information

Federal income tax, it must file Form

Return — Trust Accumulation of

A disqualified person is:

5227 each year.

Charitable Amounts.

•

1. A substantial contributor;

Form 1041-ES, Estimated Income Tax

Who Must File

2. A foundation manager;

for Estates and Trusts.

•

3. A person who owns more than 20%

Form 4720, Return of Certain Excise

All charitable remainder trusts described

of a corporation, partnership, trust, or

Taxes on Charities and Other Persons

in section 664, pooled income funds

unincorporated enterprise, which is itself

Under Chapters 41 and 42 of the Internal

described in section 642(c)(5), and

a substantial contributor;

Revenue Code.

charitable lead trusts (see Exception

•

4. A member of the family of an

Form 8275, Disclosure Statement — to

below) must file Form 5227.

individual in the first three categories; or

disclose items or positions (except those

Exception. Generally, a split-interest

5. A corporation, partnership, trust, or

contrary to a regulation — see Form

trust created before May 27, 1969, is not

estate in which persons described in 1, 2,

8275-R below) that are not otherwise

required to file Form 5227. However, if

3, or 4 above own a total beneficial

adequately disclosed on the tax return.

any amounts were transferred to the trust

interest of more than 35%.

The disclosure is made to avoid parts of

after May 26, 1969, for which a deduction

6. For purposes of section 4943

the accuracy-related penalty for disregard

was allowed under any of the sections

(excess business holdings), a disqualified

of rules or substantial understatement of

listed under section 4947(a)(2), Form

person also includes:

tax. Form 8275 is also used for

5227 must be filed for the year of the

a. A private foundation which is

disclosures relating to preparer penalties

transfer and all subsequent years

effectively controlled (directly or indirectly)

for understatements due to unrealistic

regardless of whether additional transfers

by the same persons who control the trust

positions or for willful or reckless conduct.

are made in subsequent years.

•

in question or

Form 8275-R, Regulation Disclosure

b. A private foundation substantially

Charitable lead trusts and charitable

Statement — to disclose any item on a tax

remainder trusts whose charitable

all of the contributions to which were

return for which a position has been taken

interests involve only war veterans’ posts

made (directly or indirectly) by the same

that is contrary to Treasury regulations.

•

person or persons described in 1, 2, or 3

or cemeteries described in sections

Form 8822, Change of Address.

•

above, or members of their families,

170(c)(3) and 170(c)(5), respectively, are

Form 8868, Application for Extension

within the meaning of section 4946(d),

not required to complete Parts VI and VII

of Time To File an Exempt Organization

who made (directly or indirectly)

of Form 5227.

Return.

Cat. No. 13228E

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8